Analysts: Elisa Gayle,

Brenna Koch, Jonathan Ramirez

Applied Portfolio Management

LOW

Lowe's Companies Inc.

SELL

Consumer Discretionary

Sector:

Report Date:

Market Cap (mm)

Return on Capital

EPS (ttm)

Current Price

12-mo. Target Price

$37,274

9.3%

$1.44

$31.09

$31.00

Annual Dividend

Dividend Yield

Price/Earnings (ttm)

Economic Value-Added (ttm)

Free Cash Flow Margin

$0.53

1.7%

21.7

$254

7.9%

Business Description

Lowe’s Companies, Inc., together with its subsidiaries, operates as a home

improvement retailer. It offers a range of products for maintenance,

repair, remodeling, and home decorating. The company provides home

improvement products under the categories of appliances, lawn and

landscape, fashion electrical, lumber, building materials, paint, home

fashions, storage and cleaning, rough plumbing, flooring, tools, seasonal

living, millwork, hardware, fashion plumbing, nursery, and cabinets and

countertops, as well as boards, panel products, irrigation pipe, vinyl

siding, and ladders. It also offers installation services through independent

contractors in various product categories. The company serves

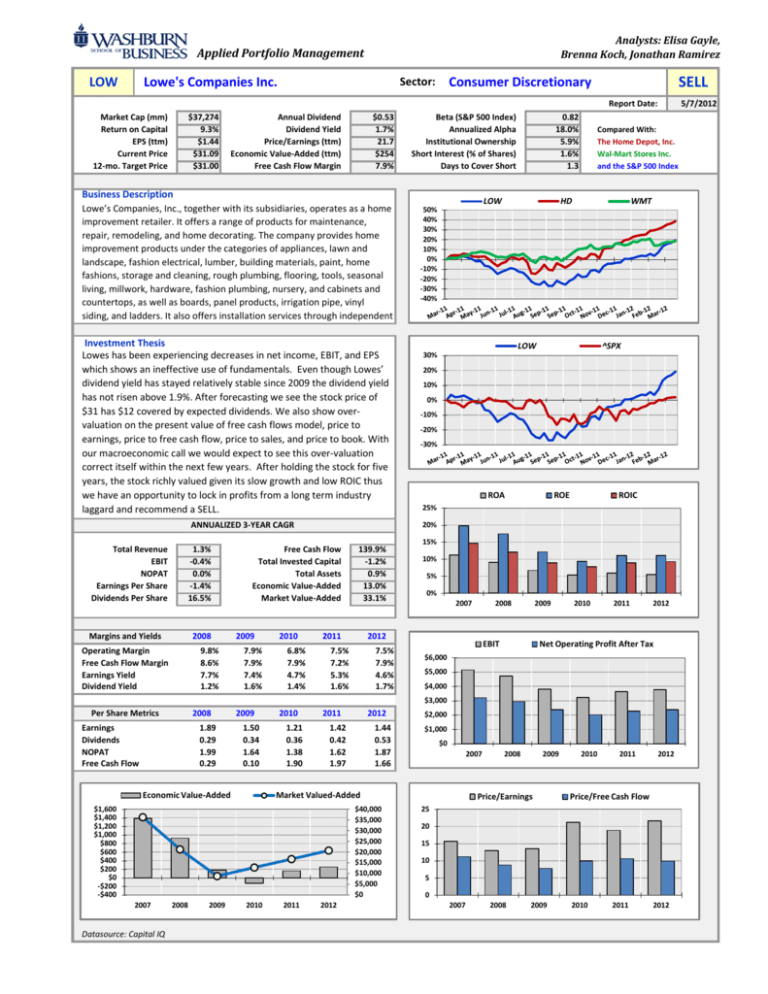

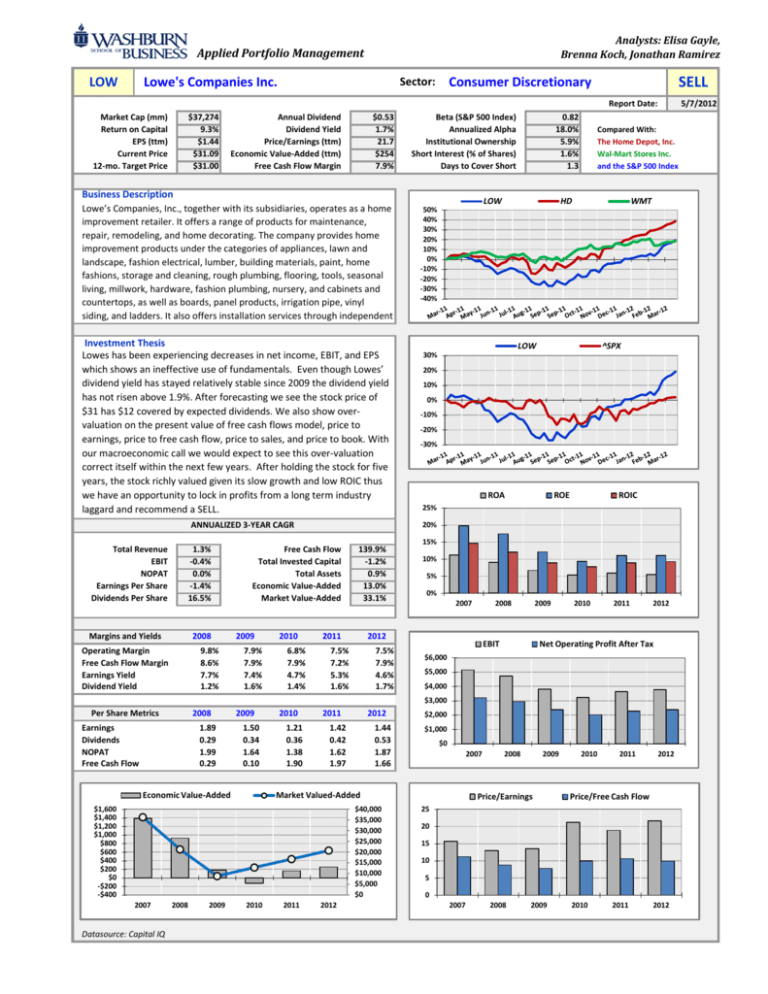

Investment Thesis

Lowes has been experiencing decreases in net income, EBIT, and EPS

which shows an ineffective use of fundamentals. Even though Lowes’

dividend yield has stayed relatively stable since 2009 the dividend yield

has not risen above 1.9%. After forecasting we see the stock price of

$31 has $12 covered by expected dividends. We also show overvaluation on the present value of free cash flows model, price to

earnings, price to free cash flow, price to sales, and price to book. With

our macroeconomic call we would expect to see this over-valuation

correct itself within the next few years. After holding the stock for five

years, the stock richly valued given its slow growth and low ROIC thus

we have an opportunity to lock in profits from a long term industry

laggard and recommend a SELL.

ANNUALIZED 3-YEAR CAGR

Total Revenue

EBIT

NOPAT

Earnings Per Share

Dividends Per Share

1.3%

-0.4%

0.0%

-1.4%

16.5%

Margins and Yields

2008

Operating Margin

Free Cash Flow Margin

Earnings Yield

Dividend Yield

9.8%

8.6%

7.7%

1.2%

7.9%

7.9%

7.4%

1.6%

2010

6.8%

7.9%

4.7%

1.4%

0.82

18.0%

5.9%

1.6%

1.3

LOW

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

5/7/2012

Compared With:

The Home Depot, Inc.

