Corporate Class Cash Management Double your return by cutting

advertisement

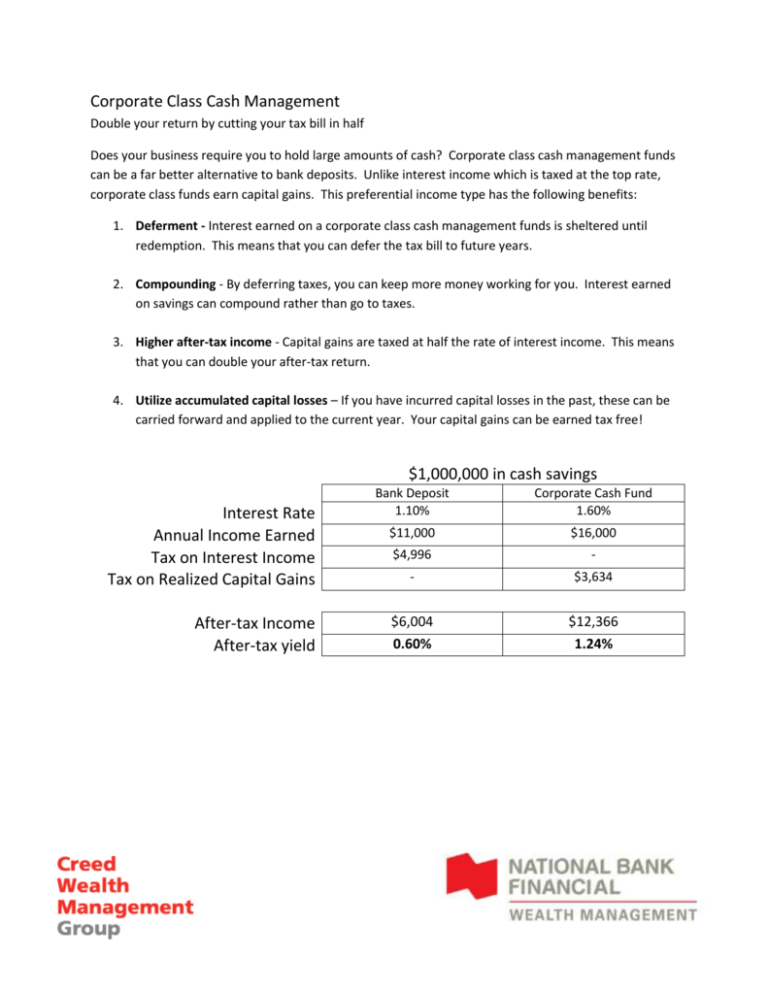

Corporate Class Cash Management Double your return by cutting your tax bill in half Does your business require you to hold large amounts of cash? Corporate class cash management funds can be a far better alternative to bank deposits. Unlike interest income which is taxed at the top rate, corporate class funds earn capital gains. This preferential income type has the following benefits: 1. Deferment - Interest earned on a corporate class cash management funds is sheltered until redemption. This means that you can defer the tax bill to future years. 2. Compounding - By deferring taxes, you can keep more money working for you. Interest earned on savings can compound rather than go to taxes. 3. Higher after-tax income - Capital gains are taxed at half the rate of interest income. This means that you can double your after-tax return. 4. Utilize accumulated capital losses – If you have incurred capital losses in the past, these can be carried forward and applied to the current year. Your capital gains can be earned tax free! $1,000,000 in cash savings Interest Rate Annual Income Earned Tax on Interest Income Tax on Realized Capital Gains After-tax Income After-tax yield Bank Deposit 1.10% Corporate Cash Fund 1.60% $11,000 $16,000 $4,996 - - $3,634 $6,004 0.60% $12,366 1.24%