Final Ac - Sole Trader (C)

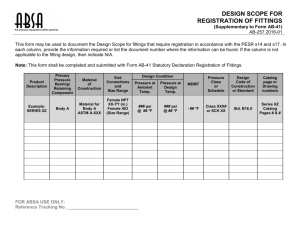

advertisement

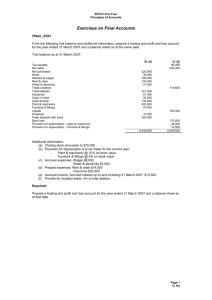

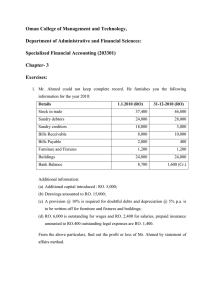

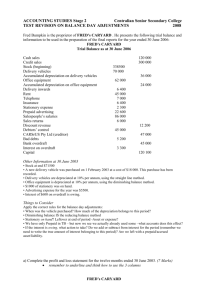

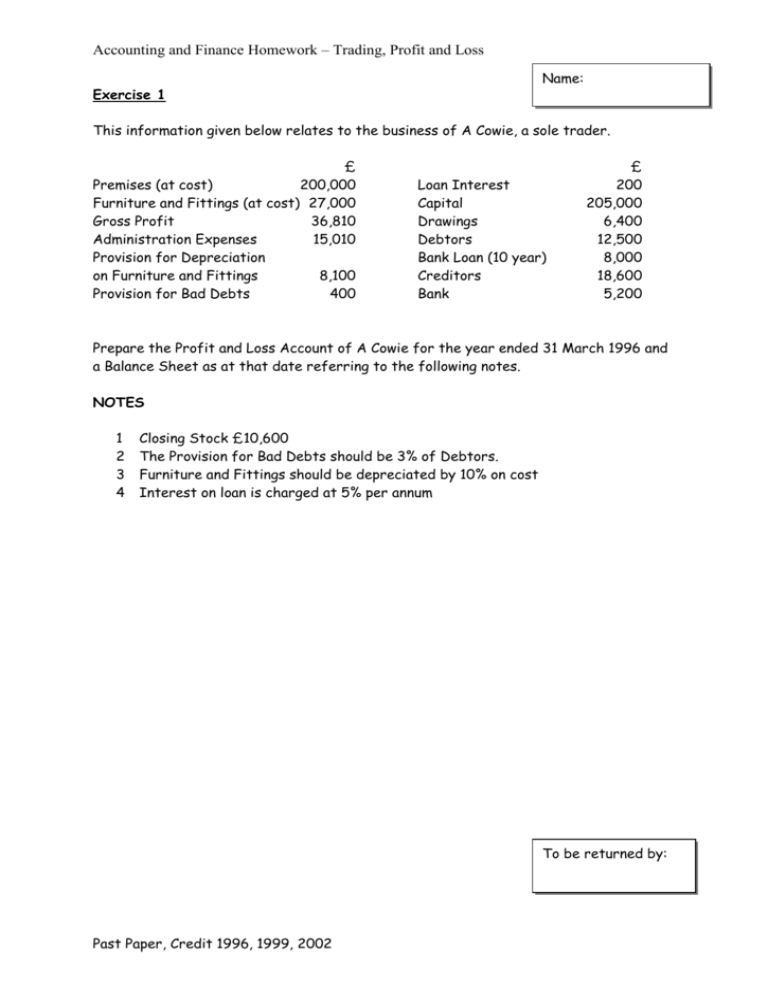

Accounting and Finance Homework – Trading, Profit and Loss Name: Exercise 1 This information given below relates to the business of A Cowie, a sole trader. £ Premises (at cost) 200,000 Furniture and Fittings (at cost) 27,000 Gross Profit 36,810 Administration Expenses 15,010 Provision for Depreciation on Furniture and Fittings 8,100 Provision for Bad Debts 400 Loan Interest Capital Drawings Debtors Bank Loan (10 year) Creditors Bank £ 200 205,000 6,400 12,500 8,000 18,600 5,200 Prepare the Profit and Loss Account of A Cowie for the year ended 31 March 1996 and a Balance Sheet as at that date referring to the following notes. NOTES 1 2 3 4 Closing Stock £10,600 The Provision for Bad Debts should be 3% of Debtors. Furniture and Fittings should be depreciated by 10% on cost Interest on loan is charged at 5% per annum To be returned by: Past Paper, Credit 1996, 1999, 2002 Accounting and Finance Homework – Trading, Profit and Loss Name: Exercise 2 Amanda Geddes is the owner of Mercury Music. From the following information, prepare her Profit and Loss Account for the year ended 31 January 1999 and a Balance Sheet at that date. Fixtures & Fittings Bank Loan Rent Advertising Depreciation Provision on Fixtures and Fittings VAT Premises Cash £ 7,000 5,000 1,650 360 700 79 18,400 170 (Dr) Debtors Gross Profit Loan Interest Capital Provision for Bad Debts Creditors Bank Drawings Stock £ 1,400 4,598 125 20,000 66 2,560 400 2,800 540 Notes: 1 2 3 4 Interest on loan – 5% per annum; Depreciation Provision on Fixtures and Fittings is to be 10% per annum on cost; Rent accrued £150; Provision for Bad Debts is to be 4% of Debtors. To be returned by: Past Paper, Credit 1996, 1999, 2002 Accounting and Finance Homework – Trading, Profit and Loss Name: Exercise 3 Scott Napier is a sole trader and the information below relates to his business for the year ended 30 April 2002. Gross Profit Discount Received Carriage Out Bad Debts Wages Debtors Creditors Bank Overdraft Van (at cost) Computer (at cost) Drawings Capital Advertising Provision for Depreciation on Van Provision for Bad Debts Closing Stock £15,400 £380 £22 £120 £19,500 £11,000 £870 £120 £8,300 £1,000 £1,500 £35,272 £450 £2,600 £250 £300 Taking the following notes into account, prepare the Profit and Loss Account for the year 30 April 2002. Notes: 1 2 3 4 Advertising prepaid £65 Wages accrued £50 The Van and Computer should be depreciated by 10% on cost. The Provision for Bad Debts should be 5% of Debtors. Show the Financed By section only part of the Balance Sheet as at 30 April 2002. To be returned by: Past Paper, Credit 1996, 1999, 2002