71. The systematic risk of the market is measured by: a beta of 1.0

advertisement

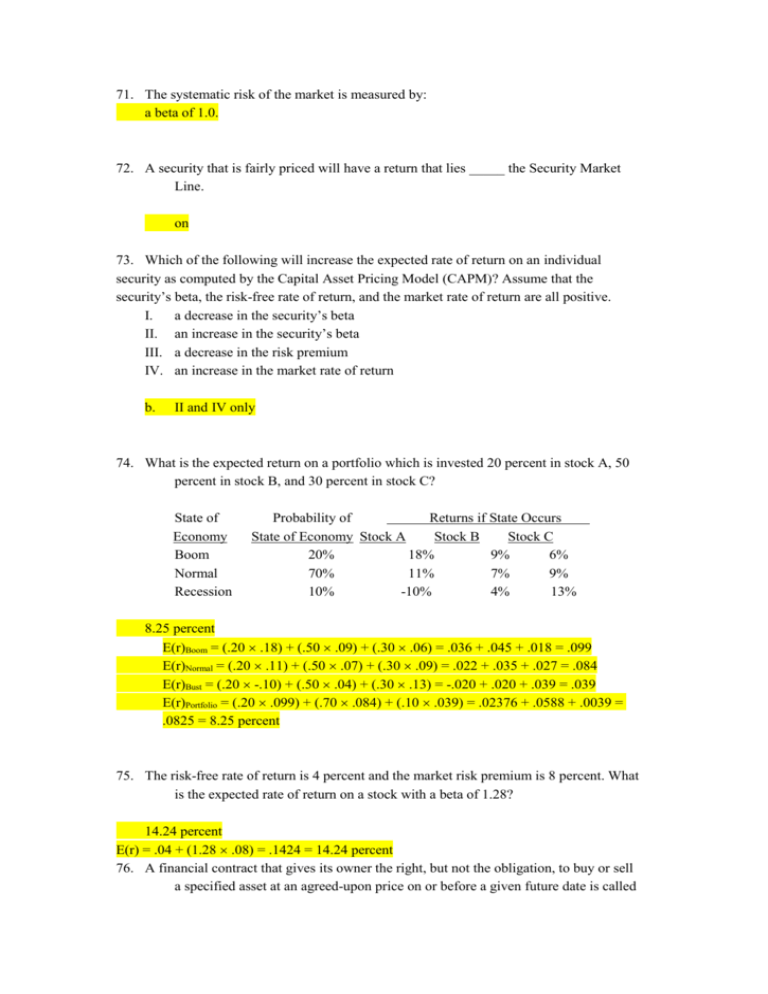

71. The systematic risk of the market is measured by: a beta of 1.0. 72. A security that is fairly priced will have a return that lies _____ the Security Market Line. on 73. Which of the following will increase the expected rate of return on an individual security as computed by the Capital Asset Pricing Model (CAPM)? Assume that the security’s beta, the risk-free rate of return, and the market rate of return are all positive. I. a decrease in the security’s beta II. an increase in the security’s beta III. a decrease in the risk premium IV. an increase in the market rate of return b. II and IV only 74. What is the expected return on a portfolio which is invested 20 percent in stock A, 50 percent in stock B, and 30 percent in stock C? State of Economy Boom Normal Recession Probability of Returns if State Occurs State of Economy Stock A Stock B Stock C 20% 18% 9% 6% 70% 11% 7% 9% 10% -10% 4% 13% 8.25 percent E(r)Boom = (.20 .18) + (.50 .09) + (.30 .06) = .036 + .045 + .018 = .099 E(r)Normal = (.20 .11) + (.50 .07) + (.30 .09) = .022 + .035 + .027 = .084 E(r)Bust = (.20 -.10) + (.50 .04) + (.30 .13) = -.020 + .020 + .039 = .039 E(r)Portfolio = (.20 .099) + (.70 .084) + (.10 .039) = .02376 + .0588 + .0039 = .0825 = 8.25 percent 75. The risk-free rate of return is 4 percent and the market risk premium is 8 percent. What is the expected rate of return on a stock with a beta of 1.28? 14.24 percent E(r) = .04 + (1.28 .08) = .1424 = 14.24 percent 76. A financial contract that gives its owner the right, but not the obligation, to buy or sell a specified asset at an agreed-upon price on or before a given future date is called a(n) _____ contract. option 77. The number of shares of stock received for each convertible bond converted into stock is called the: conversion ratio. 78. The intrinsic value of a call is: I. the value of the call if it were about to expire. II. equal to the lower bound of a call’s value. III. another name for the market price of a call. IV. always equal to zero if the call is currently out of the money. I, II, and IV only 79. Employee stock options: are frequently granted on a regular basis such as quarterly or annually. 80. You own two call option contracts on ABC stock with a strike price of $15. When you purchased the shares the option price was $1.20 and the stock price was $15.90. What is the total intrinsic value of these options if ABC stock is currently selling for $14.50 a share? $0