2015 PERSONAL AND CORPORATE TAX RATES On a personal

advertisement

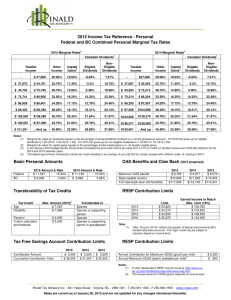

2015 PERSONAL AND CORPORATE TAX RATES On a personal tax basis, the marginal tax rates for 2015 are effectively lower than 2014, due to a continuing increase in the federal and provincial tax bracket limits. For 2014, the first two federal tax brackets were increased to $44,700 and $89,401 respectively, and the top tax bracket increased to $138,587, up from $136,270 in 2014. BC introduced a temporary personal income tax bracket for 2014 and 2015 of 16.8% on taxable income in excess of $150,000. The maximum annual contribution limit is $24,930 for RRSP’s and $5,500 for TFSA’s. For those with investment income, tax on regular dividends is lower than the tax on capital gains until personal income exceeds $44,700, after which capital gains become the less expensive option, based on the tax rates in Table 1. Eligible dividends receive a 38% “gross up” and are eligible for a 20.73% tax credit and have a negative marginal tax rate until personal income exceeds $44,700. Small business dividends are subject to a “gross up” of 18% and receive a 13% dividend tax credit. Maximum CPP retirement payments are $12,780 ($1,065 per month). The maximum CPP post-retirement benefit is $320 ($27 per month) for contributions made after you begin to receive the retirement pension, CPP contributions are mandatory until age 65. Maximum OAS payments for the year are $6,765 ($564 per month). For 2015, OAS claw back begins at an income threshold of $72,809, and is completely eliminated once a pensioner’s net income exceeds $117,908. For 2015, BC has the ninth lowest top marginal tax rate of the 13 Provinces and Territories with Alberta, Nunavut, Yukon, Ontario, Newfoundland/Labrador, Northwest Territories, Saskatchewan and Prince Edward Island, being lower. The small business limit for corporate tax rates remains unchanged at $500,000. Table 1 – 2015 Personal Tax Rates Taxable Income 0 - 37,869 37,870 - 44,700 44,701 - 75,739 75,740 - 86,958 86,959 - 89,401 89,402 - 105,592 105,593 - 138,587 138,588 - 150,000 150,001 and above 1. Salary & Interest 20.06% 22.70% 29.70% 32.50% 34.29% 38.29% 40.70% 43.70% 45.80% Small Business Dividends1 7.61% 10.73% 18.99% 22.29% 24.40% 29.12% 31.97% 35.51% 37.98% Eligible Dividends1 (6.84)% (3.20)% 6.46% 10.32% 12.79% 18.31% 21.64% 25.78% 28.68% Capital Gains 10.03% 11.35% 14.85% 16.25% 17.15% 19.15% 20.35% 21.85% 22.90% Marginal tax rate is for actual amount of dividends received (not the “gross-up” taxable amount). Table 2 – 2015 Corporate Tax Rates (Canadian Controlled Private Corporations – CCPC) $0 – $500,000 General M&P Inactive2 Federal Provincial 11.00% 2.50% 15.00% 11.00% 15.00% 11.00% 34.67% 11.00% Total 13.50% 26.00% 26.00% 45.67% 2. 26.67% of the 45.67% tax paid on inactive business income is refundable upon payment of dividends, resulting in net tax payable of 19.00%. N:\FILES\WORD\Miscellaneous\Tax Rates\2015\2015 PERSONAL AND CORPORATE TAX RATES.docx