Learning Objectives

advertisement

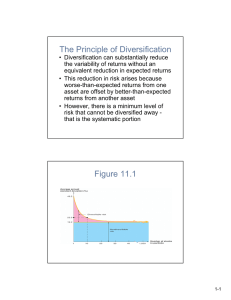

Learning Objectives Chapter 6 The Meaning and Measurement of Risk and Return § Define and measure the expected rate of return of an individual investor. § Define and measure the riskiness of an individual investment. § Compare the historical relationship between risk and return in the capital markets. Learning Objectives Principles Used in this Chapter § Explain how diversifying investments affects the riskiness and expected rate of return of a portfolio or combination of assets. • Principle 1: The Risk-Return Trade-off – We Won’t Take on Additional Risk Unless We Expect to Be Compensated with Additional Return. § Explain the relationship between an investor’s required rate of return on an investment and the riskiness of the investment. Expected Cash Flow • Weighted Average of the possible cash flows outcomes such that the weights are the probabilities of the occurrence of the various states of the economy. • Principle 3: Cash-Not Profits-Is King. Expected Cash flow • Conventionally, we measure the expected cash flow as follows: P(X1)X1 + P(X2)X2 + … + P(Xn)Xn X = where n = the number of possible states of the economy Xi =the cash flow in the ith state of the economy P(Xi) = the probability of the ith cash flow 1 Expected Rate of Return Measuring the Expected Return State of the economy Probability of the states Cash flow from the investment % Return (Cash Flow/Inv. Cost) Economic Recovery 20% $1,000 10% ($1,000/$10,000) Moderate Economic Growth 30% 1,200 12% ($1,200/$10,000) Strong Economic Growth 50% 1,400 14% ($1,400/$10,000) • Weighted average of all the possible returns, weighted by the probability that each return will occur. Expected Cash flow = 0.2*1000 + 0.3*1200 + 0.5* 1400 = 1260 Risk Studying and Understanding Risk • What is risk? • How do we know the amount of risk associated with a given investment; that is how do we measure risk? • If we choose to diversify our investments by owning more that one asset, as most of us do, will such diversification reduce the riskiness of our combined portfolio of investments? • Potential variability in future cash flows • The wider the range of possible events that can occur, the greater the risk Standard Deviation of Return • Square root of the weighted average squared deviation of each possible return from the expected return • Quantitative measure of an asset ’s riskiness • Measures the volatility or riskiness of portfolio returns Standard Deviation of Return − n ∑ (k σ= i − k )2 P( ki ) i =1 Where, n Ki = the number of possible outcomes = the value of ith possible rate of return P(k i ) = Prob. that ith return wil l occur - k = Expected value of the rate of return 2 Annual Rates of Return, 19262000 Total Risk or Variability • Company -Unique Risk (Unsystematic) • Market Risk (Systematic) Diversification • If we diversify investments across different securities, the variability in the returns declines Company-Unique Risk • Unsystematic risk • Diversifiable --Can be diversified away • We can lower risk without sacrificing expected return, and/or we can increase expected return without having to assume more risk. • Diversifying among different kinds of assets is called asset allocation. Compared to diversification within the different asset classes, the benefits received are far greater through effective asset allocation. Rates of Return: The Investors’ Experience • Data have been compiled by Ibbotson and Associates on the actual returns for various portfolios of securities from 1926-1998. • The following portfolios were studied: • • • • • • 1. 2. 3. 4. 5. 6. Common stocks of large firms Common stocks of small firms Corporate bonds Long-term U.S. government bonds Intermediate U.S. government bonds U.S. Treasury bills • Investors historically have received greater returns for greater risktaking with the exception of the long -term U.S. government bonds. • The only portfolio with returns consistently exceeding the inflation rate has been common stocks. Total variability • Total variability can be divided into: – The variability of returns unique to the security (diversifiable or unsystematic risk) – The risk related to market movements (nondiversifiable or systematic risk) • By diversifying, the investor can eliminate the "unique" security risk. – The systematic risk, however, cannot be diversified away. 3 Market Risk • Systematic • Non-diversifiable • Cannot be eliminated through random diversification Measuring Market Risk • Characteristic line – The slope of the characteristic line measures the average relationship between a stock’s returns and those of the S&P 500 Index Returns. – Indicates