Tax: Basis and Capital Gains

advertisement

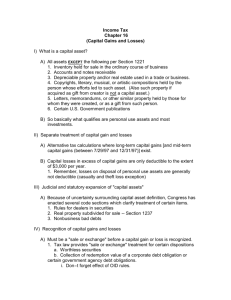

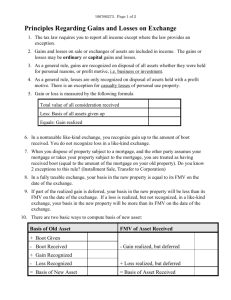

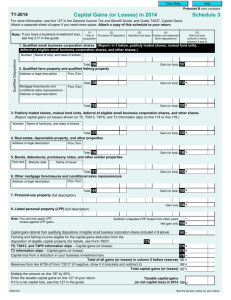

Capital Gains and Losses Capital assets: everything except Inventory Depreciable property A/R All capital gains are taxable Sell wife’s diamond ring… Unless like kind exchange Capital losses deductible if related to business or investment Sell your old shoes for $12. Purchased for $90 Long-term vs. short-term Long-term: capital assets held for more than 12 months Unless acquired from decedent Step into donor’s shoes if received property as a gift: holding period “tacks” on to yours If capital asset has carryover basis from gift or exchange, then holding period from carries over also Basis In general, what you paid for the asset Includes debt assumed Acquired from decedent FMV at date of death Gain prior to death not taxed Acquired from gift Carryover basis Unless loss, then double basis (should sell) Prevents transfers of losses Basis Increased by income Reinvested dividends in mutual funds Decreased by losses Decreased by distributions S corporations Increased by loans to corporation Capital gains tax rates Long-term: 15% Scheduled to increase to 20% in 2011 Elections Dividends: Also taxed at capital gains rates Hold stock for 60 of 120 days beginning 60 days before ex-dividend date Unless 10% or 15% marginal tax rate for ordinary income, then 5% In 2008 -2010, 0% Capital gains tax rates Unless 10% or 15% marginal tax rate for ordinary income, then 5% In 2008 -2010, 0% Hmmmm. Transfer appreciated stock to kids Kiddie tax: unearned income above $1,900 taxed at parents rates Up to 18 years old: kid 19-23 years old: kid starting in 2008 Capital gains tax rates 25%: to extent of depreciation on real estate 28%: collectibles 1245 gain: ordinary income Many countries don’t tax capital gains Represent just inflation? In 2000, represented 12% of individual income taxes Capital losses After netting against capital gains Can offset up to $3,000 of other income with capital losses each year Excess carries over to the following years until entire amount of capital loss is utilized Net capital gains and losses Netting capital gains and losses Short-term netted Long-term netted If both gains, taxed at appropriate rates If one gain and one loss, netted If both losses, utilize under $3,000 rule and losses retain their character as shortterm and long-term if amounts are carried over Section 1231 gains and losses Section 1231 assets: depreciable assets used in business held for more than one year Gains are long-term gains Must first offset with any Section 1231 losses from last five years Losses are ordinary losses Not subject to $3,000 per year limitation