Chapter 5

advertisement

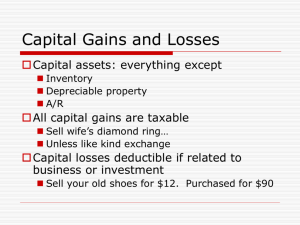

Chapter 5 Income Statement Shows how well company did over a period of time. Helps in making predictions about amount, timing and degree of uncertainty about future cash flows. Best predicator of future performance is past performance. Header: capital maintenance: transactional approach: comprehensive income: Purposes of Income Statement: 1. 2. 3. 4. return on investment: risk: financial flexibility: operating capability: earnings management – Elements of income statement 1. revenues: a. recognition: b. realization: c. four methods of revenue recognition 1. percent of completion 2. proportional performance 3. installment method 4. cost recovery 2. Expenses Three recognition principles a. association of cause & effect b. systematic & rational c. immediate recognition 3. Gains: 4. Losses: Differences between revenue/gain and expenses/losses a) b) c) Gains/Losses classified into three categories: a) b) c) Income from continuing operations 1. Sales Revenue 2. Cost of Goods Sold 3. Operating Expenses 4. Other Items 5. Income Tax Expense Single Step Format Vs. Multiple Step Format: Single Step: all revs & gains less all exps & losses income from continuing operations Advantage: Multiple Step: + - Net Sales COGS Gross Margin (Gross Profit) Operating Exps Income from Operations Other revs & gains Other exps & losses Income before taxes income tax expense income from continuing operations Advantage: Would income from continuing operations ever be different because single-step were used instead of multiple step? On either style Income Statement, additional information may appear after Income from Continuing Operations; if it does not, then of course Income from Continuing Operations would be called . All additional items are reported NET OF TAX. What does "net of tax" mean? taxes on gains: taxes on losses: 1. Discontinued Operations - disposal of compenent of business. Two separate lines: Operating income of segment up to date of disposal and Gain or Loss on sale Definition of a component: Examples: Disposal of segment Not disposal of segment Disclosures: a) b) c) d) If you decide to sell in one period and the actual sale isn’t until another period classify the component as ____________________________. Six criteria have to be met: a) b) c) d) e) f) When classify as held for sale: If fair value less the book value: When you actually sell: 2. Extraordinary Items-– Unusual in nature AND infrequent in occurrence, considering the environment in which the company operates. or by Pronouncement: What do you do with economic events that are material, yet don't meet the requirements for an extraordinary item? (i.e. they are EITHER unusual or infrequent, but not both) Always required statement is for corporation on the . face of Net Income – Preferred Dividends Weighted average common shares outstanding Earnings per share - the income Change in Accounting Estimate: Examples: change in life or salvage value of PPE Change in estimated collectability of A/R Limitations of Income Statement – a) b) c) d) e) f) Statement of Retained Earnings - Net Income/Net Loss – Dividends - Change in Accounting Principle - Correction of Error - Comprehensive Income Three ways to report: 1) 2) 3) Statement of Cash Flow