Chapter 5

advertisement

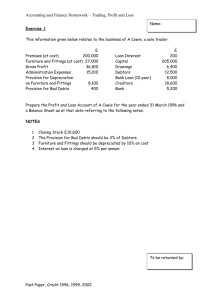

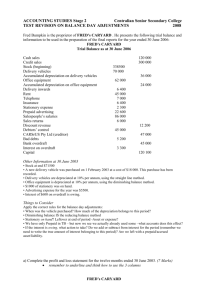

Chapter 5 Last minute adjustments E5.1 Croxteth has been in the retail trade for many years. The following is his trial balance as at 31 July 2008: Bank Capital Creditors Delivery vans at cost Depreciation of delivery vans (at 1 August 2007) Shop equipment at cost Depreciation of equipment (at 1 August 2007) Drawings Purchases Sales Shop expenses Stock (at 1 August 2007) Dr £ 2,000 Cr £ 35,000 4,800 40,000 12,000 8,000 2,400 8,000 70,000 85,000 7,200 4,000 139,200 ______ 139,200 Additional information: 1) Stock at 31 July 2008: £14,000. 2) Depreciation on delivery vans at a rate of 30% per annum on cost, and on shop equipment at a rate of 10% per annum on cost. Required: Prepare Croxteth’s trading and profit and loss account for the year to 31 July 2008 and a balance sheet as at that date. E5.2 Daly’s book-keeper has extracted the following trial balance as at 31 January 2001: Administrative expenses Capital Cash at bank and in hand Creditors Debtors Drawings Furniture and fittings: Dr £’000 63 Cr £’000 252 9 8 1 18 At cost Accumulated depreciation (at 1 February 2000) Motor vehicles: At cost Accumulated depreciation (at 1 February 2000) Purchases Rent, rates, heat and light Sales Stock (at 1 February 2000) Trade creditors Trade debtors Wages and salaries 200 90 800 480 500 9 760 35 170 70 55 1,760 _____ 1,760 Additional information: 1) Stock at 31 January 2001: £40,000. 2) Depreciation is charged on the furniture and fittings at a rate of 15% on cost and on the motor vehicles at a rate of 60% on the reduced balance. 3) A trade debt of £10,000 is to be written off. 4) A provision for bad and doubtful debts is to be established equivalent to 5% of outstanding trade debtors at the end of the year. Required: Prepare Daly’s trading and profit and loss account for the year to 31 January 2001 and a balance sheet as at that date. E5.3 Elm is a wholesaler. The following is his trial balance at 30 June 2006: Advertising Bank Capital Cash Depreciation (at 1 July 2005): Furniture Vehicles Discounts allowed Discounts received Drawings Electricity Furniture, at costs Dr £ 3,000 400 Cr £ 73,500 100 1,800 7,000 400 500 10,000 3,200 12,000 General expenses Interest on investments Investments Provision for bad and doubtful debts (at 1 July 2005) Purchases Purchases returns Rates Sales Sales returns Stock (at 1 July 2005) Telephone Trade creditors Trade debtors Vehicles, at cost Wages and salaries 28,900 800 5,000 2,300 645,000 2000 6,000 820,000 4,000 47,000 1,300 13,000 42,000 35,000 77,600 920,900 ______ 920,900 Additional information: 1) Stock at 30 June 2006: £50,000. 2) The provision for bad and doubtful debts is to be made equal to 5% of the trade debtors as at 30 June 2006. 3) Furniture is to be depreciated at a rate of 15% on cost, and the vehicles at a rate of 20% on a reducing balance basis. 4) At 30 June 2006, amount owing for electricity: £300; rates paid in advance: £1,000. Required: Prepare Elm’s trading and profit and loss account for the year to 30 June 2006 and a balance sheet as at that date. E5.4 Teak has extracted the following trial balance from his books of account as at 31 December 2008: Building society deposit Capital Cash at bank and in hand Depreciation (at 1 January 2008): Plant and equipment Vehicles Dividends received (interim) Interest received from building society Interest received from Gray Dr £ 20,000 Cr £ 66,500 400 30,000 16,000 100 700 500 Investments at cost Loan to Gray (repayable 1 October 2009) Office expenses Plant and equipment at cost Purchases Sales Stock (at 1 January 2008) Trade debtors/trade creditors Vehicles at cost Vehicle expenses 5,000 10,000 39,000 50,000 83,000 164,000 2,800 13,200 64,000 12,600 300,000 22,200 _______ 300,000 Additional information: 1) Stock at 31 December 2008: £15,800. 