Model Paper Fundamentals Accounting

advertisement

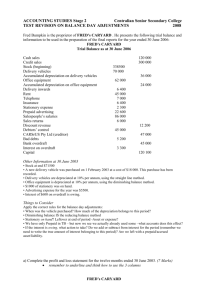

Course Outline Course Title: Fundamentals of Accounting Course No: BS (A&F): ACC 103 Class: BS (A &F), BS (Commerce), Course No: BS (Commerce): ACC 103 B.Com (Annual system): B.Com (Annual system): Part I, Paper II Course Objectives: 1. To introduce accounting concepts which enable students to recognize, understand and maintain different accounts of business according to the Accounting Standards, with a clear understanding of how transactions are recorded in different types of business? 2. Understand the basic elements of double-entry accounting systems, accounting cycle, entering transactions in journals, posting to ledgers, compiling end-of-period worksheets with adjusting entries and preparation of financial reports. Course Contents: Topic Source Introduction to Business, Commerce, Trading, Finance and Financial Ch.1, book 1 Institutions. Concept of account, assets, liabilities, revenues, expenses, capital etc. Section A Introduction to accounting and accounting equation Ch.2, book 1 Section A The IASB, and financial reporting IFRS-1 Ch.1, book 1 Section A Recording the business transaction: sources , records and books of Ch.2, book 1 original entry journal, ledger accounting & trial balance Ch.3, book 2 Section A Adjusting entries: contra Accounts, accruals and prepayments, Ch.3, book 1 adjusting trial balance, financial statements Ch.3, book 2 Section A Completing the accounting cycle, Closing entries: temporary and Ch.4, book 1 permanent accounts, post close trial balance, reversing entries and Worksheet Section A Special journals for repetitive transaction, their types and formats Ch.4, book 2 Subsidiary ledgers and Control accounts. for sales, purchases, transactions etc. Section B Accounting for merchandising concerns: purchase, sales, discounts, Ch.5, book 1 returns and allowances, FOB destination and shipping point , cost of goods sold, completing the accounting cycle, financial statement formats Section B IAS-2 Inventories, types and its evaluation Ch.2, book 3 Section B Inventories and its types, inventory costing under perpetual and Ch.6, book 1 periodic systems , financial statement effects of costing methods, Section B Accounting concepts and conventions: IAS-1 inventory errors and decision analysis Internal control, its types, purpose and limitations, control of cash, Ch.8, book 1 banking activities as controls, bank statement, bank reconciliation, Cash book. Section B Accounting for accounts receivables, notes Receivables, its recognition Ch.9, book 1 and disposition. , Bad debts, direct and allowance approach, provision and reserve Section C Accounting for fixed assets; property plant and equipment, cost determination of fixed assets, Accounts for assets acquired in non monetary exchanges, Disposal of fixed Assets. Section C Ch.10 book 1 Ch. 9 book 2 Depreciation, Describe the purpose, process and calculation of depreciation, depletion and amortization, impairment of assets and revision of depreciation. Natural resources & intangibles Current liabilities and payroll accounting Ch.11, book 1 Section C Partnership accounts with reference to Partnership Act-1932 Ch.12, book 1 Formation, admission, retirement, death, profit distribution and book 4 dissolution. Section C Recommended Text (Latest Editions): 1. Larson, K. D., Wild, J. J., & Chiappetta, B. (2005), “Fundamentals of Financial Accounting”, 17th edition, McGraw Hill Irwin. 2. Meigs, B. Walter., Johnson, E. Charles. & Meigs, F. Robert (2003), “Accounting: the basis of Business decisions”, 11th edition McGraw Hill,. 3. International Accounting Standards Committee Foundation (IASCF) 2005, International Financial Reporting Standards (IFRSs) , London United Kingdom. Suggested Readings 4. 5. 6. 7. Partnership Act-1932 Fees Reeve Warren (2005), “Accounting”, 21st editions, Thomson South-Western, ICAP (2004), “Introduction to Financial Accounting”, Module-B, 17 editions, .PBP professional education, ICMAP (2006), “Fundamentals of Financial Accounting and Taxation”, Stage-1 2nd edition. PBP professional education, MODEL PAPER FOR B.COM PART 1 ANNUAL EXAMINATION SYSTEM 2009 & ONWARDS FUNDAMENTALS OF ACCOUNTING OBJECTIVE PART TIME ALLOWED = 30 MINUTES MAX MARKS = 30 INSTRUCTIONS TO CANDIDATES: This paper comprises 30 MCQ’s. Each MCQ carries 1 mark. Please encircle the correct option only. Cutting, overwriting and use of ink remover is not allowed. 