the average movement in a stock’s price to a movement in the S&P 500 Price Index. Measuring Market Returns Monthly Holding-Period Returns of Barnes & Noble and the S&P 500 Index, December 2002 to November 2004 Market Risk Events that affect market risk Changes in the general economy, major political events, sociological changes Examples: *Interest rates *General economic conditions *Changes in tax legislation that affect all companies *War Measuring Market Risk…. • The characteristic line tells us the average movement in a firm's stock price in response to a movement in the general market, such as the S&P 500 Index. – The slope of the characteristic line, which has come to be called beta, is a measure of a stock's systematic or market risk. The slope of the line is merely the ratio of the "rise" of the line relative to the "run" of the line. – If a security's beta equals one, a 10 percent increase (decrease) in market returns will produce on average a 10 percent increase (decrease) in security returns. – A security having a higher beta is more volatile and thus more risky than a security having a lower beta value. Beta • Average relationship between a stock’s returns and the market’s returns • Slope of the characteristic line—or the line that measures the average relationship between a stock’s returns and the market • Measure of a firm’s market risk or systematic risk that remains for a company even after diversified our portfolio. 4 Beta • A stock with a Beta of 0 has no systematic risk • A stock with a Beta of 1 has systematic risk equal to the “typical” stock in the marketplace • A stock with a Beta exceeding 1 has systematic risk greater than the “typical” stock • Most stocks have betas between .60 and 1.60 Portfolio Beta Holding-Period Returns: High- and Low-Beta Portfolios and the S&P 500 Index Asset Allocation • Diversification among different kinds of asset types: T Bills Long-Term Government Bonds Common Stocks Portfolio Beta • Weighted average of the individual securities’ betas, with the weights being equal to the proportion of the portfolio invested in each security • Portfolio beta indicates the percentage change on average of the portfolio for every 1 percent change in the general market Risk and Diversification • The market rewards diversification • We can lower risk without sacrificing expected returns • We can increase expected returns without having to assume more risk Required Rate of Return • Minimum rate of return necessary to attract an investor to purchase or hold a security • Considers the opportunity cost of funds – The next best investment 5 Real Average Annual Rate of Return • Nominal rate of return less the inflation rate Required Rate of Return k=kf r + krp Where: k = required rate of return kfr = Risk-Free Rate krp = Risk Premium Risk-Free Rate Risk Premium • Required rate of return or discount rate for risk-less investments • Typically measured by U.S. Treasury Bill Rate • Additional return we must expect to receive for assuming risk • As risk increases, we will demand additional expected returns Measuring the Required Rate of Return Measuring the Required Rate of Return • Systematic risk is the only relevant riskthe rest can be diversified away • The required rate of return, k, equals the risk free rate, k rf, plus a risk premium, k rp Risk Premium = Required Return – RiskFree rate krp = k - kf r Where: k = required rate of return k fr = Risk-Free Rate k rp = Risk Premium 6 Capital Asset Pricing Model CAPM • Equation that equates the expected rate of return on a stock to the risk-free rate plus a risk premium for the systematic risk. If required return is 15% and the risk-free rate is 5%, then the risk premium is 10%. If the required rate of return for the market portfolio k m is 12%, and the k rf is 5%, the risk premium krp for the market would be 7%. • CAPM provides for an intuitive approach for thinking about the return that an investor should require on an investment, given the asset’s systematic or market risk. CAPM CAPM This 7% risk premium would apply to any security having systematic (nondiversifiable) risk equivalent to the general market, or beta of 1. In the same market, a security with Beta of 2 would provide a risk premium of 14%. CAPM Example: Market risk = 12% Risk-free rate = 5% 5% + B(12% - 5%) If B = 0 Required rate = 5% If B = 1 Required rate = 12% If B = 2 Required rate = 19% • CAPM suggests that Beta is a factor in required returns kj = krf + B(market rate – risk-free rate) The Security Market Line • Graphic representation of the CAPM, where the line shows the appropriate required rate of return for a given stock’s systematic risk. 7 The Security Market Line 8