2) During the year to 31 December 2008, Teak had used some goods (purchased through the business) for his own personal consumption. At cost price these goods were estimated to be worth £6,000. No entries had been made in the books of account to reflect this transaction. 3) At 31 December 2008 there was an amount outstanding for office expenses of £1,200. At the same date Teak was due to receive interest from the building society of £800, and a final dividend of £600 from a company in which he had some investments. 4) Depreciation is to be charged on plant and equipment at a rate of 30% per annum on cost, and on vehicles at a rate of 25% on the reduced balance. 5) Office expenses include Teak’s drawings for the year of £9,000. Required: Prepare Teak’s trading and profit and loss account for the year to 31 December 2008 and a balance sheet as at that date. E5.5 Patsy Chan has been in business for several years. The following trial balance was extracted from her books of account as at 30 September 2009: Bad debt Capital Carriage inwards Carriage outwards Cash at bank and in hand Discounts allowed Discounts received Dividends received Drawings Investments at cost Dr £’000 15 Cr £’000 653 10 34 7 18 27 2 12 20 Motor vehicles: At cost Accumulated depreciation (at 1 October 2008) Office expenses Plant and equipment: At cost Accumulated depreciation (at 1 October 2008) Provision for bad and doubtful debts (at 1 October 2008) Purchases Salaries Sales Stock (at 1 October 2008) Trade creditors Trade debtors Wages 600 300 35 240 144 3 570 105 900 200 71 160 74 2,100 _____ 2,100 Additional information: 1) Stock at 30 September 2009: £180,000. 2) Depreciation on motor vehicles is charged at a rate of 25% on cost and on plant and equipment at a rate of 30% on cost. 3) Wages owing at 30 September 2009: £2,000. 4) Business rates paid in advance at 30 September 2009: £5,000. 5) A provision for bad and doubtful debts is maintained at a rate equivalent to 2.5% of outstanding trade debtors as at the end of the year. Required: Prepare Patsy Chan’s trading and profit and loss account for the year to 30 September 2009 and a balance sheet as at that date. E5.6 Essce Limited is a new company. Following the end of its first financial year to 31 March 2004, it is now considering what accounting policies and methods it should adopt in preparing its accounts. The following data are relevant to some of the issues which it has to face: Sales Purchases Stocks (at 31 March 2004, based on the latest prices paid; the replacement cost of this stock is estimated to be £330,000) £’000 1,500 900 300 Fixed assets at cost: Plant and equipment (estimated life: 10 years; estimated residual value: £100,000) Motor vehicles (estimated life: 5 years; estimated residual value: £50,000) Trade debtors (at 31 March 2004, including a debt outstanding of £20,000 since April 19X3) Fuel and power (for the 11 months to 28 February 2004; invoice received in June 2004 for £15,000 for the three months to 31 May 2004) Insurance (for the 18 months to 30 September 2004) 1,500 500 270 30 90 Note: By using the latest prices for valuing its closing stock, the Company would appear to be using what is known as the LIFO (last-in, first-out) method for pricing the cost of selling (or issuing) goods. This method is the opposite of the FIFO (first-in, first-out) method. LIFO is not common in the United Kingdom as SSAP 9 does not approve of it and it is not allowable for taxation purposes. Required: Insofar as the information permits, advise management on (i) the accounting policies and methods, and (ii) the suggested amounts that should be included in the financial accounts for the year to 31 March 2004 in respect of each of the following items: (a) stock valuation; (b) depreciation; (c) bad and doubtful debts; (d) fuel and power; and (e) insurance.