1. A. B. C. D. Internal users of accounting information include which of the following: Company officers. Investors. Financial Institutions Competitors 2. Which of the following is not an accounting convention? A. Substance over form B. Consistency C. Depreciation D. Matching 3. A. B. C. D. If during the accounting period the assets increased by Rs. 10,000, and equity increased by Rs. 2,000, then how did liabilities change? Increased by Rs. 8,000 Increased by Rs. 12,000 Decreased by Rs. 8,000 Decreased by Rs. 12,000 4. A. B. C. D. Profit and loss account would not include? Salaries Drawings. Rent received. Carriage outwards. 5. A. B. C. D. Accrued expenses affects: assets and expenses. liabilities and revenues. assets and revenues. expenses and liabilities. 6. A. B. C. D. 7. A. B. C. D. Which of the following items would not appear in a debtors control account? Cash received Returns inwards Discount received Interest charged on overdue accounts. In a bank reconciliation, deposits in transit are: deducted from the cash book balance. added to the cash book balance. added to the bank statement balance. deducted from the bank statement balance. 8. A. B. C. D. Overstating ending inventory will understate: assets. cost of goods sold. net income. owner's equity. 9. A. B. C. D. Which of the following records is not a book of prime entry? Bank statements Petty cash book Journal Sales returns day book. 10. IAS-2, does not recommend the following method of stock valuation for incorporating its value in financial statements. A. B. C. D. FIFO method The weighted average method LIFO method None of the Above 11. A. B. C. D. The method that ignores scrap value in determining the amount of depreciation is the: straight-line method. units-of-activity method. declining-balance method. None of these options. 12. In normal trading circumstances, which of the following would not be found in a partner’s current account? A. Drawings B. Goodwill C. Interest on drawings D. Salaries 13. The correct entry to record increase in the provision for doubtful debts is: Debit Credit A. Profit & Loss Provision for doubtful debts B. Bad debts Provision for doubtful debts C. Provision for doubtful debts Profit & Loss D. Provision for doubtful debts Bad debts 14. A. B. C. D. Wages and salaries payable are classified as a: Current liability. Long-term liability. Non-current liability. Intangible liability. 15. In the absence of any agreement to the contrary, the Partnership Act 1932 prescribes interest on drawings should be paid: A. To none of the partners B. To all the partners in equal amounts. C. Only to partners active in the business D. Only to partners with limited liability NOTE: Only 15 MCQ’s (5 MCQ’s from each section) are provided for specimen purposes. Actual paper will comprise 30 MCQ’s (10 MCQ’s from each section) MODEL PAPER FOR B.COM PART 1 ANNUAL EXAMINATION SYSTEM 2009 & ONWARDS FUNDAMENTALS OF ACCOUNTING SUBJECTIVE PART TIME ALLOWED = 90 MINUTES MAX MARKS = 45 INSTRUCTIONS TO CANDIDATES: This paper comprises of 3 Sections Attempt only one question from each section. Each question carries 15 marks. SECTION A (Attempt any one of two) Question No 1: Dawood extracted a trial balance at 31st December 2008 from his books after he had prepared his trading account for the year ended on that date. It was as follows: Trial Balance of Dawood Fixed Assets Stock at 31st December 2008 Trade Debtors Trade Creditors Bank Long tem loan Gross profit Rent Electricity Stationary Motor expenses Interest on loan Drawings Capital Grand Total Rs. (000’s) 40,000 7,000 1,600 2,524 Rs. (000’s) 1,400 10,000 30,000 2,600 926 405 725 500 5120 61,400 20,000 61,400 Further Information: 1. At 31 December 2008, rent had been prepaid in the sum of Rs.300,000 2. The following amounts were owing at 31st December 2008: electricity Rs.242,000; stationary Rs.84,000; motor expenses Rs.160,000. 3. Debts amounting to Rs.100,000 were to be written off and company decided to create a provision for doubtful debts equal to 5% of the remaining debtors. 