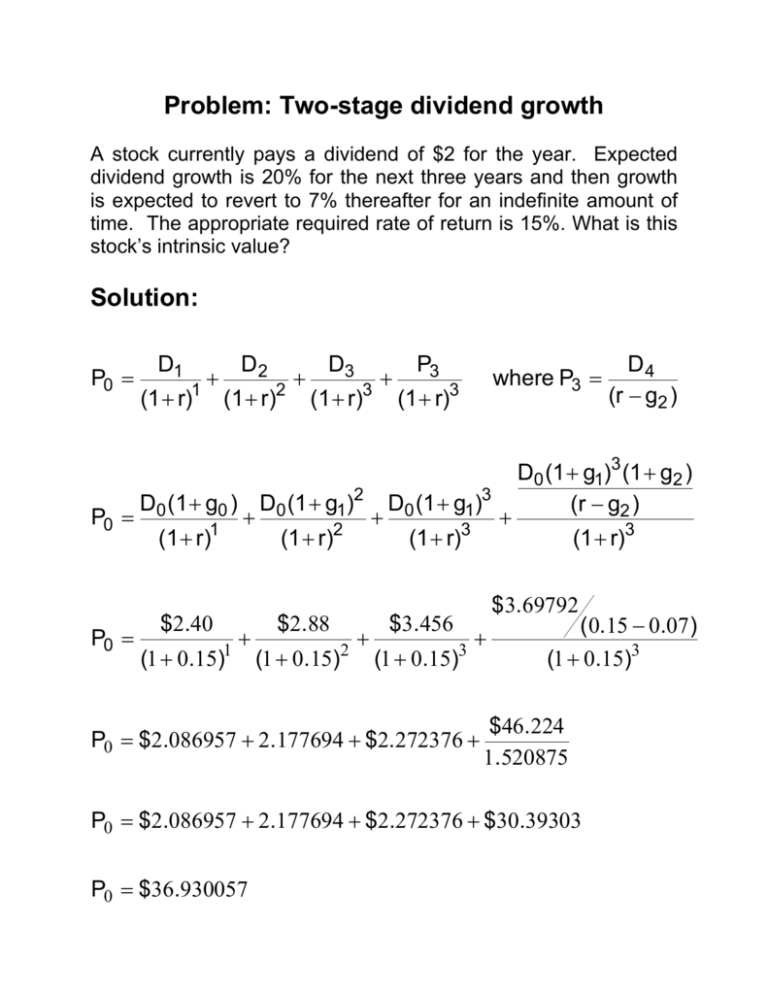

Two-Stage Dividend Growth Problem & Solution

advertisement

Problem: Two-stage dividend growth A stock currently pays a dividend of $2 for the year. Expected dividend growth is 20% for the next three years and then growth is expected to revert to 7% thereafter for an indefinite amount of time. The appropriate required rate of return is 15%. What is this stock’s intrinsic value? Solution: P0 = D1 D2 D3 P3 + + + (1 + r)1 (1 + r)2 (1 + r)3 (1 + r)3 where P3 = D0 (1 + g0 ) D0 (1 + g1)2 D0 (1 + g1)3 P0 = + + + 3 2 1 (1 + r) (1 + r) (1 + r) P0 = $2.40 $2.88 $3.456 P0 = $2.086957 + 2.177694 + $2.272376 + D0 (1 + g1)3 (1 + g2 ) (r − g2 ) (1 + r)3 $3.69792 + + + 1 2 3 (1 + 0.15) (1 + 0.15) (1 + 0.15) ( 0.15 − 0.07 ) (1 + 0.15)3 $46.224 1.520875 P0 = $2.086957 + 2.177694 + $2.272376 + $30.39303 P0 = $36.930057 D4 (r − g2 )