Bad Debt, New Business, Parent Company Service Fees/Charges

advertisement

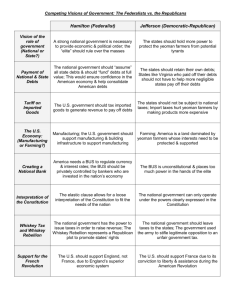

Demystifying Advertiser “Hot Buttons” Presented to the ANA Task Force September 13, 2005 by AAAA Task Force 1 “Hot Buttons” • At our last meeting, we heard that several ANA members have identified three agency expenses as “hot buttons” specifically: – Bad Debts – New Business Costs – Parent Company Service Fees We would like to talk about these today. 2 Bad Debts What are Bad Debts? • Be definition, Bad Debts are “a sum of money owed that is unlikely to be repaid” • For Agencies bad debts represent billings not paid by advertisers – Usually bankruptcy related – Bad debts are not related to Intra Agency billings 3 Bad Debts (Cont.) • All businesses have bad debts – some more than others • Bad debts are anticipated and budgeted cost of doing business in most industries – Cost built into pricing – Bad debts typically represent a very small portion of agency overhead barring a major client bankruptcy. • US GAAP requires that Accounts Receivable be recorded at net realizable value, and a bad debt recorded to reflect uncollectible billing • Bad debts are legitimate business expenses and are 100% tax deductible under the US Tax Code • Which businesses do not have bad debts? We cannot think of any. 4 Bad Debts (Cont.) • We are curious why bad debts are being singled out in Agencies as “hot buttons” when all businesses have them, they represent bills not paid by advertisers and are a cost of doing business similar to any other business. 5 Bad Debts (Cont.) Example – Bad debt impact on overhead Background Tom’s Department Store was a client of XYZ Agency for several years and its revenue served to reduce Agency overhead for the years 2000-2003. In 2004 Tom’s Department Store went bankrupt. Because of the bankruptcy Tom’s did not pay XYZ Agency billings in year 2004 resulting in a Bad Debt expense in 2004. • Questions Why is the 2004 bad debt on XYZ Agency an issue with some advertisers? • If an advertiser does not want to include the bad debt charge in XYZ Agency overhead in 2004 should it be rebilled for Tom’s Department Store overhead adjustment for 2000-2003 to remove positive benefit Tom’s Department Store revenue contributed to XYZ Agency overhead? • If answer is no, would that seem contradictory? 6 New Business Expense What are New Business Expenses? • Equivalent to R & D or customer acquisition costs – • Both seek to develop new products (clients), processes and innovations which will generate future revenue streams and ensure existence of the company, funded from current operations. In the agency business, New Business is a regular, recurring expense, required to replenish the agencies’ revenue stream, reflecting the relationship or assignment life cycle – – If on average a traditional agency – client relationship lasts 5-6 years (latest AAAA estimate), then an agency must replace 15-20% of its client base each year With today’s increased emphasis on projects and below-the-line work, many agencies in fact need to replace anywhere from 25% to 75% of their revenue base every year. • New Business activities ensure a steady revenue stream and client base, over which a relatively fixed overhead base is allocated, keeping overhead rates for all clients lower • New Business expenses are typically research, presentation and other out of pocket expenses incurred in the effort to secure new clients • U.S. GAAP defines R & D as research and development costs to translate the research into a new process, improve/develop an existing process, product or client resulting in future revenue streams. – – – • According to GAAP R & D costs must be expensed in year incurred. New business/R & D/Customer acquisition costs are fully deductible under the US Internal Revenue Tax Code; in fact US government provides tax credits to stimulate R & D spending. R & D costs are built into advertiser pricing even unsuccessful R & D/Customer acquisition ventures Virtually all companies have new business or R & D costs. 7 Top 20 Companies Ranked by 2002 US R&D Expenditures Rank Company R&D Expense $Dollars in Billions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Ford Motor Co General Motors Corp Pfizer IBM Microsoft Intel Johnson & Johnson Motorola Cisco System Hewlett-Packard Merck & Co Lucent Tech. Bristol Myers Squibb General Electric Lily (Eli) & Co Wyeth Sun Microsystems Delphi Corp Boeing Co Texas Instruments $ 7,700 5,800 5,076 4,411 4,307 4,034 3,957 3,754 3,448 3,312 2,677 2,310 2,218 2,215 2,149 2,060 1,832 1,700 1,639 1,618 Source: Industrial Research Institute, Inc. 2005 8 New Business Expense (Cont.) • Why is new business important to Agencies? – Ensure a steady revenue stream and client base – Keeps overhead rates lower, by allocating fixed overhead over a larger client base – Provides insights and market research to expand Intellectual Property of agency • Builds overall Agency knowledge base, benefiting all existing clients – Allows existing staff to work on variety of accounts/ industries – Allows Agency to continue to attract and retain top talent • Provides access for new talent with marketing experience in new industries – Identifies new processes – Fosters positive culture and momentum 9 New Business Expense (Cont.) Questions for those who label new business a “Hot Button: Would these advertisers … • want dedicated agencies with no other clients? • want their agencies not to pitch new business? • allow their agency to work on competing brands? • be pleased to forego the related overhead reductions or knowledge gained through new business efforts? 10 Parent Company Service Fees What are these costs? • Fees cover services that would ordinarily be borne by the Agency if it were a stand-alone company, including allocation of expenses such as audit fees, tax preparation, legal services, membership dues, insurance costs, & centralized services (e.g. accounting, IT, HR, etc.) • Typical costs included in service fee: – Payroll, human resource + benefit processing admin – Corporate insurance – Tax research, planning and preparation (payroll, sales + use, state, federal, property tax) – Real Estate Management – Information Technology Management – Consolidated Purchasing Management – Professional Fees 11 Parent Company Service Fees (Cont.) • The following are not included in Parent Company Service Fees: – Profit – Restructuring, or acquisition costs – Goodwill amortization 12 Parent Company Service Fees (Cont.) • Typical business/accounting + tax treatment for all multinational and domestic companies with multiple locations/divisions (A Best Practice) – All companies have these charges • Represents value received by operating units for services purchased centrally to leverage purchasing power • Cost Efficient: If services purchased individually costs would most likely increase • Excluding these costs does not present true cost of operating unit 13 Conclusion • We are confused why these three expense items would be considered “hot buttons” by some ANA members • It is our understanding that all companies have these expenses and exclusion of any would be inappropriate “cherry picking” without business justification. • Thank you – we would appreciate your help in clarifying. 14