Wal-Mart Stores Inc.

and the S&P 500 Index

HD

WMT

LOW

^SPX

30%

20%

10%

0%

-10%

-20%

-30%

ROA

ROE

ROIC

25%

20%

Free Cash Flow

Total Invested Capital

Total Assets

Economic Value-Added

Market Value-Added

2009

Beta (S&P 500 Index)

Annualized Alpha

Institutional Ownership

Short Interest (% of Shares)

Days to Cover Short

139.9%

-1.2%

0.9%

13.0%

33.1%

2011

15%

10%

5%

0%

2007

2008

2012

7.5%

7.2%

5.3%

1.6%

7.5%

7.9%

4.6%

1.7%

2009

EBIT

2010

2011

2012

Net Operating Profit After Tax

$6,000

$5,000

$4,000

$3,000

Per Share Metrics

2008

Earnings

Dividends

NOPAT

Free Cash Flow

1.89

0.29

1.99

0.29

2009

1.50

0.34

1.64

0.10

Economic Value-Added

2010

1.21

0.36

1.38

1.90

2011

2012

1.42

0.42

1.62

1.97

1.44

0.53

1.87

1.66

$40,000

$35,000

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

Datasource: Capital IQ

2008

2009

$1,000

$0

2007

Market Valued-Added

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

-$200

-$400

2007

$2,000

2010

2011

2012

2008

2009

Price/Earnings

2010

2011

2012

Price/Free Cash Flow

25

20

15

10

5

0

2007

2008

2009

2010

2011

2012

20

28

PRVit® -- the Performance Risk Valuation investment technology

PRVit® is powered by EVA® and EVA Momentum®,

from EVA Dimensions LLC

LOWE'S COMPANIES INC

registered marks of EVA Dimensions LLC

Date

Share

Price

4-May-12

$31.09

Specialty Retail

LOW

Lowe's Companies, Inc., together with its subsidiaries, operates as a home improvement retailer. It offers a

range of products for maintenance, repair, remodeling, and home decorating. The company provides home

improvement products under the categories of appliances, lawn and landscape, fashion electrical, lumber,

building materials, paint, home fashions, storage and cleaning, rough plumbing, flooring, tools, seasonal living,

millwork, hardware, fashion plumbing, nursery, and cabinets and countertops, as well as boards, panel products,

irrigation pipe, vinyl siding, and ladders. It also offers installation services through independent contractors in

various product categories. The company serves homeowners and renters consisting of do-it-yourself customers

and do-it-for-me customers; and commercial business customers who work in construction, repair/remodel,

commercial and residential property management, or business maintenance professions. As of February 3, 2012,

it operated 1,745 stores, including 1,712 stores in 50 U.S. states, 31 stores in Canada, and 2 stores in Mexico.

The company also offers its products through Lowes.com. Lowe's Companies, Inc. was founded in 1946 and is

based in Mooresville, North Carolina.

Performance Score (P)

LOW

25th

50th

75th

% Russell

0.3%

0.5%

-5.3%

-3.4%

0.6%

0.7%

4.6%

4.8%

46

48

P2 Trend

The growth rate in the firm's economic profit (its EVA)

EVA Momentum (vs Cap)

3 Year Trend (ΔEVA/Cap)

Last Quarter (ΔEVA/Cap)

LOW

25th

50th

75th

% Russell

-0.2%

0.0%

1.0%

-1.0%

-0.3%

-1.9%

0.6%

0.7%

0.5%

2.4%

2.2%

2.6%

34

30

57

Risk Score (R)

12

21

R1

Lower is better

Volatility

Variability in stock price and the EVA profit margin

Stock Price Volatility

EVA Margin Variability

42

R2

LOW

25th

50th

75th

% Russell

28%

0.8%

36%

2.0%

46%

4.4%

57%

11.8%

9

5

Vulnerability

25th

50th

75th

% Russell

Free Cash Flow Rate

Op Cash Gen Return

10%

13%

6%

54%

0%

23%

-10%

11%

16

72

Total Debt/Total Capital

Total Debt/EBITDAR

37%

1.8

8%

0.7

25%

1.9

45%

3.5

66

48

Valuation Score (V)

79

61

V1

MVA Margin

MVA Spread

54

LOW

25th

50th

75th

% Russell

39%

71%

-8%

-7%

37%

30%

129%

117%

51

66

V2 Wealth Multiples

Valuation multiples to cash flow, earnings, EVA

EBITDAR Multiple

NOPAT Multiple

Future Growth Reliance

LOW

25th

50th

75th

% Russell

8.0

22.0

35%

5.5

14.6

-13%

7.5

19.8

20%

10.2

27.3

62%

56

60

61

The PRVit Matrix: depicts a company’s PRVit score by plotting its “intrinsic” value score – what PRVit rates the firm is truly

worth based on its risk-adjusted performance, i.e., its comparative P-R score – against its actual valuation score – which

reflects the company’s current trading multiples. Companies rated “Hold” plot along the diagonal, which is where the firms’

actual valuation multiples align with their intrinsic values. “Buys” plot in the upper right green zone, which is where PRVit rates

the firms as worth more than their current share values, and “Sells” appear in the lower left red zone, where the firms’ P-R

scores fall short of their V scores. The top grid rates the firms against the entire market, and the lower one ranks them against

industry peers (which is the basis for the official “PRVit” score).

Sales vs. Capital

ROC vs. COC

$60,000

$50,000

$40,000

$0

1/07

1/08

1/09

Sales

1/10

Capital

1/11

1/12

60

80

60

LOW

40

20

0

100

80

60

$35,000

$1,400

90

$30,000

$1,200

$1,000

$25,000

$800

$20,000

$600

$15,000

4%

$10,000

2%

$5,000

0%

$0

1/08

1/09

ROC

1/10

40

20

0

Actual Valuation Vs. Industry

(V=74th Percentile)

PRVit Scores

16%

1/07

40

20

0

Actual Valuation Vs. Russell 3000

(V=79th Percentile)

LOW PRVit Score Vs Industry 24

100

6%

$10,000

80

$1,600

8%

$20,000

20

Market Value Added (MVA) vs. EVA

10%

$30,000

40

$40,000

12%

1/11

COC

1/12

$400

1/08

1/09

1/10

MVA

1/11

80

70

60

50

40

30

$200

20

$0

10

-$200

1/07

Buy

80-100

LOW

60

18%

14%

Overweight

60-79

80

100

Valuation multiples to book capital (as adjusted)

Hold

40-59

LOW PRVit Score Vs Market 26

100

Lower is better

Wealth Ratios

24

46

0

Leveraged, negative cash flow firms are suspect

LOW

Underweight

20-39

100

Financial strength in generating a return on capital over the full cost

EVA Margin (EVA/Sales)

EVA Spread (EVA/Capital)

28

Higher is better

Intrinsic Value Vs. Russell 3000

(P(37)-R(12)=56th Percentile)

P1 Profitability

(vs Industry)

LOW's PRVit score is at the 24th percentile of all firms in its industry, which

leads to a recommendation to Underweight. LOW is less attractively priced

in relation to its true value than well over half of the stocks in its industry.

Intrinsic Value Vs. Industry

(P(31)-R(4)=52nd Percentile)

48

26

PRVit Score

LOW's weak performance (37th percentile vs. Russell 3000 companies),

coupled with its very low risk (12th percentile), indicates a moderate

intrinsic valuation is warranted (56th percentile), which compared to its

actual market valuation (79th percentile at its $31.09 share price) makes for

a PRVit score of 26th percentile vs. the market.

Sell

0-19

37

PRVit Score Industry

(vs Market) Median

0

1/12

EVA

EVA Dimensions LLC l 15 Watersedge Court l Locust Valley, NY 11560 l Support Hot Line 1.888.500.3560 l support@evadimensions.com

No part of this report may be reproduced or distributed in any form except to authorized licensees of EVA Dimensions LLC

Copyright 2010 All Rights Reserved

1/07

1/08

1/09

Vs Market

1/10

1/11

Vs Industry

1/12

Investment Thesis

Concerns regarding the Home Improvement Industry have led us to evaluate LOW which

is a current stock in the Washburn University Student Investment Fund.

Even though LOW has maintained stable revenues over the past five years, Net Income,

EBIT and EPS have all shown decreases since 2007. This is a large concern for the

company’s future profitability.

Gross Profit margin has stayed stable over the past five years (2007-2012), but

Operating Profit Margin and Net Profit Margin have both decreased since 2007. OPM

dropped from roughly 10% in 2007 to 7.5% in 2012 and Net Profit Margin dropped from

roughly 6% in 2007 to 4% in 2012. This illustrates a ineffectiveness of fundamentals.

Since 2009 the dividend yield has been relatively stable, but has not risen above 1.9%.

