QUESTION 13

advertisement

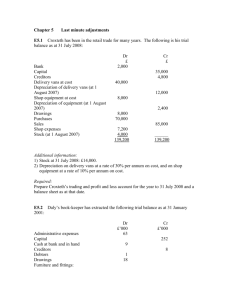

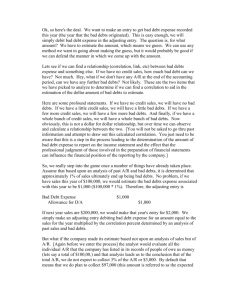

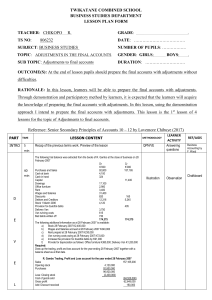

ACCOUNTING STUDIES Stage 2 Centralian Senior Secondary College TEST REVISION ON BALANCE DAY ADJUSTMENTS 2008 Fred Bumpkin is the proprietor of FRED’s CARYARD . He presents the following trial balance and information to be used in the preparation of the final reports for the year ended 30 June 2006: FRED’s CARYARD Trial Balance as at 30 June 2006 Cash sales Credit sales Stock (beginning) Delivery vehicles Accumulated depreciation on delivery vehicles Office equipment Accumulated depreciation on office equipment Delivery inwards Rent Telephone Insurance Stationery expense Prepaid advertising Salespeople’s salaries Sales returns Discount revenue Debtors’ control CARSrUS Pty Ltd (creditor) Bad debts Bank overdraft Interest on overdraft Capital 120 000 300 000 338500 70 000 36 000 62 000 24 000 6 400 45 000 7 000 6 400 2 300 22 600 86 000 6 000 12 200 45 000 47 000 5 200 45 000 3 300 120 100 Other Information at 30 June 2003 • Stock at end $71500 • A new delivery vehicle was purchased on 1 February 2003 at a cost of $18 000. This purchase has been recorded. • Delivery vehicles are depreciated at 10% per annum, using the straight line method. • Office equipment is depreciated at 10% per annum, using the diminishing balance method. • $1000 of stationery was on hand. • Advertising expense for the year was $5500. • Interest of $600 on overdraft is owing. Things to Consider Apply the correct rules for the balance day adjustments: • When was the vehicle purchased? How much of the depreciation belongs to this period? • Diminishing balance IS the reducing balance method • Stationery on hand? Leftover at end of period -Asset or expense? • We have only Prepaid in TB – but now we see we actually already used some –what accounts does this effect? • If the interest is owing, what action to take? Do we add or subtract from interest for the period (remember we need to write the true amount of interest belonging to this period)? Are we left with a prepaid/accrued asset/liability. a) Complete the profit and loss statement for the twelve months ended 30 June 2003. (7 Marks) remember to underline and think how to use the 3 columns FRED’s CARYARD Profit and Loss Statement for Twelve Months Ended 30 June 2003 $ $ $ REVENUE COST OF GOODS SOLD GROSS PROFIT SELLING EXPENSES ADMINISTRATIVE EXPENSES FINANCIAL EXPENSE NET PROFIT / LOSS FRED’s CARYARD Balance Sheet as at 30 June 2003 $ $ OWNER’S EQUITY ASSETS Current Non-current LIABILITIES Current NET ASSETS $ Revision notes – Study the relationship between the accounting period concept and balance day adjustments Depreciation – using Acc concepts –explain why & how Bad & Doubtful debts – relationship – how treated with/without existing provision Current provision for Doubtful debts is $6000, Bad Debts for the period are $300. Debtors closing balance is $60000. Provision for Doubtful debts for next period is 10% of Debtors. a) Draw up the ledgers and the original balances for the period and the Balance day Adjustments. (4 marks) _________debtors control______________ ____________Bad debts_____________ _________Doubtful Debts______________ ____Provision for doubtful debts________ b) Fill in the General Journal with the appropriate entries (2 Marks) General Journal Date Particulars c) Show the extract for the: i) Balance Sheet Dr ii) Profit & Loss Statement Cr (2 Marks)