04/04

advertisement

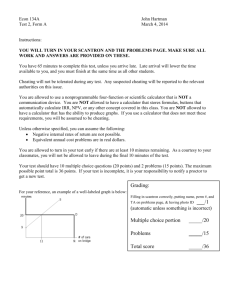

Daily quiz-25 (04/04): Print your name and ID in BLOCK letters. The Price-Earnings ratio or the P/E of a company = Market price of the share/Profits or Earnings per share (before dividend payout). Q1. Philly Cheese Corporation had a P/E ratio of 20, retained earnings of $1.50 per share and a dividend of $.50. What was its dividend yield (dividend/market price)? Ans: E = 1.50+0.50 =2.0, P = 2x20 = 40, dividend yield = 0.50/40 = 1.25% Q2. In 2008, CDZ Corporation had total earnings of $500 million and CDZ retained 30 percent of its earnings for future investments. If the price of a share of CDZ stock is $70 and if 80 million shares of its stock were outstanding, then what is the priceearnings ratio? Ans: Earnings per share = 500/80 = 6.25, P/E = 70/6.25 = 11.2 (not all information provided is relevant) Q3. From a household’s point of view, a Savings Account is a financial asset. Does a Savings Account have more in common with a company bond or a company stock? Ans: Savings Account has more in common with a company bond because like a bond, it pays a constant interest rate at fixed points of time.