Even though the dividend yield is stable, the level is lower than that desired yield for the

Student Investment Fund.

The Macroeconomic call the Applied Portfolio Management class developed calls for an

economic slow-down which would decrease the value of this stock. This stock has

reached a level that would allow for a profitable sale.

Highlights

LOW has been able to maintain a slow long term revenue growth rate of approximately

1.5%.

LOW fiscal analysis stated that Operating Profit was expected to decrease .8% to .9%.

The company estimates that .8% of that decrease would be related with store closing

and discontinuation of products.

LOW estimated that EPS would decrease to $1.37 from $1.40 for the fiscal year ended

February 3, 2012. LOW also indicated that they estimate $.0.20 of the impact would be

related to store closings and the discontinuing of products.

LOW has declared a cash dividend since becoming a public company in 1961.

Macroeconomic Thesis

Consumer spending has been on a decline since 2009 and personal income has also seen a

declining trend. LOW struggles under these conditions because most of their products are not

considered necessities and are included under the consumer discretionary sector. An economy

that is struggling to gain traction combined with the news of a weakening housing market

portrays a glim future for LOW.

International Exposure

LOW currently has 1712 stores in the United States and recently has begun to expand

internationally. LOW has opened several stores in Canada and now has two in Mexico with

plans to continue to increase international stores in the future. In 2009, LOW entered into a

joint venture with Woolworth limited to development of chains of home improvement stores in

Australia. These stores were set to open in late 2011 but not a single store has opened as of

now.

1 Year Returns

6 Month Returns

As shown on these four graphs above, LOW stock has been on an overall increasing trend. This

upcoming trend can be accredited to a positive outlook on the housing market and reporting

higher than expected profits due to a mild winter profit nationwide. However, the company

analysis will support the theory that this increasing trend is not guaranteed to continue into the

upcoming future.

Industry Presences

Technological Improvements

In 2010 LOW made the largest investment in stores technology in the company’s history. This

investment should lead to improvements in customer service, such as allowing for free Wi-Fi

usage. LOW also made improvements to their website, which has led to a 70% increase in ecommerce sales in the past year.

Market Share

The home improvement/renovation industry generated approximately $300 billion dollars in

2011. In 2011 LOW generated 50.2 billion dollars in revenue which accounts for 16.7% of the

total market share for this industry. LOW is second in market share to HD which generated

70.4 billion in sales in 2011 and has 23.4% of the market share. Low will see an opportunity to

increase their market share in the future with Sears declaring bankruptcy. Sears competes with

LOW in sales of appliances and hardware which account for 11% and 6% of LOW overall

revenue.

LOW

HD

Revenue

(in

billions)

50.208

70.395

Profit Margin

Dividend Yield

ROIC

3.9%

5.6%

1.9%

2.24%

9.5%

14.4%

Model Assumptions

Our valuation of LOW was done using conservative numbers to assess the value of the

company. Our discounted free cash flow model generated a current intrinsic value of $17.24,

which indicates that LOW is currently over-valued.

Income Statement Inputs

Revenue Growth: Over the last five years LOW has experienced decreases in revenue in

2009 and 2010 of -.1% and -2.1%. This can be attributed to the recession of 2008 which

led to a decrease in consumer spending because of a lack of discretionary income.

These periods of negative revenue growth led to an average of 1.4% revenue growth

over the last 5 years. LOW management forecast revenue growth between 2% and 3%

for the next year and slow long term growth in periods after. So to remain conservative

in our forecasting assumptions we have chosen a long-term growth rate of 1.5%.

Net Profit Margin: The NPM average over the past 5 years is 4.4%. Looking at the last

three years percentages; we decreased the net margin to 3.8% which is the average

from 2010-2012.

Year

Net Profit Margin

2011

4.1%

2012

3.7%

2013

3.8%

Share Growth: Recently LOW announced a plan to raise 2 billion dollars in the bond

market to repurchase outstanding shares. The plan states that they will buy back shares

annually through 2015. LOW had a common share growth rate of -9.3% in 2012 and we

expect this level of buyback to remain stable for 2013 and then begin to taper down to a

long term buyback rate of -.1%.

Year

Common Share

Growth

2010

3.8%

2012

-9.3%

2013

-8%

2014

-6%

2015

-4%

2016

-2%

2017

-.1%

Dividend Growth: LOW has declared a dividend since 1961 when they first became a

publicly traded company. Over the past 5 years LOW has an average dividend growth

rate of 24.1%. This is skewed from 2008 growth rate of 61.1%. Therefore we decreased

the forecasted growth rates as follows.

Year

Dividend Growth

2013

20%

2014

15%

2015

10%

2016

5%

2017

3%

This allows for a margin of safety as well as tapering down to what we believe as the perpetual

dividend growth.

Financial Analysis

Return on Equity (ROE) and Return on

Assets (ROA)

Return on Assets decreased from 11%

in 2007 to 5.5% in 2010. From 2010 to

2012, ROA has stabilized. ROE

decreased from 20% in 2007 to 9% in

2010 and then began recovery in 2011

and 2012. These levels are low and

have not shown signs of full recovery.

Earnings Yield and Dividend Yield

The earnings yield decreased from 7.9%

in 2008 to less than 5% in 2010. EPS has

not shown signs of recovering. The

dividends yield is gradually increasing

over the past six years; however, the

dividend yield has not exceeded 1.9%.

The dividend yield has not reached the

desired level for the Washburn University

Student Investment Fund.

Value Creation Metrics

Net Operating Profit After Tax and Free

Cash Flow

NOPAT shows a decrease from year 2008

to 2012. While free cash flow has high

volatility with a decreasing trend over

the past three years.

Economic Value Added and Market

Value Added

EVA and MVA have sharp decreases from

2007 to 2009. The Market seemed to

over appreciate Lowes stock since the

positive trend for MVA began a year

before the positive EVA trend. The

difference from the two variables has

been consistently similar over the past

three years showing the growing over

evaluation.

Value Spread: ROIC to WACC

One of the major contributions to evaluating value creation is determining the ROIC to WACC

Spread.

Return on Invested Capital (ROIC) and

ROIC to WACC spread.

ROIC decreased from 15% in 2007 to

about 7% in 2010. In 2011 and 2012

ROIC has stabilized to around 9.3%.

With a WASS of 8.3, ROIC-WACC

Spread is 1%. This spread is very small

and does not contribute a great deal to

the value creation process.

Weighted Average Cost of Capital (WACC) Assumptions

A WACC of 8.3% was calculated

using.

Short term debt cost of

2.27%

Long term growth rate of

2.0%

Cost of Equity of 9.3% was

calculated using:

o Risk Free Rate of

2.27%

o Market risk

premium of 7.0%

o Beta of 1.0

Other Analyst Recommendation

These results were derived

from the performance risk

valuation investment theory

which is provided by EVA

Dimensions LLC. The PRVit

Scores are used to further

strengthen our

understanding of the Lowes

stock prices, versus their

value potential. We conclude

that this method also

matches our finding that

Lowes stock is significantly

over valued.

When comparing LOW’s stock versus the

industry average we conclude the actual

valuation is within the 80th percentile.

This indicates significant overvaluation.

On the vertical axis the intrinsic value of

LOW’s stock is compared to the

industry’s average intrinsic value. LOW’s

stock is in the 54th percentile showing it

has average intrinsic value for the

industry. After intersecting the values we

can see it is below the line indicating a

sell recommendation.

Financial Stability

Since 2009, LOW stock has become increasingly overvalued.

Looking at the Dividend Discount Model, the Intrinsic Value of the Dividends account for $12.15

of the $31.09 of the stock. This impact on the valuation will be shown on the recommendation

summary of the report. If the stock was purchased today at $31.09 the expected return on the

stock, based on the dividend stream alone, would be -14.8%.

Recommendation Summary

Due to LOW’s over evaluation in all of our models, decreasing net income, EBIT and EPS we rate

LOW as a SELL stock for the Student Investment Fund.

Over evaluation for the dividend discount model shows this stock is not performing

above average in dividends and we can see this confirmed by noting the 1.7% dividend

yield. The dividend yield has never increased above 1.9% since 2009. This is not ideal for

the student investment fund.

