Closing at Year End

advertisement

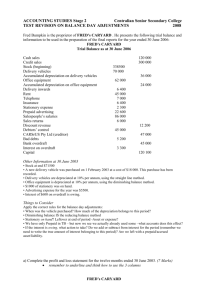

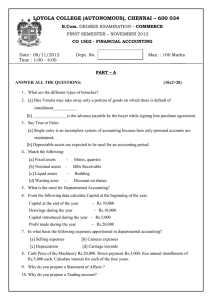

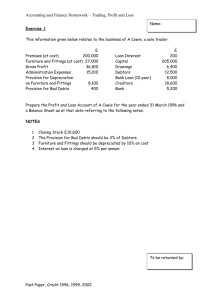

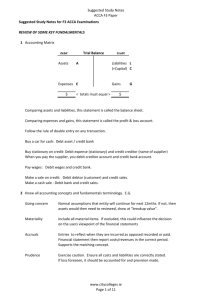

Closing at Year End United Kingdom Procedures for Year End The trial balance is extracted from the ledger accounts by obtaining a balance for each account. If the balances do not give a balance then the difference is placed in a suspense account. The cause of any such difference must be investigated and corrections made before proceeding. Once the trial balance balances the next step is to proceed to make any necessary adjustments. Adjustments • • • • • • Accruals Prepayments Bad Debts Provision for Doubtful Debtors Depreciation Closing Stock Accruals Any invoices received after the trial balance has been obtained which relate to the previous period should be included in the accounts. Where there is no invoice, but the sum involved is substantial then it should be fairly estimated and included. Matching expenditure to the relevant accounting period is an example of the accruals concept. The appropriate expense or purchases account is debited and the accruals account is credited. Prepayments Income should also be matched to the correct financial period, the process of making this adjustment is one of calculating prepayments. For example, if the financial year ended on December 31st and premises insurance for 12 months was paid of September 1st: 4 months of premises insurance have been used, but the remainder of the payment relates to premises insurance for the forthcoming period. This amount is calculated and entered as a prepayment. The entry must be to debit the prepayment account and to credit the appropriate expense or other account. Bad debts At the end of any year it is likely that there will be a number of debtors from whom it is unlikely that revenue will be recovered from. This may be because they have gone out of business or because all means of trying to recover the money have failed. The procedure is to credit the debtors account (accounts receivable) and to debit the bad debt expense account. If the bad debt is older than 6 months from the date that the invoice was due to be paid then the VAT can also be recovered. Should the debt later be recovered then a further entry is made to the accounts. Provision for doubtful debtors Where it is determined that a number of debtors will become ‘bad’ (i.e. will not be recovered) then a provision is made in the accounts for doubtful debtors. This provision usually represents a percentage of total debtors after writing off any bad debts. Since the total of the debtors will vary from year to year then the he provision.adjustment will be made each year. The adjustment takes into account the change in the total of t Depreciation The provision for depreciation is calculated each year for nearly all fixed assets. The provision is recorded as a credit in the Accumulated Depreciation Account (a balance sheet account) and as a debit in the Depreciation Expense Account (an expense account). The method by which depreciation is calculated for each asset is determined when the asset is first purchased. Under normal circumstances this method of depreciation should not change. Closing Stock Adjustments are made to determine the valuation of the closing stock. The method for doing this will usually be by a physical stock take and then using FIFO or AVCO. For some businesses a determination is made of the work in hand. This is considered in a similar way to closing stock. Both closing stock and work in hand appear as assets on the balance sheet. Partnerships Once the net profit has been determined then the closing procedure to set out the financial statements will involve: Setting out the current accounts for each partner Setting out the capital accounts for each partner This must be done in accordance with the partnership agreement. Companies Calculation of taxes is carried out. Any dividends to be declared are determined.