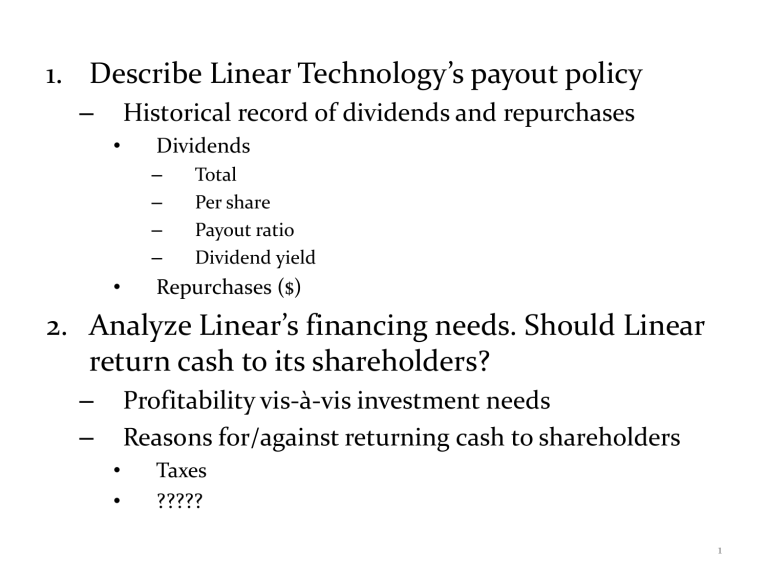

Questions/Discussion

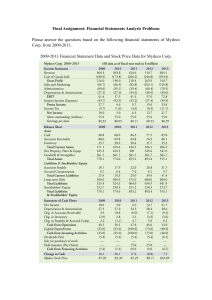

1. Describe Linear Technology’s payout policy

– Historical record of dividends and repurchases

• Dividends

– Total

– Per share

– Payout ratio

– Dividend yield

• Repurchases ($)

2. Analyze Linear’s financing needs. Should Linear return cash to its shareholders?

– Profitability vis-à-vis investment needs

– Reasons for/against returning cash to shareholders

• Taxes

• ?????

1

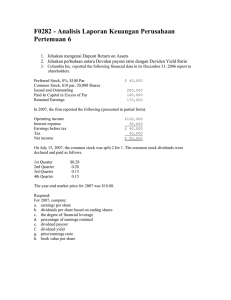

3. If Linear were to pay out its entire cash balance as a special dividend, what would be the effect on the share price? On earnings? On number of shares outstanding? On earnings per share?

What if Linear repurchased shares instead?

– Assume a Modigliani and Miller world: no taxes, no agency costs, perfect information, no transactions costs

– Assume the company will use $1.5 billion of cash. The cash earns 3% interest income if the company keeps it.

– Hint: Earnings for 2003 are only for the first 3 quarters.

You need the earnings for the full year (i.e. 4 quarters)

2003.

2

4. Why do firms pay dividends?

– Refer to class notes

5. What should Paul Coghlan recommend to the board?

3