LOW is over evaluated for the present value of free cash flows model which concludes

the expected income is less than what is needed to support the stock price.

When LOW stock price is compared to earnings, free cash flow, sales and to book value

it is consistently over-valued.

The Macroeconomic call the Applied Portfolio Management class developed calls for an

economic slow-down which would decrease the value of this stock.

Lowe's Companies Inc.

LOW

Sector

Consumer Discretionary

Stock Price

$31.09

Historical Income Statements

Report Date

5/7/2012

Historical Balance Sheets

2007

2008

2009

2010

2011

2012

Total Revenue

Cost of Goods Sold

Gross Profit

46,927

30,729

16,198

48,283

31,556

16,727

48,230

31,729

16,501

47,220

30,757

16,463

48,815

31,663

17,152

50,208

32,858

17,350

Cash and Equivalents

Short-Term Investments

Total Cash & ST Invest.

ASSETS

2007

2010

2011

2012

364

184

548

SG&A Expense

R&D Expense

Dep. & Amort.

Other Oper. Exp.

9,879

0

1,162

41,770

10,628

0

1,366

43,550

11,155

0

1,539

44,423

11,623

0

1,614

43,994

11,925

0

1,586

45,174

12,107

0

1,480

46,445

Total Receivables

Inventory

Prepaid Expenses

Total Current Assets

Operating Income

Interest Expense

Other Non-Oper. Exp.

EBT ex-Unusuals

5,157

(206)

0

5,003

4,733

(239)

0

4,539

3,807

(320)

0

3,527

3,226

(304)

0

2,939

3,641

(344)

0

3,309

3,763

(383)

0

3,392

Total Unusual Exp.

Earnings Before Tax

(5)

4,998

(28)

4,511

(21)

3,506

(114)

2,825

(81)

3,228

Income Tax Expense

Net Income

1,893

3,105

1,702

2,809

1,311

2,195

1,042

1,783

1,218

2,010

2008

281

82

363

2009

245

416

661

632

425

1,057

652

471

1,123

1,014

286

1,300

0

7,144

0

8,314

0

7,611

0

8,686

0

8,209

0

9,190

0

8,249

0

9,732

0

8,321

0

9,967

0

8,355

0

10,072

Gross PPE

Accumulated Depr.

Net PPE

Long-Term Investments

25,104

(6,133)

18,971

133

28,836

(7,475)

21,361

337

31,477

(8,755)

22,722

110

32,268

(9,769)

22,499

75

33,345

(11,256)

22,089

748

34,332

(12,362)

21,970

242

(486)

2,906

Goodwill

Total Assets

0

27,767

0

30,869

0

32,625

0

33,005

0

33,699

0

33,559

1,067

1,839

LIABILITIES AND EQUITY

Accounts Payable

3,524

3,713

4,109

4,287

4,351

4,352

1,075

23

6,539

4,325

1,138

1,064

7,751

5,576

434

987

7,560

5,039

1,213

0

7,355

4,528

1,318

0

7,119

6,537

1,317

0

7,891

6,669

Diluted EPS

Total Diluted Shares

Dividends Per Share

1.99

1,566

0.18

1.86

1,507

0.29

1.49

1,468

0.34

1.21

1,464

0.36

1.42

1,403

0.42

1.43

1,273

0.53

Accrued Expenses

Short-Term Debt

Total Current Liab.

Long-Term Debt

Effective Tax Rate

37.9%

37.7%

37.4%

37.4%

37.7%

36.7%

Pension Benefits

Total Liabilities

0

12,042

0

14,771

0

14,570

0

13,936

0

15,587

0

17,026

2.02

1,535

6,394

5,157

6,712

2.82

$31.61

1.89

1,481

6,197

4,733

6,566

2.80

$24.53

1.50

1,457

5,474

3,807

5,873

2.62

$20.32

1.21

1,462

4,959

3,226

5,369

2.56

$25.63

1.42

1,401

5,325

3,641

5,727

2.52

$26.82

1.44

1,271

5,342

3,763

5,752

3.14

$31.09

Preferred Equity

Common Stock & APIC

Retained Earnings

Treasury Stock

Total Common Equity

Total Equity

Total Liab. and Equity

0

864

14,860

0

15,725

15,725

27,767

0

745

15,345

0

16,098

16,098

30,869

0

1,012

17,049

0

18,055

18,055

32,625

0

735

18,307

0

19,069

19,069

33,005

0

688

17,371

0

18,112

18,112

33,699

0

635

15,852

0

16,533

16,533

33,559

Earnings Per Share

Total Common Shares

EBITDA

EBIT

EBITDAR

Free Cash Flow/Share

Year-end Stock Price

Total Revenue

Net Income

Earnings Per Share

$60,000

$2.50

$50,000

$2.00

$40,000

Dividends Per Share

EBITDA

$6,000

$5,000

$1.50

$4,000

$1.00

$3,000

$30,000

$20,000

$10,000

$0.50

$0

$0.00

2007

2008

2009

2010

LOW Performance Analysis. Datasource: CapitalIQ

2011

2012

EBIT

$7,000

$2,000

$1,000

$0

2007

2008

2009

2010

2011

2012

Historical Performance, Page 1 of 4

2007

2008

2009

2010

2011

2012

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Margins

2007

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Free Cash Flow Margin

2008

34.5%

11.0%

6.6%

9.2%

Gross Profit Margin

2009

34.6%

9.8%

5.8%

8.6%

34.2%

7.9%

4.6%

7.9%

2010

2011

34.9%

6.8%

3.8%

7.9%

2012

35.1%

7.5%

4.1%

7.2%

Operating Profit Margin

Relative Valuation

34.6%

7.5%

3.7%

7.9%

Price/Earnings

40%

35%

30%

25%

20%

15%

10%

5%

0%

2007

Price/Earnings

Price/Book

Price/Free Cash Flow

Earnings Yield

Dividend Yield

2008

15.6

1.7

11.2

6.4%

0.6%

Price/Free Cash Flow

15

10

5

0

2009

Liquidity and Debt

2010

2007

Current Ratio

Quick Ratio

Days Sales Outstanding

Inventory Turnover

Long-Term Debt to Equity

Total Debt to Assets

Times Interest Earned

2011

2012

2008

1.27

0.18

0.00

6.57

27.5%

15.7%

25.03

2009

1.12

0.14

0.00

6.34

34.6%

21.5%

19.80

Current Ratio

2008

2009

1.32

0.20

0.00

5.72

23.7%

13.7%

10.61

0.3

1

0.2

1

0.2

1

0.1

0

0.1

0

Net Profit Margin

2011

0.0

0

2009

2010

2012

1.40

0.23

0.00

5.87

36.1%

19.4%

10.58

2012

Free Cash Flow Margin

2012

1.28

0.22

0.00

6.01

40.3%

19.9%

9.83

2007

Net Profit Margin

Total Asset Turnover

Equity Multiplier

Return on Assets

Return on Equity

Return on Invested Capital

2008

2009

6%

4%

2%

0%

2007

2008

2009

2010

2011

LOW Performance Analysis. Datasource: CapitalIQ

2012

2010

Total Asset Turnover

6.6%

1.69

1.77

11.2%

19.7%

14.6%

2011

2011

2012

18.9

1.1

10.6

5.3%

1.6%

21.7

1.2

9.9

4.6%

1.7%

Dividend Yield

25%

2.0

20%

1.5

2010

2011

2009

2010

4.6%

1.48

1.81

6.7%

12.2%

8.9%

3.8%

1.43

1.73

5.4%

9.4%

7.8%

2008

2012

Historical Performance, Page 2 of 4

2011

2012

2011

2012

4.1%

1.45

1.86

6.0%

11.1%

8.9%

3.7%

1.50

2.03

5.5%

11.1%

9.3%

Long-Term Debt to Equity

2009

ROA

2.1

1.6

2010

Total Debt to Assets

Equity Multiplier

1.7

2009

2009

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

2007

1.8

2008

2008

5.8%

1.56

1.92

9.1%

17.4%

12.1%

2012

1.9

2007

2008

Inventory Turnover

1.75

1.70

1.65

1.60

1.55

1.50

1.45

1.40

1.35

1.30

8%

2007

7

7

6

6

6

6

6

5

5

2007

10%

2011

Profitability

Days Sales Outstanding

Quick Ratio

2010

2008

2011

1.22

0.13

0.00

5.88

27.9%

18.5%

11.90

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

0.0

2007

2007

2010

21.2

1.1

10.0

4.7%

1.4%

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

20

2008

2010

13.6

0.9

7.8

7.4%

1.6%

Earnings Yield

25

2007

2009

13.0

1.2

8.8

7.7%

1.2%

2010

ROE

2011

2012

ROIC

15%

10%

5%

0%

2007

2008

2009

2010

2011

2012

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Net Fixed Assets

Capital, NOPAT & FCF

Total Invested Capital

Net Oper. Working Capital

Net Fixed Assets

Total Invested Capital

Net Oper. Profit After Tax

Free Cash Flow

NOPAT Per Share

Free Cash Flow Per Share

Return on Invested Capital

$30,000

$25,000

$20,000

$15,000

$10,000

Compared With:

$5,000

The Home Depot, Inc.

