Accountancy Practice Paper 2 for TERM II (2015-16)

advertisement

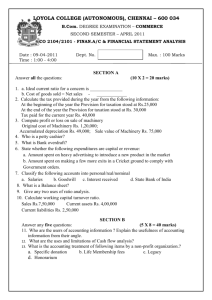

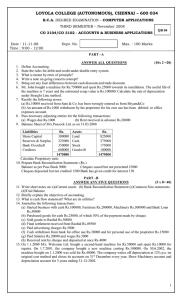

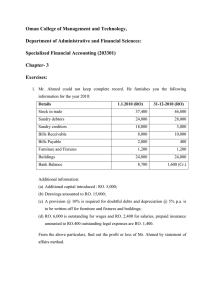

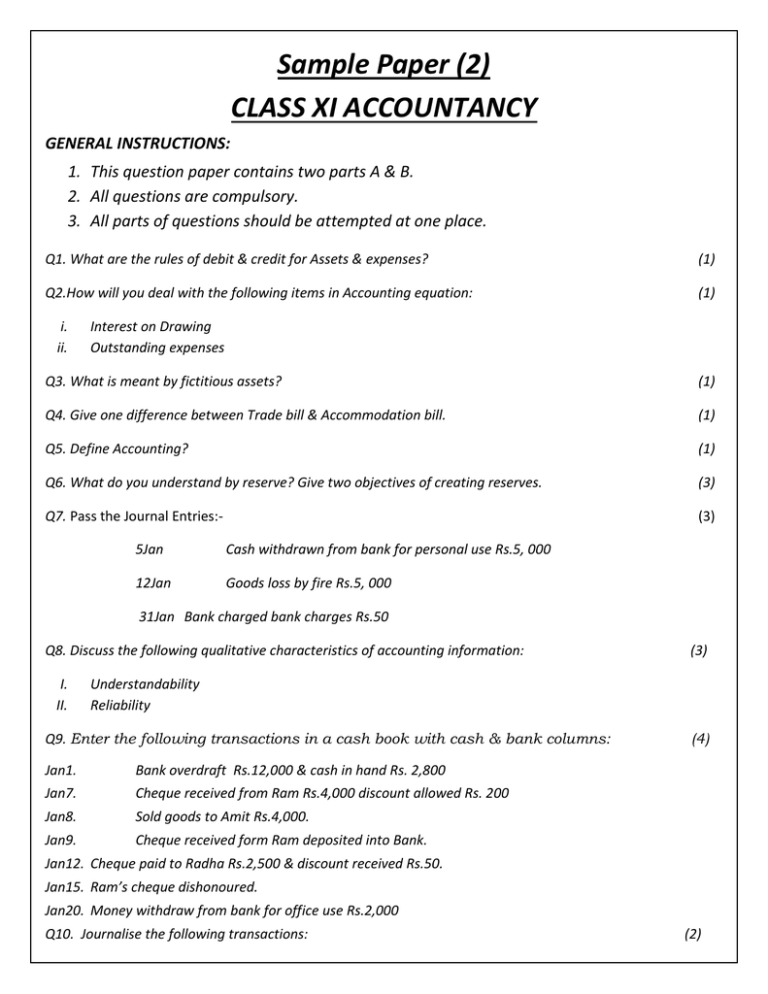

Sample Paper (2) CLASS XI ACCOUNTANCY GENERAL INSTRUCTIONS: 1. This question paper contains two parts A & B. 2. All questions are compulsory. 3. All parts of questions should be attempted at one place. Q1. What are the rules of debit & credit for Assets & expenses? (1) Q2.How will you deal with the following items in Accounting equation: (1) i. ii. Interest on Drawing Outstanding expenses Q3. What is meant by fictitious assets? (1) Q4. Give one difference between Trade bill & Accommodation bill. (1) Q5. Define Accounting? (1) Q6. What do you understand by reserve? Give two objectives of creating reserves. (3) Q7. Pass the Journal Entries:- (3) 5Jan Cash withdrawn from bank for personal use Rs.5, 000 12Jan Goods loss by fire Rs.5, 000 31Jan Bank charged bank charges Rs.50 Q8. Discuss the following qualitative characteristics of accounting information: I. II. (3) Understandability Reliability Q9. Enter the following transactions in a cash book with cash & bank columns: Jan1. Bank overdraft Rs.12,000 & cash in hand Rs. 2,800 Jan7. Cheque received from Ram Rs.4,000 discount allowed Rs. 200 Jan8. Sold goods to Amit Rs.4,000. Jan9. Cheque received form Ram deposited into Bank. (4) Jan12. Cheque paid to Radha Rs.2,500 & discount received Rs.50. Jan15. Ram’s cheque dishonoured. Jan20. Money withdraw from bank for office use Rs.2,000 Q10. Journalise the following transactions: (2) 1. Goods costing Rs. 1,000 sold at 10% loss out of which Rs. 300 was received in cash & rest by cheque. 2. Paid cash to Mr. Mahesh on behalf of Mr. Arun Rs.2050. Q11. “According to what concept closing stock is valued at cost price or realisable value whichever is less.” Explain the concept in which the statement is based. (3) Q12. Briefly answer the following questions with reason: According to modern concept. I. II. (4) Sold goods on credit to Ram, mention which account will be debited & which will be credited. Bank interest Rs.150 credited by bank. Mention which account will be debited & which account will be credited. Q13. On Jan 1,2004, JANKI & SONS purchased plant costing Rs.80,000. It was decided to provide for depreciation @ 20% on straightline value. The plant was destroyed by fire on 31 st July, 2007 & insurance claim of Rs.25,000 was admitted by insurance company. Prepare Plant account & it’s working clearly. Accounts are closed on 31st December every year. (5) Q14. ENTER THE FOLLOWING TRANSACTIONS IN THE SALES BOOK OF M/S SHRI RAM & SONS, Kolkata:- (6) 1994 JAN5. Sold to Ramesh stationery House, Kolkata:50 Dozen penciles @ RS.20 Per Dozen. 