Basic Income Tax Terminology & Concepts

advertisement

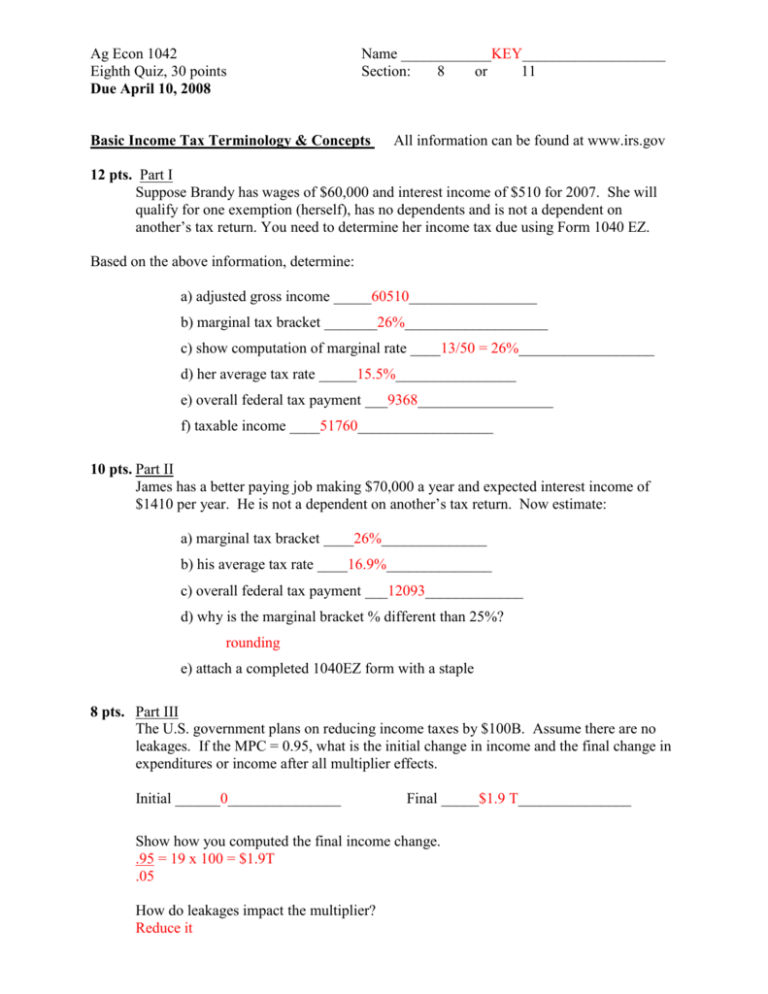

Ag Econ 1042 Eighth Quiz, 30 points Due April 10, 2008 Name ____________KEY___________________ Section: 8 or 11 Basic Income Tax Terminology & Concepts All information can be found at www.irs.gov 12 pts. Part I Suppose Brandy has wages of $60,000 and interest income of $510 for 2007. She will qualify for one exemption (herself), has no dependents and is not a dependent on another’s tax return. You need to determine her income tax due using Form 1040 EZ. Based on the above information, determine: a) adjusted gross income _____60510_________________ b) marginal tax bracket _______26%___________________ c) show computation of marginal rate ____13/50 = 26%__________________ d) her average tax rate _____15.5%________________ e) overall federal tax payment ___9368__________________ f) taxable income ____51760__________________ 10 pts. Part II James has a better paying job making $70,000 a year and expected interest income of $1410 per year. He is not a dependent on another’s tax return. Now estimate: a) marginal tax bracket ____26%______________ b) his average tax rate ____16.9%______________ c) overall federal tax payment ___12093_____________ d) why is the marginal bracket % different than 25%? rounding e) attach a completed 1040EZ form with a staple 8 pts. Part III The U.S. government plans on reducing income taxes by $100B. Assume there are no leakages. If the MPC = 0.95, what is the initial change in income and the final change in expenditures or income after all multiplier effects. Initial ______0_______________ Final _____$1.9 T_______________ Show how you computed the final income change. .95 = 19 x 100 = $1.9T .05 How do leakages impact the multiplier? Reduce it