$0

2007

2008

2009

2010

Net Oper. Profit After Tax

2011

$2,500

$2,000

$1,500

$1,000

$500

$0

Cost of Capital

Equity Capitalization

Total Debt

Preferred Stock

Value of All Securities

Effective Tax Rate

Risk-Free Rate

Beta

Market Risk Premium

CAPM Cost of Equity

2010

2012

37,274

2011

Weight

84.8%

2009

2010

2011

LOW Performance Analysis. Datasource: CapitalIQ

2011

2012

3,381

22,499

25,880

2,020

2,773

1.38

1.90

7.8%

3,304

22,089

25,393

2,267

2,754

1.62

1.97

8.9%

3,700

21,970

25,670

2,381

2,104

1.87

1.66

9.3%

LOW

WMT

^SPX

30%

20%

10%

0%

-10%

-20%

-30%

0.4%

0.0%

8.3%

Market Valued-Added

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

2008

HD

% Cost

Wgt Cost

9.3%

7.9%

1,600

1,400

1,200

1,000

800

600

400

200

0

-200

-400

2007

2010

3,911

22,722

26,633

2,383

152

1.64

0.10

8.9%

2012

6,669

15.2%

4.5%

0

0.0%

0.0%

43,943

100.0%

36.7% Long-Term Growth Rate:

2.27%

1.5%

1.00 Alternative Beta:

7.0%

9.3%

Weighted Average Cost of Capital:

Economic Value-Added

2009

3,041

21,361

24,402

2,947

425

1.99

0.29

12.1%

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

$3,000

2009

2008

2,909

18,971

21,880

3,204

N/A

2.09

N/A

14.6%

S&P 500 Index

LOW

Free Cash Flow

$3,500

2008

Wal-Mart Stores Inc.

2012

2007

2012

Value Creation

Economic Value-Added

2007

1,390

2008

925

2009

176

2010

-126

2011

162

2012

254

Market Valued-Added

PV of Future FCFs

Value of Non-Oper. Assets

Total Intrinsic Firm Value

Intrinsic Value of Equity

Per Share Intrinsic Value

Year-End Stock Price

Over (Under) Valuation/Sh

% Over (Under) Valued

36,278

27,250

548

27,798

23,450

$14.97

$31.61

$16.64

52.6%

21,272

29,083

363

29,446

22,806

$15.13

$24.53

$9.40

38.3%

8,792

31,341

661

32,002

25,976

$17.70

$20.32

$2.62

12.9%

12,800

31,167

1,057

32,224

27,696

$18.92

$25.63

$6.71

26.2%

16,733

30,996

1,123

32,119

25,582

$18.23

$26.82

$8.59

32.0%

20,741

31,461

1,300

32,761

26,092

$20.50

$31.09

$10.59

34.1%

6.4%

3.8%

0.7%

-0.5%

0.6%

1.0%

Year-End Stock Price

Over (Under) Valuation/Sh

Per Share Intrinsic Value

% Over (Under) Valued

$18

$16

$14

$12

$10

$8

$6

$4

$2

$0

$35

$30

$25

$20

$15

$10

$5

$0

2007

2008

2009

2010

2011

2012

Historical Performance, Page 3 of 4

60%

50%

40%

30%

20%

10%

0%

2007

2008

2009

2010

2011

2012

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Historical Performance Diffusion Index

Revenues, Profits and Dividends

Total Revenue

EBITDA

EPS

DPS

Gross, Operating and Net Margins

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Free Cash Flow Margin

Relative Valuation

Price/Earnings

Price/Free Cash Flow

Earnings Yield

Dividend Yield

Profitability

ROA

ROE

ROIC

20.0%

0

0

-1

1

15.0%

0

-1

-1

0

15.0%

0

0

-1

1

10.0%

-1

-1

-1

Liquidity and Debt

Current Ratio

Quick Ratio

Days Sales Outstanding

Inventory Turnover

Total Debt/Assets

Long-Term Debt/Equity

NOPAT, Total Invested Capital, FCF

NOPAT

Total Invested Capital

Free Cash Flow

Value Creation

Economic Value-Added

Market Value-Added

Intrinsic Value

Score (max = 100%)

-25.8%

Weights

LOW Performance Analysis. Datasource: CapitalIQ

10.0%

0

1

0

1

0

-1

15.0%

-1

1

-1

15.0%

-1

1

-1

100.0%

Historical Performance, Page 4 of 4

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

LOW

2007

Lowe's Companies Inc.

2008

2009

2010

Sector

2011

Consumer Discretionary

2012

Average

Manual

2013E

2014E

2015E

2016E

2017E

Total Revenue

Cost of Goods Sold

46,927

30,729

48,283

31,556

48,230

31,729

47,220

30,757

48,815

31,663

50,208

32,858

1.4%

N/A

51,212

52,134

52,968

53,763

54,569

Gross Profit

SG&A Expense

R&D Expense

Dep. & Amort.

Other Oper. Exp.

16,198

9,879

0

1,162

41,770

16,727

10,628

0

1,366

43,550

16,501

11,155

0

1,539

44,423

16,463

11,623

0

1,614

43,994

17,152

11,925

0

1,586

45,174

17,350

12,107

0

1,480

46,445

34.7%

N/A

17,762

18,082

18,371

18,646

18,926

7.9%

N/A

4,044

4,117

4,183

4,245

4,309

Operating Income

Net Interest Expense

Other Non-Oper. Exp.

EBT ex-Unusuals

5,157

(154)

0

5,003

4,733

(194)

0

4,539

3,807

(280)

0

3,527

3,226

(287)

0

2,939

3,641

(332)

0

3,309

3,763

(371)

0

3,392

Total Unusual Exp.

Earnings Before Tax

(5)

4,998

(28)

4,511

(21)

3,506

(114)

2,825

(81)

3,228

(486)

2,906

Income Tax Expense

Net Income

1,893

3,105

1,702

2,809

1,311

2,195

1,042

1,783

1,218

2,010

1,067

1,839

4.4%

3.7%

1,895

1,929

1,960

1,989

2,019

Basic EPS

Total Common Shares

Dividends Per Share

2.02

1,535

0.18

1.89

1,481

0.29

1.50

1,457

0.34

1.21

1,462

0.36

1.42

1,401

0.42

1.44

1,271

0.53

-3.7%

24.1%

N/A

N/A

1.62

1,169

0.64

1.75

1,099

0.73

1.86

1,055

0.80

1.92

1,034

0.84

1.95

1,034

0.87

2008

1. Revenue Growth

2. Gross Margin

3. Operating Margin

4. Net Margin

5. Common Shares Growth

6. Dividend Growth

2.9%

34.6%

9.8%

5.8%

-3.5%

61.1%

Historical Growth and Margins

2009

2010

2011

-0.1%

34.2%

7.9%

4.6%

-1.6%

15.5%

-2.1%

34.9%

6.8%

3.8%

0.3%

6.0%

1. Total Revenue

3.4%

35.1%

7.5%

4.1%

-4.2%

18.3%

2012

2.9%

34.6%

7.5%

3.7%

-9.3%

26.2%

Forecast Defaults to Historical Avg. User Can Enter 1 Manual Avg. or Year-by-Year Values

Average

Manual

2013E

2014E

2015E

2016E

2017E

1.4%

34.7%

7.9%

4.4%

-3.7%

24.1%

2.0%

1.8%

1.6%

1.5%

1.5%

-8.0%

20.0%

-6.0%

15.0%

-4.0%

10.0%

-2.0%

5.0%

-0.1%

3.0%

3.7%

2. Gross Profit

3. Operating Income

$55,000

$20,000

$6,000

$50,000

$18,000

$4,000

$45,000

$16,000

$2,000

$40,000

$14,000

$0

4. Net Income

5. Total Common Shares

$4,000

2,000

$3,000

1,500

$2,000

1,000

$1,000

500

$0

0

LOW Performance Analysis. Datasource: CapitalIQ

6. Dividends Per Share

$1.00

$0.50

$0.00

Income Statement Forecast, Page 1 of 1

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

LOW

2007

ASSETS

Cash and Equivalents

Short-Term Investments

Total Cash & ST Invest.