20 Dozen pens @ Rs.5 per pen. Trade discount 10% Jan 8. Sold to Gupta Stationery shop, Kanpur:10 Dozen Note books @ Rs.60 per dozen 15 Gross Rubbers @10 per Dozen. Jan20. Sold old newspapers for Rs.150 Jan24. Sold to Modern stationery house, Lucknkow for cash:25 Dozen Pencils @ Rs.22 per Dozen. Jan28. Soldto Ali Mohammad & sons, Allahabad:10 Reams of paper @ Rs.80 per Ream Discount 15% Jan 31. Sold old Furniture to Kedar Nath & co. Allahabad on credit Rs.2,200. Q15. X sold goods to Y for Rs. 23,400 on 1st January 2009 and drew a bill upon him. Y accepted the bill and sent it to X on the same date. X discounted the bill with the bank. On the due date Y failed to pay the due amount to bank and hence subsequently dishonoured the bill. Y requested to X to accept Rs.3,400 immediately & charge the interest @ 10% p.a for further 3 months with the new bill. X agree for this & draw the new bill for the same amount. On the due date the bill is honoured. Pass journal entries in the book of X. (6) Q16. Draw up a bank reconciliation statement as on 30th September, 2003 from the following particulars: (6) On 31st March, 2005 your pass book showed a balance of RS.6000 to your credit. 1. Before that date, you had issued cheques amounting to RS.1500 of which cheques of RS.900 have been presented for payment. 2. A cheque of RS.800 paid by you into bank on 29th March, 2005 is not credited in the pass book. 3. There was a credit of RS.85 for interest on current account in the pass book. 4. On 31st March, 2005 a cheque for RS.510 received by you & was paid into bank but the same was omitted to be entered in the cash book. Q17. You are presented with a trial balance showing a difference, which has been carried to Suspense Account and the following errors are revealed: (7) (i) Rs. 350 paid in Cash for a typewriter was charged to Office Expenses A/c. (ii) Goods amounting to Rs.660 sold to W were correctly entered in the Sales Book but posted to W’s Account as Rs. 760. (iii) Goods worth Rs. 130 returned by G, were entered in the Sales Book and posted there from to the credit of G’s personal account. (iv) Goods sold for Rs. 1,240 and debited on 20th December to C, were returned by him on 23rd and taken into stock on 31st December, no entries being made in the books for return. (v) Sales book was overcast by Rs. 100. Journalize the necessary corrections PART - B Q18. The under mentioned Trial Balance was extracted from the books of Mr. Kumar on 31 st March, 2002: Debit Balances Rs. Credit Balance Rs. Land and