Chapter 8-3

advertisement

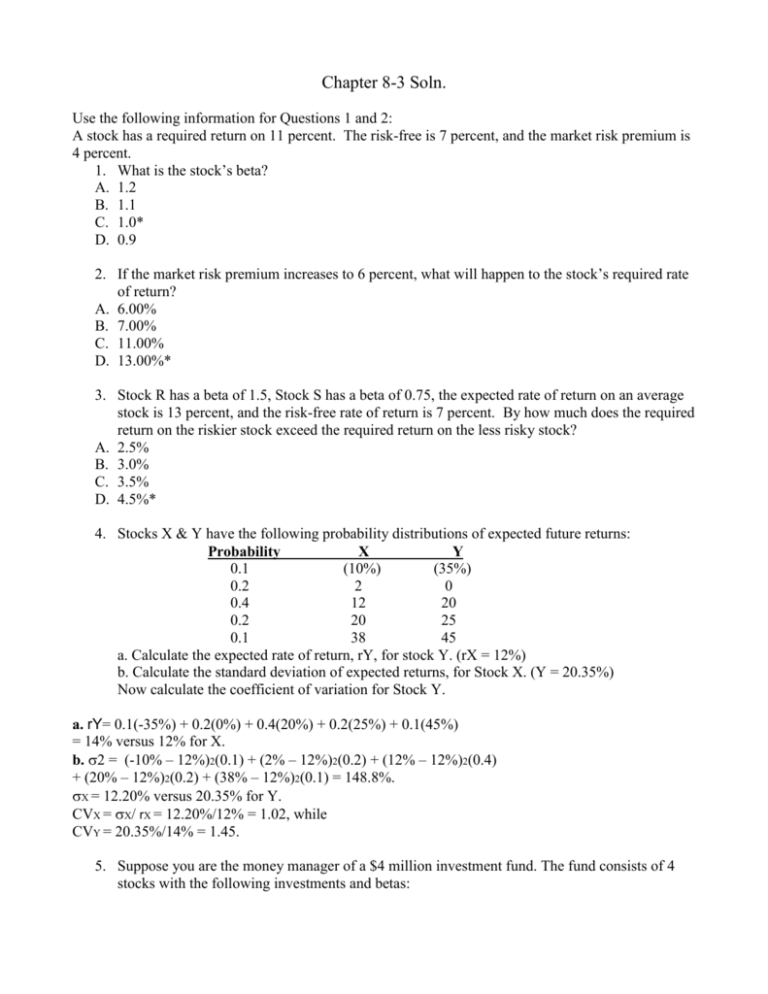

Chapter 8-3 Soln. Use the following information for Questions 1 and 2: A stock has a required return on 11 percent. The risk-free is 7 percent, and the market risk premium is 4 percent. 1. What is the stock’s beta? A. 1.2 B. 1.1 C. 1.0* D. 0.9 2. If the market risk premium increases to 6 percent, what will happen to the stock’s required rate of return? A. 6.00% B. 7.00% C. 11.00% D. 13.00%* 3. Stock R has a beta of 1.5, Stock S has a beta of 0.75, the expected rate of return on an average stock is 13 percent, and the risk-free rate of return is 7 percent. By how much does the required return on the riskier stock exceed the required return on the less risky stock? A. 2.5% B. 3.0% C. 3.5% D. 4.5%* 4. Stocks X & Y have the following probability distributions of expected future returns: Probability X Y 0.1 (10%) (35%) 0.2 2 0 0.4 12 20 0.2 20 25 0.1 38 45 a. Calculate the expected rate of return, rY, for stock Y. (rX = 12%) b. Calculate the standard deviation of expected returns, for Stock X. (Y = 20.35%) Now calculate the coefficient of variation for Stock Y. a. rY= 0.1(-35%) + 0.2(0%) + 0.4(20%) + 0.2(25%) + 0.1(45%) = 14% versus 12% for X. b. = (-10% – 12%)2(0.1) + (2% – 12%)2(0.2) + (12% – 12%)2(0.4) + (20% – 12%)2(0.2) + (38% – 12%)2(0.1) = 148.8%. X = 12.20% versus 20.35% for Y. CVX = X/ rX = 12.20%/12% = 1.02, while CVY = 20.35%/14% = 1.45. 5. Suppose you are the money manager of a $4 million investment fund. The fund consists of 4 stocks with the following investments and betas: Stock Investment Beta A $400,000 1.50 B 600,000 (.50) C 1,000,000 1.25 D 2,000,000 0.75 If the market’s required rate of return is 14% and the risk-free rate is 6%, what is the funds required rate of return? Portfolio beta = [400,000/4,000,000](1.50) + [600,000/4,000,000] (-0.50) + [1,000,000/4,000,000] (1.25) + [2,000,000/4,000,000] (0.75) bp = (0.1)(1.5) + (0.15)(-0.50) + (0.25)(1.25) + (0.5)(0.75) = 0.15 – 0.075 + 0.3125 + 0.375 = 0.7625. rp = rRF + (rM – rRF)(bp) = 6% + (14% – 6%)(0.7625) = 12.1%.