Lowe's Companies Inc.

2008

2009

2010

Sector

2011

Consumer Discretionary

2012

Average

Manual

2013E

2014E

2015E

2016E

2017E

364

184

548

281

82

363

245

416

661

632

425

1,057

652

471

1,123

1,014

286

1,300

1.2%

N/A

592

603

613

622

631

Total Receivables

Inventory

Prepaid Expenses

Total Current Assets

0

7,144

0

8,314

0

7,611

0

8,686

0

8,209

0

9,190

0

8,249

0

9,732

0

8,321

0

9,967

0

8,355

0

10,072

0.0%

16.8%

N/A

N/A

0

8,597

0

8,752

0

8,892

0

9,026

0

9,161

19.6%

N/A

10,051

10,232

10,396

10,552

10,710

Gross PPE

Accumulated Depr.

Net PPE

25,104

(6,133)

18,971

28,836

(7,475)

21,361

31,477

(8,755)

22,722

32,268

(9,769)

22,499

33,345

(11,256)

22,089

34,332

(12,362)

21,970

45.6%

N/A

23,354

23,774

24,154

24,517

24,884

Long-Term Investments

Goodwill

Total Assets

133

0

27,767

337

0

30,869

110

0

32,625

75

0

33,005

748

0

33,699

242

0

33,559

67.5%

N/A

34,553

35,175

35,737

36,273

36,818

LIABILITIES AND EQUITY

Accounts Payable

Accrued Expenses

Short-Term Debt

Total Current Liabilities

4,599

3,524

1,075

23

6,539

4,851

3,713

1,138

1,064

7,751

4,543

4,109

434

987

7,560

5,500

4,287

1,213

0

7,355

5,669

4,351

1,318

0

7,119

5,669

4,352

1,317

0

7,891

10.8%

N/A

15.5%

N/A

Long-Term Debt

Pension Benefits

Total Liabilities

4,325

0

12,042

5,576

0

14,771

5,039

0

14,570

4,528

0

13,936

6,537

0

15,587

6,669

0

17,026

12.5%

N/A

4,348

Preferred Equity

Common Stock & APIC

Retained Earnings

Treasury Stock

Total Common Equity

Total Equity

Total Liab. and Equity

0

864

14,860

0

15,725

15,725

27,767

0

745

15,345

0

16,098

16,098

30,869

0

1,012

17,049

0

18,055

18,055

32,625

0

735

18,307

0

19,069

19,069

33,005

0

688

17,371

0

18,112

18,112

33,699

0

635

15,852

0

16,533

16,533

33,559

36.2%

N/A

2008

0.6%

0.0%

15.8%

2009

0.5%

0.0%

17.0%

2011

1.3%

0.0%

17.0%

2012

2.0%

0.0%

16.6%

1. Cash and Equivalents

2. Total Receivables

3. Inventory

Percent of Sales

2010

1.3%

0.0%

17.5%

1. Cash and Equivalents

$1,500

Note: Forecasting Payables + Accruals together in row 19 below

5,533

5,632

5,722

5,808

5,895

7,949

8,092

8,221

8,344

8,470

6,403

6,518

6,622

6,721

6,822

6,640

6,026

4,528

6,537

6,669

Note: Forecasting ST Debt + LT Debt together in row 22 above

18,558

18,893

19,195

19,483

19,775

Forecast Defaults to Historical Avg. User Can Enter 1 Manual Avg. or Year-by-Year Values

Average

Manual

2013E

2014E

2015E

2016E

2017E

1.2%

0.0%

16.8%

2. Total Receivables

$1

3. Inventory

$10,000

$8,000

$1,000

$6,000

$1

$4,000

$500

$2,000

$0

LOW Performance Analysis. Datasource: CapitalIQ

$0

$0

Balance Sheet Forecast, Page 1 of 2

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

4. Total Current Assets

5. Net PPE

6. Total Assets

7. Payables and Accruals

8. Total Current Liabilities

9. Total Debt

10. Total Equity

2008

18.0%

44.2%

63.9%

10.0%

16.1%

13.8%

33.3%

2009

19.1%

47.1%

67.6%

9.4%

15.7%

12.5%

37.4%

Percent of Sales

2010

20.6%

47.6%

69.9%

11.6%

15.6%

9.6%

40.4%

4. Total Current Assets

$12,000

$10,000

$8,000

$6,000

$4,000

$2,000

$0

2011

20.4%

45.3%

69.0%

11.6%

14.6%

13.4%

37.1%

2012

20.1%

43.8%

66.8%

11.3%

15.7%

13.3%

32.9%

Forecast Defaults to Historical Avg. User Can Enter 1 Manual Avg. or Year-by-Year Values

Average

Manual

2013E

2014E

2015E

2016E

2017E

19.6%

45.6%

67.5%

10.8%

15.5%

12.5%

36.2%

5. Net PPE

$40,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

7. Payables and Accruals

$6,000

$30,000

$20,000

$10,000

$0

8. Total Current Liabilities

$2,000

$0

9. Total Debt

$8,000

$10,000

$8,000

$6,000

$4,000

$2,000

$0

$4,000

6. Total Assets

$6,000

$4,000

$2,000

$0

10. Total Equity

$20,000

$15,000

$10,000

$5,000

$0

LOW Performance Analysis. Datasource: CapitalIQ

Balance Sheet Forecast, Page 2 of 2

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

LOW

Total Revenue

Gross Profit

Operating Income

Net Income

Retained Earnings

Total Common Shares

Total Diluted Shares

Earnings Per Share

Dividends Per Share

Cash and Equivalents

Total Receivables

Inventory

Total Current Assets

Net PPE

Total Assets

Payables and Accruals

Total Current Liabilities

Total Debt

Total Equity

Lowe's Companies Inc.