Building 3,000 Capital 21,000 Plant and Machinery 8,000 Sales 32,000 Office Furniture 1,000 Sundry Creditors 2,900 Purchases 18,000 Returns 500 Sundry Debtors 8,500 Bills Payable 3,000 Returns 300 Provision for Doubtful Debts 400 Rent Rates & Taxes 750 Stock (1-4-2001) 3,200 Postage & Telegrams 100 Selling Expenses 900 Wages & Salaries 2,800 Telephone Charges 400 Establishment Expenses 2,450 Printing and Stationery 1,500 Bad Debts 100 Commission 1,000 Cash in hand 2,000 Motor Cycle 4,200 Travelling Expenses 400 Carriage Inwards 1,000 Drawings 200 59,800 59,800 Prepare Trading and Profit and Loss Account and Balance Sheet as on 31 st March, 2002. After taking the following adjustments into consideration: 1. The value of stock on 31st March, 2002 was Rs. 7,500 and stock of stationery in hand was Rs. 500. 2. Provision at 5% on sundry debtors is to be maintained and provide for discount on debtors at 2%. 3. Plant and Machinery is to be depreciated at 10%. Motor cycle was valued at Rs. 4,000 on 31-32002. (8) Q19. Classify the following items into capital & revenue expenditure: (4) a. Cost of installation Machinery. b. Wages paid for manufacture of saleable products. c. Cost of Patents. d. Interest on loan borrowed for business. Q20. Name the two sources of income for non- profit organization? (2) Q21. A, who keeps the books on single entry system, gives the following information. Ascertain his profit or loss for the year ending 30th June, 2006. (6) His position on 1st July, 2005 was as follows:cash in hand Rs. 400; cash at bank Rs. 2,000; stock Rs. 5,000; machine Rs. 15,000; bills payable Rs. 2,000; creditors Rs. 4,000; debtors Rs. 6,000; furniture Rs. 5,000. His position on 30th June, 2006 was as follows:cash in hand Rs. 1,600; cash at bank Rs. 1,000; stock Rs. 8,000; machinery Rs. 20,000; bills payable Rs. 2,500; creditors Rs. 3,000; debtors Rs. 7,500; furniture Rs. 6,000. During the year, A introduced Rs. 1,500 as additional capital, He sold his private scooter for Rs. 1,500 and brought this money into business. He withdrew Rs. 4,500 for domestic purposes. In addition he paid Rs. 1,000 his domestic loan and Rs. 500 to his daughter for collage fees. Provide 5% depreciation on machinery, write off Bad debt amounted to Rs. 500 and create a reserve for doubtful debts at 10% on debtors. Also prepare final statement of affairs. Q22. Prepare necessary ledgers. (3) Trial balance extract for 2010-11 Particulars Dr.(amount) Cr. (amount) Debtors 5,00,000 Provision for doubt full debts 15,000 Bad debt 50,000 Additional information:1. Further bad debts during year Rs.25,000. 2. Make the provision for bad & doubt full debt 10% on debtors.