Document

advertisement

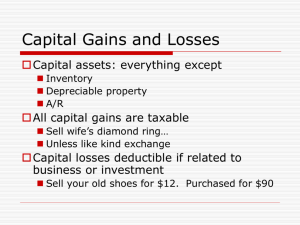

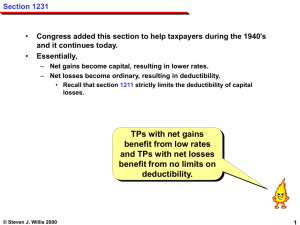

CHAPTER FIVE TAXES 1 TAXES IN THE U.S. • CORPORATE TAXES – forms of business are taxed differently • single proprietor and partnership income is taxed at personal income rates • corporate income may be taxed twice – once as it is earned using the corporate income rates – again as dividend income using the personal rates 2 CORPORATE TAX RATES • MARGINAL TAX RATES – are the most important for the corporation and represent the tax on additional income earned 3 CORPORATE TAX RATES • MARGINAL TAX RATES – are the rates on the next dollar earned 4 CORPORATE TAX RATES • MARGINAL TAX RATES: An Example Suppose a corporation earns $85,000 It pays .15 on first $50,000 = $7,500 .25 on next $25,000 = $6,250 .34 on next $10,000 = $3,400 Total tax on$85,000 = $17,150 5 CORPORATE TAX RATES • CALCULATING AVERAGE TAX RATE: TOTAL TAX PAID TOTAL TAXABLE INCOME 6 CORPORATE TAX RATES • CALCULATING AVERAGE TAX RATE An Example $17,150 / $85,000 = 20.18% 7 PERSONAL INCOME TAXES • CALCULATING AFTER-TAX INCOME GROSS INCOME - ADJUSTMENTS ADJUSTED GROSS INCOME - DEDUCTIONS TAXABLE INCOME - TAXES AFTER-TAX INCOME 8 PERSONAL INCOME TAXES • EXAMPLE: A MARRIED COUPLE IS EVALUATING AN INVESTMENT Assume: No Bracket “Creep” Taxable Income = $80,000 Marginal Tax rate = .28 Possible Investment Income: Tax (.28 x $3,000) = $840 9 PERSONAL INCOME TAXES • EXAMPLE: A MARRIED COUPLE ARE EVALUATING AN INVESTMENT Assume: Bracket “Creep” Possible Investment Income: $20,000 Tax .28 x 16,900 = $4,732 .31 x 3,100 = $ 961 20,000 = $5,693 10 PERSONAL INCOME TAXES • TAX-EXEMPT BONDS – DEFINITION: securities whose income is not subject to federal income taxes 11 PERSONAL INCOME TAXES • TAX-EXEMPT BONDS – most income from bonds issued by states, municipalities, and their agencies need not be included in taxable income for federal returns 12 PERSONAL INCOME TAXES • TAX-EXEMPT BONDS – to calculate fully-taxable-equivalent yield of a tax-exempt bond use the formula i yield = 1 t where t = the investor’s marginal tax rate i = the tax-exempt yield 13 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT 14 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT – Less than one year ordinary income 15 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT – Less than one year – 12 to 18 months ordinary income max rate = 28% 16 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT – Less than one year – 12 to 18 months – more than 18 months ordinary income max rate = 28% 20%* 17 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT – Less than one year – 12 to 18 months – more than 18 months ordinary income max rate = 28% 20%* * unless taxpayer is in the 15% tax bracket in which case the rate = 10% 18 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT – – – – Less than one year 12 to 18 months more than 18 months five years or more ordinary income max rate = 28% 20%* 18%** 19 TAX TREATMENT FOR CAPITAL GAINS AND LOSSES • CATEGORIES OF GAIN (more than 5 years) – depend on holding periods and tax treatment HOLDING PERIOD TAX TREATMENT – five years or more 18%** ** Exception: If taxpayer is in 15% tax bracket, the asset must have been sold in the year 2001 or later, then rate = 8% 20