Sector

Consumer Discretionary

2007

Historical Income Statement Highlights

2008

2009

2010

2011

2012

2013E

46,927

16,198

5,157

3,105

14,860

1,535

1,566

$2.02

$0.18

48,283

16,727

4,733

2,809

15,345

1,481

1,507

$1.90

$0.29

48,815

17,152

3,641

2,010

17,371

1,401

1,403

$1.43

$0.42

50,208

17,350

3,763

1,839

15,852

1,271

1,273

$1.45

$0.53

51,212

17,762

4,044

1,895

17,003

1,169

1,171

$1.62

$0.64

2007

Historical Balance Sheet Highlights

2008

2009

2010

2011

2012

2013E

364

0

7,144

8,314

18,971

27,767

4,599

6,539

4,348

15,725

281

0

7,611

8,686

21,361

30,869

4,851

7,751

6,640

16,098

652

0

8,321

9,967

22,089

33,699

5,669

7,119

6,537

18,112

1,014

0

8,355

10,072

21,970

33,559

5,669

7,891

6,669

16,533

592

0

8,597

10,051

23,354

34,553

5,533

7,949

6,403

18,558

48,230

16,501

3,807

2,195

17,049

1,457

1,468

$1.51

$0.34

245

0

8,209

9,190

22,722

32,625

4,543

7,560

6,026

18,055

47,220

16,463

3,226

1,783

18,307

1,462

1,464

$1.22

$0.36

632

0

8,249

9,732

22,499

33,005

5,500

7,355

4,528

19,069

Total Revenue

Report Date

Forecasted Income Statement Highlights

2014E

2015E

2016E

52,134

18,082

4,117

1,929

18,128

1,099

1,101

$1.75

$0.73

52,968

18,371

4,183

1,960

19,239

1,055

1,057

$1.86

$0.80

53,763

18,646

4,245

1,989

20,355

1,034

1,036

$1.92

$0.84

613

0

8,892

10,396

24,154

35,737

5,722

8,221

6,622

19,195

2017E

54,569

18,926

4,309

2,019

21,474

1,034

1,035

$1.95

$0.87

Forecasted Balance Sheet Highlights

2014E

2015E

2016E

603

0

8,752

10,232

23,774

35,175

5,632

8,092

6,518

18,893

2007

5/7/2012

2017E

622

0

9,026

10,552

24,517

36,273

5,808

8,344

6,721

19,483

631

0

9,161

10,710

24,884

36,818

5,895

8,470

6,822

19,775

Net Income

Earnings Per Share

$56,000

$3,500

$54,000

$3,000

$52,000

$2,500

$50,000

$48,000

$46,000

$2,000

$1.50

$1,500

$1.00

$44,000

$500

$0.50

$42,000

$0

$0.00

Dividends Per Share

$2.50

$2.00

$1,000

Total Current Assets

Cash and Equivalents

$12,000

$10,000

$8,000

$6,000

$4,000

$2,000

$0

LOW Performance Analysis. Datasource: CapitalIQ

Total Assets

Total Equity

Net PPE

25,000

$40,000

$35,000

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

20,000

15,000

10,000

5,000

0

Financial Analysis & Valuation, Page 1 of 5

Total Debt

8,000

7,000

6,000

5,000

4,000

3,000

2,000

1,000

0

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Margins

2007

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Free Cash Flow Margin

34.5%

11.0%

6.6%

9.2%

Gross Profit Margin

2008

34.6%

9.8%

5.8%

0.9%

2009

2010

34.2%

7.9%

4.6%

0.3%

2011

34.9%

6.8%

3.8%

5.9%

35.1%

7.5%

4.1%

5.6%

Operating Profit Margin

2012

2013E

34.6%

7.5%

3.7%

4.2%

34.7%

7.9%

3.7%

2.4%

Net Profit Margin

40%

35%

30%

25%

20%

15%

10%

5%

0%

2014E

2015E

34.7%

7.9%

3.7%

4.1%

34.7%

7.9%

3.7%

4.2%

2016E

2017E

34.7%

7.9%

3.7%

4.2%

34.7%

7.9%

3.7%

4.2%

Free Cash Flow Margin

10%

8%

6%

4%

2%

0%

Liquidity and Debt

Days Sales Outstanding

Inventory Turnover

Total Debt to Equity

Total Debt to Assets

2007

0.00

6.57

27.7%

15.7%

Days Sales Outstanding

2008

0.00

6.34

41.2%

21.5%

2009

2010

0.00

5.88

33.4%

18.5%

1

1

0

0

0

2007

1.69

1.77

11.2%

19.7%

14.6%

Total Asset Turnover

2008

1.56

1.92

9.1%

17.4%

12.1%

LOW Performance Analysis. Datasource: CapitalIQ

0.00

6.01

40.3%

19.9%

2013E

0.00

5.96

34.5%

18.5%

2009

2010

1.48

1.81

6.7%

12.2%

8.9%

2014E

2015E

0.00

5.96

34.5%

18.5%

0.00

5.96

34.5%

18.5%

2016E

2017E

0.00

5.96

34.5%

18.5%

2011

1.43

1.73

5.4%

9.4%

7.8%

Total Debt to Assets

1.45

1.86

6.0%

11.1%

8.9%

2012

1.50

2.03

5.5%

11.1%

9.3%

2013E

1.48

1.86

5.5%

10.2%

9.5%

Return on Equity

2014E

2015E

1.48

1.86

5.5%

10.2%

9.5%

1.48

1.86

5.5%

10.2%

9.5%

2016E

2017E

1.48

1.86

5.5%

10.2%

9.5%

Return on Assets

1.48

1.86

5.5%

10.2%

9.5%

Return on Equity

2.10

25%

25%

2.00

20%

20%

15%

15%

10%

10%

1.60

5%

5%

1.50

0%

0%

1.90

0.00

5.96

34.5%

18.5%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Equity Multiplier

1.8

1.7

1.7

1.6

1.6

1.5

1.5

1.4

1.4

1.3

2012

Total Debt to Equity

7

7

6

6

6

6

6

5

5

Profitability

0.00

5.87

36.1%

19.4%

Inventory Turnover

1

Total Asset Turnover

Equity Multiplier

Return on Assets

Return on Equity

Return on Capital

2011

0.00

5.72

23.7%

13.7%

Return on Capital

1.80

1.70

Financial Analysis & Valuation, Page 2 of 5

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Capital, NOPAT & FCF

NOWC

Net Fixed Assets

Total Invested Capital

Effective Tax Rate

NOPAT

Free Cash Flow

NOPAT Per Share

FCF/Share

Return on Capital

2007

2008

2009

2010

2011

2012

2,909

18,971

21,880

37.9%

3,204

N/A

2.09

N/A

14.6%

3,041

21,361

24,402

37.7%

2,947

425

1.99

0.29

12.1%

3,911

22,722

26,633

37.4%

2,383

152

1.64

0.10

8.9%

3,381

22,499

25,880

37.4%

2,020

2,773

1.38

1.90

7.8%

3,304

22,089

25,393

37.7%

2,267

2,754

1.62

1.97

8.9%

3,700

21,970

25,670

36.7%

2,381

2,104

1.87

1.66

9.3%

Total Invested Capital

Net Fixed Assets

2013E

$3,500

$30,000

$3,000

$25,000

$2,500

$20,000

$2,000

$15,000

$1,500

$10,000

$1,000

$5,000

$500

$0

$0

2015E

2016E

2017E

3,657

3,723

3,782

3,839

23,354

23,774

24,154

24,517

27,011

27,497

27,937

28,356

(Tax rate from last historical year used in forecasts)

2,559

2,605

2,647

2,687

1,218

2,119

2,207

2,267

2.19

2.37

2.51

2.60

1.04

1.93

2.09

2.19

9.5%

9.5%

9.5%

9.5%

NOPAT

$35,000

2014E

3,897

24,884

28,781

2,727

2,301

2.64

2.23

9.5%

Economic Value-Added

Free Cash Flow

$35,000

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

Intrinsic Value of FCFs Valuation Model

Value Creation

2007

2008

2009

2010

2011

2012

2013E

2014E

2015E

2016E

2017E

Economic Value-Added

Market Valued-Added

PV of Future FCFs

Value of Non-Oper. Assets

Total Intrinsic Firm Value

Intrinsic Value of Equity

Per Share Intrinsic Value

Year-End Stock Price

Over (Under) Valuation/Sh

% Over (Under) Valued

1,390

32,796

26,921

364

27,285

22,937

$14.94

$31.61

$16.67

52.7%

925

20,231

28,727

281

29,008

22,368

$15.10

$24.53

$9.43

38.4%

176

11,551

30,956

245

31,201

25,175

$17.28

$20.32

$3.04

15.0%

-126

18,402

30,749

632

31,381

26,853

$18.37

$25.63

$7.26

28.3%

162

19,463

30,544

652

31,196

24,659

$17.60

$26.82

$9.22

34.4%

254

22,982

30,971

1,014

31,985

25,316

$19.92

$31.09

$11.17

35.9%

320

7,952

32,320

592

32,913

26,510

$22.67

326

8,073

32,880

603

33,483

26,966

$24.53

331

8,195

33,399

613

34,012

27,389

$25.96

336

8,318

33,900

622

34,522

27,800

$26.88

341

8,442

34,408

631

35,040

28,217

$27.30

Cost of Capital

Equity Capitalization

2012

37,274

Weight

84.8%

Total Debt

Preferred Stock

Value of All Securities

Effective Tax Rate

Risk-Free Rate

5-Yr Beta

Market Risk Premium

CAPM Cost of Equity

% Cost

Wgt Cost

9.3%

7.9%

6,669

15.2%

4.5%

0

0.0%

0.0%

43,943

100.0%

36.7% Long-Term Growth Rate:

