Chapter 11

Investments

McGraw-Hill/Irwin

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Learning Objectives

1.

2.

3.

4.

5.

Explain how interest income and dividend income are

taxed

Compute the tax consequences associated with the

disposition of capital assets, including the netting process

for calculating gains and losses

Describe common sources of tax-exempt investment

income and explain the rationale for exempting some

investments from taxation

Calculate the deduction for portfolio investment-related

expenses, including investment expenses and investment

interest expense

Understand the distinction between portfolio investments

and passive investments and apply tax basis, at-risk and

passive activity loss limits to losses from passive

investments

11-2

Investments Overview

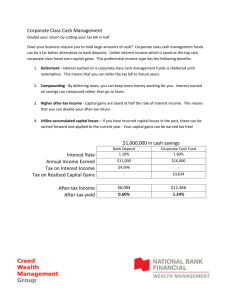

Before-tax rate of return on investment

After-tax rate of return on investment

Depends on when investment income is taxed

Depends on the rate at which the income is

taxed

Relates to timing tax planning strategy

Relates to the conversion tax planning

strategy

Portfolio vs. Passive investments

Portfolio losses deferred until investment is sold

Passive losses may be deducted annually

11-3

Portfolio Income: Interest and

Dividends

Usually taxable when received

Interest from bonds CDs, savings accounts

Ordinary income taxed at ordinary rate unless

municipal bond interest

Interest from U.S. Treasury bonds not taxable by

states

Dividends on stock

Typically taxed at preferential capital gains rate

11-4

Portfolio Income: Dividends

Qualified Dividends

Dividends must be paid by domestic or certain foreign

corporations that are held for a certain length of time

Subject to preferential tax rate

15% generally

0% if would have been taxed at 10% or 15% if it had been

ordinary income

After tax rate of return assuming 8% before-tax rate of

return

.08(1 - .15) = 6.8%

Nonqualified dividends are taxed as ordinary income

11-5

Portfolio Income:

Capital Gains and Losses

Investments held for appreciation potential

Gains deferred for tax purposes

Generally taxed at preferential rates

Special loss rules apply

These types of investments are generally

investments in capital assets

11-6

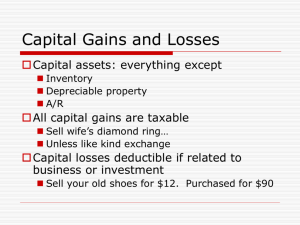

Portfolio Income:

Capital Gains and Losses

Capital asset is any asset other than:

Asset used in trade or business

Accounts or notes receivable acquired in business

from sale of services or property

Inventory

Sale of capital assets generates capital gains

and losses

Specific identification vs. FIFO

Long-term if capital asset held more than a year

Short-term if capital asset held for year or less

11-7

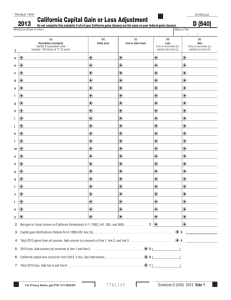

Portfolio Income:

Capital Gains and Losses

Capital gains

Net short-term capital gains taxed at ordinary rates

Generally net capital gains taxed at a maximum

preferential rate of 15%

Unrecaptured §1250 gain from the sale of depreciable real

estate is taxed at a maximum rate of 25%

Long-term capital gains from collectibles and qualified small

business stock are taxed at a maximum rate of 28%.

11-8

Portfolio Income:

Capital Gains and Losses

Capital losses

Individuals allowed to deduct up to $3,000 of net

capital loss against ordinary income. Remainder

carries over indefinitely to subsequent years.

11-9

Limitations on Capital Losses

The “wash sale” rule disallows the loss on

stocks sold if the taxpayer purchases the

same or “substantially identical” stock within

a 61-day period centered on the date of sale.

30 days before the sale

the day of sale

30 days after the sale

Intended to ensure that taxpayers cannot

deduct losses from stock sales while

essentially continuing their investment.

11-10

Tax Planning Strategies for

Capital Assets

After-tax rate of return

1/n

(FV/I)

–1

FV = future value of the investment

I = amount of the initial nondeductible investment

n = number of years the taxpayer holds asset before

selling

See Example 11-12

11-11

Tax Planning Strategies for

Capital Assets

After-tax rate of return

Increases the longer taxpayer holds asset

Present value of tax decreases

Increases because of the lower the rate at which

long-term capital gains are taxed

Preferential rate generally applies because gains are

generally long-term capital gains.

11-12

Tax Planning Strategies for

Capital Assets

Tax planning strategies

Hold capital assets for more than a year

Loss harvesting

Taxed at preferential rate

Tax deferred

$3,000 offset against ordinary income

Offset other (short-term) capital gains

Must balance tax with nontax factors

What happened to the stock market in 2008?

11-13

Municipal Bonds

Offer a lower rate of interest because the interest is

tax exempt.

Differences in rates of returns of municipal bonds

and taxable bonds are sometimes referred to as

“implicit taxes.”

This is different than “explicit taxes” which are

actually levied by and paid to governmental entities.

In choosing between taxable and nontaxable bond

marginal tax rate is important

Natural “clienteles”

11-14

Life Insurance

Life insurance can be an investment vehicle

because life insurance companies offer life

insurance policies with an investment component

Life insurance proceeds are tax exempt if held until

death

After-tax rate of return = Before-tax rate of return no matter

how long the investment horizon

However, if the policy is cashed in early the cash surrender

value in excess of the taxpayer’s cost of the insurance is

subject to tax at ordinary rates.

11-15

Qualified Tuition Program

(529 plan)

Allows parents, grandparents, and other

individuals to contribute up to the maximum

allowed by each state to the 529 plan.

Earnings of the plan accumulate tax free.

Distributions from the plan are tax free if used for

qualified higher education expenses such as

tuition, books, and supplies.

If distributions to the beneficiary made for

another purpose they are taxed at the rate of the

beneficiary and are subject to 10% penalty tax.

11-16

Coverdell Educational

Savings Account

Similar to 529 plans except that

contributions to the plan are limited to

$2,000 per year for each beneficiary.

Distributions may be used to pay for the

tuition and other qualified costs of

Kindergarten – 12th grade students.

The $2,000 contribution is phased out:

$190,000 to $220,000 married filing jointly

$95,000 to $110,000 all other tax payers

11-17

Passive Activity Income and

Losses

Passive Investments

Typically an investment in a partnership, S corporation,

or direct ownership in rental real estate.

Ordinary income from these investments is taxable

annually as it is earned.

Ordinary losses may be deducted currently if able to

overcome:

Tax basis limitation

At-risk limitation

Passive loss limitation

11-18