Chapter 5

advertisement

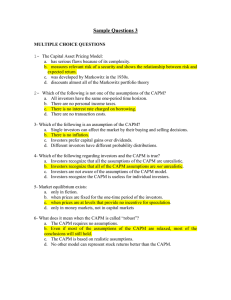

Chapter 5 Analysis of Risk and Return Copyright ©2003 South-Western/Thomson Learning Introduction • This chapter develops the risk-return relationship for individual projects (investments) and a portfolio of projects. Risk and Return • • • Risk refers to the potential variability of returns from a project or portfolio of projects. Returns are cash flows. Risk-free returns are known with certainty. – • U.S. Treasury Securities Check out interest rates on the following URLs – – http://www.stls.frb.org/fred/data/irates.html http://www.bloomberg.com/ Expected Return • A weighted average of the individual possible returns ^ • The symbol for expected return, r, is called “r hat.” • r = Sum (all possible returns their probability) ^ Let’s Analyze Risk • Standard Deviation is an absolute measure of risk. • Z score measures the number of standard deviations a particular rate of return r is from ^ the expected value of r. See table V page T5 and slide 6 • Coefficient of variation v is a relative measure of risk. • Risk is an increasing function of time. Calculating the Z Score Target score – Expected value • Z score = Standard deviation • What’s the probability of a loss on an investment with an expected return of 20 percent and a standard deviation of 7 percent? • (0% – 20%)/17% = –1.18 rounded • From table V = 0.1190 or 11.9 percent probability of a loss Coefficient of Variation • The coefficient of variation is an appropriate measure of total risk when comparing two investment projects of different size. Risk-Return Relationship Required return = Risk-free return + Risk premium Real rate of return Risk-free rate Expected inflation premium Check out the risk-free rate at this Web site: http://www.cnnfn.com/markets/rates.html Expected Inflation Premium • Compensates investors for the loss of purchasing power due to inflation Risk Premium • Maturity risk premium • Default risk premium • Seniority risk premium • Marketability risk premium • Business risk • Financial risk Term Structure of Interest Rates • Expectations theory • Liquidity premium theory • Market segmentation theory Characteristics of the Securities Comprising the Portfolio • Expected return • Standard deviation, • Correlation coefficient • Efficient portfolio Efficient Portfolio • Has the highest possible return for a ^r given • Has the lowest possible for a given expected return a c b Risk a and c are preferred to b a and c are efficient Diversification • The Portfolio effect is the risk reduction accompanying diversification. Systematic Risk Unsystematic Diversifiable CAPM: Only Systematic Risk is Relevant • Systematic risk caused • Unsystematic risk by factors affecting the caused by factors market as a whole unique to the firm – – – undiversifiable interest rate changes changes in purchasing power change in business outlook – – – diversifiable strikes government regulations management’s capabilities Systematic Risk is Measured by Beta, • A measure of the volatility of a securities return compared to the Market Portfolio βj Cov ariance j,m Variance j,m • A regression line of periodic rates of return for security j and the Market Portfolio • Search for (stock beta) on this search engine: http://www.altavista.digital.com/ SML Shows the Relationship Between r^ and ß r^ SML r^f Required Rate of Return • The required return for any security j may be defined in terms of systematic risk, j, the expected market return, r^m, ^ and the expected risk free rate, rf. k j rˆ β j (rˆ rˆ ) f m f Risk Premium • (r^m – ^ rf) • Slope of security market line • Will increase or decrease with – uncertainties about the future economic outlook – the degree of risk aversion of investors SML r^ 10.5% r^a 9% r^ SML a m 6% r^f 1.0 Risk Premium = (9% – 6%) = 3% ka = 6% + 1.5(9% – 6%) = 10.5% 1.5 CAPM Assumptions • Investors hold welldiversified portfolios • Competitive markets • Borrow and lend at the risk-free rate • Investors are risk averse • No taxes • Investors are influenced by systematic risk • Freely available information • Investors have homogeneous expectations • No brokerage charges Major Problems in the Practical Application of the CAPM • Estimating expected future market returns • Determining an appropriate r^f • Determining the best estimate of • Investors don’t totally ignore unsystematic risk. • Betas are frequently unstable over time. • Required returns are determined by macroeconomic factors. International Investing • Appears to offer diversification benefits • Returns from DMCs tend to have high positive correlations. • Returns from MNCs tend to have lower correlations. • Obtains the benefits of international diversification by investing in MNCs or DMCs operating in other countries Risk of Failure is Not Necessarily Captured by Risk Measurers • Risk of failure especially relevant – For undiversified investor • Costs of bankruptcy – Loss of funds when assets are sold at distressed prices – Legal fees and selling costs incurred – Opportunity costs of funds unavailable to investors during bankruptcy proceedings. High-Yield Securities • Sometimes called “Junk Bonds” • Bonds with credit ratings below investment-grade securities • Have high returns relative to the returns available from investmentgrade securities • Higher returns achieved only by assuming greater risk. • Ethical Issues next slide Ethical Issues • Growth in high-risk junk bonds • Savings and loan industry • Insurance industry