2.27%

1.5%

1.00 Alternative Beta:

7.0%

9.3%

Weighted Average Cost of Capital:

LOW Performance Analysis. Datasource: CapitalIQ

0.4%

0.0%

Market Valued-Added

$1,600

$1,400

$1,200

$1,000

$800

$600

$400

$200

$0

-$200

-$400

Year-End Stock Price

Per Share Intrinsic Value

$35

Over (Under) Valuation/Sh

% Over (Under) Valued

$18

$16

$14

$12

$10

$8

$6

$4

$2

$0

$30

$25

$20

$15

$10

$5

$0

60%

50%

40%

30%

20%

10%

0%

2007

8.3%

Financial Analysis & Valuation, Page 3 of 5

2008

2009

2010

2011

2012

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Relative Valuation

Stock Price/Intr. Value

Price to Earnings

Price to Free Cash Flow

Price to Sales

Price to Book

Earnings Yield

Dividend Yield

Free Cash Flow Yield

2007

2008

2009

2010

2011

2012

$31.61

15.6

N/A

1.0

1.7

6.4%

0.6%

N/A

$24.53

12.9

85.4

0.8

1.2

7.7%

1.2%

1.2%

$20.32

13.5

194.2

0.6

0.9

7.4%

1.6%

0.5%

$25.63

21.0

13.5

0.8

1.1

4.8%

1.4%

7.4%

$26.82

18.7

13.6

0.8

1.1

5.3%

1.6%

7.3%

$31.09

21.5

18.8

0.8

1.2

4.7%

1.7%

5.3%

Price to Earnings

Price to Free Cash Flow

2013E

$22.67

14.0

21.8

0.5

0.8

7.1%

2.8%

4.6%

Price to Sales

250

2014E

2015E

$24.53

14.0

12.7

0.5

0.8

7.2%

3.0%

7.9%

2016E

$25.96

14.0

12.4

0.5

0.8

7.2%

3.1%

8.1%

$26.88

14.0

12.3

0.5

0.8

7.2%

3.1%

8.2%

Earnings Yield

1.0

0.8

100

0.6

0.4

50

0.2

0

0.0

Relative Valuation Pricing Model

2013E Ratio

Ratio

Price to Earnings

14.0

Price to Free Cash Flow

21.8

Price to Sales

0.5

Price to Book

0.8

Adjust

Ratio

2013

Metric

$1.62

$1.04

$43.80

$29.55

Intrinsic

Value

$22.67

$22.67

$22.67

$22.67

Dividend Discount Valuation Model

LOW

Lowe's Companies Inc.

Annual Dividend

2007

2008

2009

2010

$0.18

$0.29

$0.34

$0.36

Intrinsic Value Estimates vs. Current

2013EPrice

Current Price

$31.09

PV of Free Cash Flows

$22.67

Dividend Discount Model

$12.15

Price to Earnings

$22.67

Price to Free Cash Flow

$22.67

Price to Sales

$22.67

Price to Book

$22.67

Dividend Yield

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

1.2

150

$27.30

14.0

12.3

0.5

0.8

7.2%

3.2%

8.2%

Price to Book

1.4

200

2017E

1-Yr Div Growth

3-Yr Div Growth

5-Yr Div Growth

Risk-Free Rate

5-Yr Beta

Market Premium

Required Return

Alternative Beta

Intrinsic Value Estimates vs. Current Price

26.2%

16.5%

24.1%

2.27%

1.00

7.0%

9.3%

May 7, 2012

2011

$0.42

PV Dividends 1-4

PV Perpetual Div.

Intrinsic Value

Current Price

20.0%

2013E

$0.64

2012

$0.53

$2.40

$9.75

$12.15

$31.09

($31.09)

Expected Dividend Growth Rates

15.0%

10.0%

5.0%

2014E

2015E

2016E

$0.73

$0.80

$0.84

Dividend Yeld

1.7%

If Purchased For:

Expected Return =

$0.64

$0.73

$31.09

-14.8%

$0.80

$14.74

Analyst Notes:

Based on a current dividend of $0.53, expected growth as shown above and an equity required

return of 9.3%, LOW is worth $12.15 per share, vs. a current price of $31.09.

Compared With:

Compared With:

The Home Depot, Inc.

S&P 500 Index

3.0%

2017E

$0.87

$13.89

Wal-Mart Stores Inc.

$35

$30

LOW

$25

$20

$15

$10

$5

$0

Current

Price

PV of Free

Cash Flows

Dividend

Discount

Model

Price to

Earnings

LOW Performance Analysis. Datasource: CapitalIQ

Price to Free

Cash Flow

Price to

Sales

Price to

Book

HD

50%

40%

30%

20%

10%

0%

-10%

-20%

-30%

-40%

WMT

LOW

^SPX

30%

20%

10%

0%

-10%

-20%

-30%

Financial Analysis & Valuation, Page 4 of 5

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez

Piotroski Financial Fitness Scorecard (10-point scale)

2008

Positive Net Income

Positive Free Cash Flow

Growing ROA (% change NI > % change TA)

Earnings Quality (Operating Income > Net Income)

Total Assets Growing Faster Than Total Liabilities

Increasing Liquidity (Current Ratio)

% Change Shares Outstanding (Diluted) < +2.0%

Expanding Gross Margin

Asset Turnover (% change sales > % change assets)

Total Liabilities to Operating Cash Flow (EBIT) < 4.0

Piotroski Score

Altman Probability of Bankruptcy Z-Score

(Current Assets-Current Liabilities)/Total Assets

Retained Earnings/Total Assets

Earnings Before Interest & Tax/Total Assets

Market Value Equity/Total Liabilities

Sales/Total Assets

Altman Score

2009

1

1

0

1

0

0

1

1

0

1

6

Weight

1.200

1.400

3.300

0.600

0.999

1

1

0

1

1

1

1

0

0

1

7

2010

2011

1

1

0

1

1

1

1

1

0

1

8

1

1

1

1

0

1

1

1

1

1

9

2012

1

1

0

1

0

0

1

0

1

1

6

2008

2009

2010

2011

2012

0.0363

0.6739

0.5060

1.4757

1.5626

4.25

0.0600

0.6585

0.3851

1.2192

1.4768

3.80

0.0864

0.7232

0.3226

1.6133

1.4293

4.17

0.1014

0.7606

0.3565

1.4464

1.4471

4.11

0.0780

0.7247

0.3700

1.3925

1.4946

4.06

2013E

1

1

1

1

1

0

1

1

0

1

8

2013E

0.0730

0.6423

0.3862

0.9945

1.4807

3.58

2014E

1

1

0

1

1

0

1

0

0

1

6

2014E

0.0730

0.6767

0.3862

0.9937

1.4807

3.61

2015E

1

1

0

1

0

0

1

0

0

1

5

2015E

0.0730

0.7102

0.3862

0.9934

1.4807

3.64

2016E

1

1

0

1

1

0

1

0

0

1

6

2016E

0.0730

0.7425

0.3862

0.9934

1.4807

3.68

2017E

1

1

0

1

0

0

1

0

0

1

5

2017E

0.0730

0.7740

0.3862

0.9934

1.4807

3.71

The interpretation for the Altman Score is: Safe Zone = Z > 2.9, Grey Zone = 1.23 < Z < 2.9, Distress Zone = Z < 1.23

Piotroski Financial Fitness Scorecard (10-pt scale)

Altman Probability of Bankruptcy Z-Score

10

4

8

4

6

4

4

4

4

2

3

0

3

LOW Performance Analysis. Datasource: CapitalIQ

Financial Analysis & Valuation, Page 5 of 5

Analysts: Elisa Gayle, Brenna Koch, Jonathan Ramirez