Revenue - the price received, or to be received from a service

advertisement

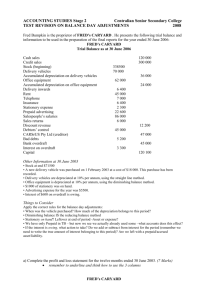

Ok, so here's the deal. We want to make an entry to get bad debt expense recorded this year (the year that the bad debts originated). This is easy enough, we will simply debit bad debt expense in the adjusting entry. The question is, for what amount? We have to estimate the amount, which means we guess. We can use any method we want in going about making the guess, but it would probably be good if we can defend the manner in which we come up with the amount. Lets see if we can find a relationship (correlation, link, etc) between bad debts expense and something else. If we have no credit sales, how much bad debt can we have? Not much. Hey, what if we don't have any A/R at the end of the accounting period, can we have any further bad debts? Not likely. These are the two items that we have picked to analyze to determine if we can find a correlation to aid in the estimation of the dollar amount of bad debts to estimate. Here are some profound statements. If we have no credit sales, we will have no bad debts. If we have a little credit sales, we will have a little bad debts. If we have a few more credit sales, we will have a few more bad debts. And finally, if we have a whole bunch of credit sales, we will have a whole bunch of bad debts. Now obviously, this is not a dollar for dollar relationship, but over time we can observe and calculate a relationship between the two. [You will not be asked to go thru past information and attempt to draw out this calculated correlation. You just need to be aware that this is a step in the process leading to the determination of the amount of bad debt expense to report on the income statement and the effect that the professional judgment of those involved in the preparation of financial statements can influence the financial position of the reporting by the company.] So, we really step into the game once a number of things have already taken place. Assume that based upon an analysis of past A/R and bad debts, it is determined that approximately 1% of sales ultimately end up being bad debts. No problem, if we have sales this year of $100,000, we would estimate the bad debts expense associated with this year to be $1,000 ($100,000 * 1%). Therefore, the adjusting entry is Bad Debt Expense Allowance for D/A $1,000 $1,000 If next year sales are $200,000, we would make that year's entry for $2,000. We simply make an adjusting entry debiting bad debt expense for an amount equal to the sales for the year multiplied by the correlation percent determined by an analysis of past sales and bad debts. But what if the company made its estimate based not upon an analysis of sales but of A/R. [Again before we enter the process] the analyst would evaluate all the individual A/R that the company has listed in its records of people of owe us money (lets say a total of $100,00,) and that analysis leads us to the conclusion that of the total A/R, we do not expect to collect 3% of the A/R or $3,000. By default that means that we do plan to collect $97,000 (this amount is referred to as the expected realizable value). The function of the adjusting entry is to result in the account "Allowance for D/A" to have a credit balance of $3,000. Therefore, if the Allowance account has a zero balance prior to the adjusting entry, the adjusting entry will be for $3,000; if the account has a $1,000 credit balance, the adjusting amount will be for $2,000; if the account has a $2,000 debit balance, the adjusting amount will be for $5,000. The bottom line is that after the adjusting entry has been recorded and posted, the account Allowance for D/A will have a credit balance equal to the amount calculated in the analysis.