Chapter 16

advertisement

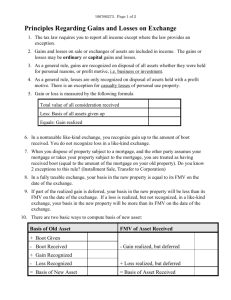

Income Tax Chapter 16 (Capital Gains and Losses) I) What is a capital asset? A) All assets EXCEPT the following per Section 1221 1. Inventory held for sale in the ordinary course of business 2. Accounts and notes receivable 3. Depreciable property and/or real estate used in a trade or business. 4. Copyrights, literary, musical, or artistic compositions held by the person whose efforts led to such asset. (Also such property if acquired as gift from creator is not a capital asset.) 5. Letters, memorandums, or other similar property held by those for whom they were created, or as a gift from such person. 6. Certain U.S. Government publications B) So basically what qualifies are personal use assets and most investments. II) Separate treatment of capital gain and losses A) Alternative tax calculations where long-term capital gains [and mid-term capital gains (between 7/29/97 and 12/31/97)] exist. B) Capital losses in excess of capital gains are only deductible to the extent of $3,000 per year. 1. Remember, losses on disposal of personal use assets are generally not deductible (casualty and theft loss exception) III) Judicial and statutory expansion of "capital assets" A) Because of uncertainty surrounding capital asset definition, Congress has enacted several code sections which clarify treatment of certain items. 1. Rules for dealers in securities 2. Real property subdivided for sale -- Section 1237 3. Nonbusiness bad debts IV) Recognition of capital gains and losses A) Must be a "sale or exchange" before a capital gain or loss is recognized. 1. Tax law provides "sale or exchange" treatment for certain dispositions a. Worthless securities b. Collection of redemption value of a corporate debt obligation or certain government agency debt obligations. i. Don=t forget effect of OID rules. B) Treatment of sale of options 1. Character of underlying property determines nature of gain. C) Treatment of Patents -- Automatic long term capital gain treatment assuming the Aholder@ is an individual. D) Sales of franchise generally results in ordinary income because significant powers, rights, or continuing interests are retained. V) Classification of capital gains and losses A) Holding periods 1. Pre July 29, 1997--short-term vs long-term 2. After July 28, 1997 and before January 1, 1998--short-term, mid-term, long-term 3. After December 31, 1997--short-term vs. long-term B) Special rules for determining holding period. 1. Inherited property -- Always long-term 2. Gift property -- if substituted basis (gain rule) is used, then a substituted holding period. C) Capital gain rates--post December 31, 1997 1. Short-term gains--taxed at regular tax rates 2. Long-term gains--taxed at a rate of 10% or 20% or 25% or 28% depending upon type of property. D) Lowest rates (10/20%) only apply to Aadjusted net capital gain@ 1. This is the net capital gain determined without considering --gain from the sale of a collectible(28% rate) --unrecaptured section 1250 gain (25% rate) --gain excluded from income from sale of Asmall business stock@ (28% rate) E) Special rates for tax years beginning after December 31, 2000 1. The Aadjusted net capital gain@ on assets held more than 5 years, an 8% tax rate applies in lieu of the 10% rate (i.e. taxpayer in 15% bracket) 2. The Aadjusted net capital gain@ on assets held more than 5 years, considering only property for which the holding period begins after December 31, 2000 qualifies for an 18% rate rather than a 20% rate. a) A taxpayer (except a corporation) may elect to treat any readily tradable stock, and/or any other capital asset or property used in a trade or business, as having been sold on January 1, 2001 and reacquired on that date for an amount equal to its FMV. I) Gains will generally be recognized. ii) Losses will not be allowed. F) Netting of Capital gains and losses 1. LTCG's----------LTCL's ----------- Net LTCG or LTCL--\ STCG's---------/ STCL's ---------- Net STCG or STCL-- Net if opposite (i.e. one gain and other loss) 2. Results of netting Gain -LTCG STCG LT and ST Losses -- LTCL STCL LT and ST 3. If netting results in a LTCG, the portion attributable to each alternative rate must be determined. (How much of the gain is subject to a 28% rate, how much to a 25% rate, and how muchqualifies for 10/20% rate) 4. During the netting process (within LT category) losses always reduce gains taxed at the highest rate first. (See Examples 57 and 58 in text) a) Also, any net STCL will offset highest rate LTCG=s first. G) Limitation and carryover of capital losses. 1. Limitation on capital loss deduction is $3,000 per year. 2. Short-term losses are used first. 3. Excess capital losses may be carried over indefinitely. They retain their character (ST vs. LT) . 4. Watch for special carryover computations where you have negative taxable incomes. a) Capital losses are only deemed used if they serve to reduce taxable income. b) Carryover is measured by the capital loss minus the lesser of: --capital loss deduction claimed on the return (generally $3,000), --or taxable income increased by the capital loss deducted plus the personal and dependency exemptions. c) Calculate taxable income before capital loss deduction and personal and dependency exemptions. This is the measure for determining whether any benefit from the capital loss deduction was received.