Chapter 14

advertisement

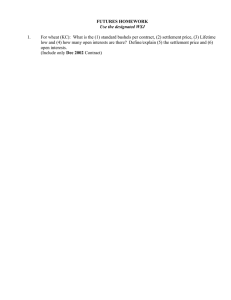

Investing In Stocks & Bonds Chapter 14 Personal Finance FIN 235 Stocks (Common & Preferred) A. Common Stock Basic form of corporate ownership 2. Common stockholders have voting power 1. a. b. c. d. 3. Amend the corporate charter Approve mergers and acquisitions Elect directors Raise ne capital (debt and equity) Residual claim on income and assets B. Motives for Purchasing Common Stock Receive dividends (if paid) 2. Participate in capital growth 1. Stocks (Common & Preferred) B. Preferred Stock Preferred claim on dividends 2. May have one of several features; 1. a. b. c. 3. Cumulative Participating Convertible Typically non-voting except if several dividend payments in a row are unpaid. Evaluating Stock Investments What makes a particular stock an attractive investment? A. 1. 2. 3. 4. Good growth opportunities Good dividend yields Market leader Good management How do we find out about these stocks? B. 1. 2. 3. 4. 5. 6. Research reports: Barron’s, Investor’s Business Daily Brokerage recommendations (in-house research) Investment websites: Zack’s, Motley Fool, The Street.Com Individual Company websites Stock Advisory Services: Value Line, Standard & Poor’s, Mergent Magazines: Forbes, Business Week, Fortune, Money, Inc. Important Decision Factors A. Earnings and Earnings Growth 1. 2. 3. Earnings Per Share: trailing vs. forecast P/E ratio PEG ratio B. Dividends 1. 2. Dividend growth rates Coverage C. Industry Characteristics 1. 2. 3. Growth Mature Declining Stock Markets A. Primary Where new issues are sold: e.g. IPO 2. Investment Bankers dominate this market 1. B. Secondary Markets Where “seasoned” issues are traded. 2. Examples; New York Stock Exchange, Nasdaq (OTC) 1. C. Securities Exchanges Specialists (provide liquidity) 2. Floor Traders (execute public trades) 1. Brokerage Services Full Service (Retail) A. 1. 2. 3. Best place to start for individual new to investing More expensive to trade Research reports available Discount Brokers B. 1. 2. 3. Best for experienced traders Do your own research Less expensive Online C. 1. 2. 3. Same as above, but typically higher incidence of trades Investors totally comfortable with online training Least expensive way to trade. Details of Stock Transactions A. Types of Orders Market: willing to buy at ASK, sell at BID 1. a. Limit: will trade at specified price 2. a. Deferred execution Stop: order becomes active when stop price is “hit” 3. a. b. 4. 5. 6. 7. Immediate execution Stop [Sell] Loss: sell position when price gets too low. Stop Buy: add to position if prices start to move up. Day Order: if no execution, automatically cancelled Good till Cancel (GTC): stays active until executed Fill or Kill: get it now or cancel order All or Nothing: for large orders Commission Schedules A. Retail Brokers 1. By the size of the order B. Online / Discount Flat fee for trades up to 1000 shares. 2. More expensive if broker assisted. 1. C. Bid-Ask Spread Cost of liquidity 2. Bid = highest price of unexecuted orders to buy 3. Ask = lowest price of unexecuted orders to sell 1. Investment Strategies A. Short-Term Attempting to time the market 2. Expensive and risky 1. B. Long-Term Buy and Hold 2. Occasional trading to rebalance portfolio or take profits 1. C. Dollar Cost Average Buying [small] dollar amounts of an issue over time. 2. Most popular technique with mutual funds and retirement plans 1. Investment Strategies Long versus Short Positions A. 1. 2. Long: expect prices to go up Short: expect Prices to go down Buying on Margin B. 1. 2. 3. Borrow money from broker to finance purchase Maximum margin = 50% Margin requirement controlled by Federal Reserve Selling Short C. 1. 2. 3. 4. 5. Margin Account Borrow stock and sell it Buy stock back and return: trick is to buy back at a lower price. Example: Sell ABC short at $50, then buy back later at $40 Short sellers always expect stock price to decline. Options and Futures A. Options Right but not obligation to buy (call) or sell (put) a stock 2. Contracts are for round lots (100 shares) 3. Price of an option is called a premium. 4. Options have relatively short lives (6 – 7 months) 1. a. Exception: LEAPS – run up to two years. Options can be used to Speculate or to Hedge 5. a. b. Speculate: bet on market move in one direction Hedge: protect an underlying stock position Options and Futures B. Futures Used to speculate or hedge commodity positions 2. Commodities: 1. a. b. c. d. Financial (bills and bonds) Industrial (lumber, copper, gold) Agricultural (wheat, corn, cocoa) Exchange (Euro, Swiss Franc, UK Pounds) Require greater net worth than stocks 4. Many hazards associated with futures trading 3. HOMEWORK A. Do the Math: 1, 2, 4 B. Be Your Own Personal Financial Planner 2 – Compare different stocks as Investment (w/s 54) 2. 5 – Current Yield (w/s 58) 1.