4. The stock of unused stationary on hand at 31st December 2003 was valued at cost Rs.100, 000. Required: Prepare Income Statement for the year ended 31 st December 2008 & Balance Sheet as on 31st December 2008 Question No 2: Prepare adjusting journal entries for the year ended December 31, 2008, for each of these separate situations. Assume that prepaid expenses are initially recorded in asset accounts. Also assume that fees collected in advance of work are initially recorded as liabilities. a. b. c. d. e. Depreciation on the company’s equipment is computed to be Rs.16,000. The prepaid Insurance account had a Rs.9,000 debit balance at December 31, 2008, before adjusting for the costs of any expired coverage. An analysis of the company’s insurance policies showed that Rs.3,000 of unexpired insurance coverage remains. The office supplies account had a Rs.600 debit balance on December 31, 2004; and Rs.2,680 of the office supplies was purchased during the year. The December 31, 2008, physical count showed Rs.400 of the supplies available. One half of the work related to Rs.15,000 received in advance was performed during the period. Wages expenses of Rs.4,000 have been incurred but are not paid as of December 31, 2008 SECTION B (Attempt any one of two) Question No 2: The cash account for Pak Store at April 30, 2008, indicated a balance of Rs. 13,290.95. The bank statement indicated a balance of Rs. 18,016.30 on April 30, 2008. Comparing with the bank statement and the accompanying canceled checks and memorandums with the records revealed the following reconciling items: a. b. c. d. e. f. Checks outstanding totaled Rs.7,169.75 A deposit of Rs.5189.40, representing receipts of April 30, had been made too late to appear on the bank statement. The bank had collected Rs.3,240 on a note left for collection. The face of the note was Rs.3,000. A check for Rs. 1960 returned with the statement had been incorrectly recorded by Pak Store as Rs. 1,690. The check was for the payment of an obligation to Javaid for the purchase of office equipment on account. A check drawn for Rs.1,680 had been erroneously charged by the bank as Rs.1,860. Bank service charges for April amounted to Rs.45. Required: Prepare a bank reconciliation statement. Question No 3: Wireless Company uses a perpetual inventory system. It entered into the following calendar year 2008 purchases and sales transactions. Date 1-Jan 10-Jan 13-Feb 15-Feb 21-Jul 5-Aug 10-Aug Activities Beginning Inventory Purchase Purchase Sales Purchase Purchase Sales Total Units acquired at cost 600 units @ Rs.55 / unit 450 units @ Rs.58 / unit 200 units @ Rs.59 / unit Units sold at retail 430 units @ Rs. 100/unit 230 units @ Rs.60/unit 345 units @ Rs.65/unit 1,825 units 335 units @ Rs. 100/unit 765 units Required: 1. 2. 3. 4. Compute the cost of goods available for sale. Compute the number of units in ending inventory Compute the cost assigned to ending inventory using (a) LIFO and (b) Weighted Average Compute gross profit earned by the company for each of the two methods in part 3. SECTION C (Attempt any one of two) Question No 5: On January 2, 2008, Ahmad & Co disposes of a machine costing Rs.84,000 with accumulated depreciation of Rs.45,250. Prepare the entries to record the disposal under each of the following separate assumptions: 1. 2. 3. Machine is sold for Rs.32,500 cash. Machine is traded in on similar but newer machine having a Rs.117,000 cash price. A Rs.40,000 trade in allowance is received, and the balance is paid in cash. Machine is traded in on similar but newer machine having a Rs.117,000 cash price. A Rs.30,000 trade in allowance is received, and the balance is paid in cash. Question No 6: Ali and Ahmad began a partnership by investing Rs.60,000 and Rs. 80,000, respectively. During its first year, the partnership earned Rs.160,000. During the year partners withdraws Rs.5,000 each. Prepare Profit and Loss appropriation account and Partners’ capital accounts under each of the following three separate cases: 1. 2. 3. No agreement was in place between the partners. Partner’s agreed to share profits and losses in proportion of their initial investments. Partners agreed on the following terms. (a) Rs.50,000 salary is to be paid to Ali and Rs.40,000 to Ahmad, (b) 10% interest on initial capital investments (c) profits and losses to be shared in the ratio of 3:2. (End of Question paper)