Just For Feet Inc. Financial Analysis 1997-1998

advertisement

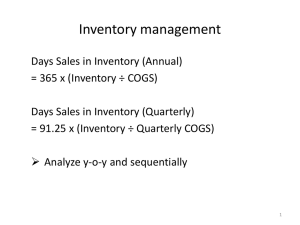

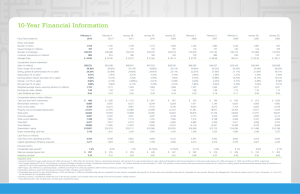

Just-For-Feet – Page 20 Solution to Just For Feet, Inc.: Chapter 2 Just For Feet, Inc. ASSETS Cash and equivalents Accounts receivable Merchandise inventory Other Total Current Assets Property and Equipment, net Goodwill, net Other Total Fixed Assets Total Assets LIABILITIES AND EQUITY Short-term borrowings Accounts payable Accrued expenses Income taxes Short-Term Deferred income taxes Current maturities Total Current Liabilities Long-term obligations Deferred lease rentals Long-Term Deferred income taxes Total Long Term Liabilities Common stock Paid-in capital Retained earnings Total Shareholders' Equity Total Liabilities Financials and Financial Ratios 30-Jan-99 $12,412 18,875 399,901 18,302 449,490 160,592 71,084 8,230 239,906 689,396 31-Jan-98 $82,490 15,840 206,128 6,709 311,167 94,529 36,106 6,550 137,185 448,352 100,322 24,829 90,667 51,162 9,292 1,363 902 6,639 132,692 216,203 13,162 1,633 230,998 3 249,590 76,113 325,706 689,396 3,222 155,706 16,646 7,212 704 24,562 3 218,616 49,465 269,084 448,352 Just-For-Feet – Page 21 STATEMENT OF EARNINGS Net sales Cost of sales Gross profit Franchise fees, royalties, etc Operating expenses Store operating Store opening costs Amortization of intangibles General and administrative Total operating Operating income Interest expense Interest income Earnings before income taxes Provision of income tax Net earnings Shares outstanding Diluted Fiscal 1998 774,863 452,330 322,533 1,299 Fiscal 1997 478,638 279,816 198,822 1,101 232,505 13,669 2,072 24,341 272,587 51,245 -8,059 143 43,329 16,681 26,648 30,737 31,852 139,659 6,728 1,200 18,040 165,627 34,296 -1,446 1,370 34,220 12,817 21,403 29,615 30,410 STATEMENT OF CASH FLOWS Fiscal 1998 Fiscal 1997 Net earnings 26,648 21,403 Adjustments to reconcile net earnings to net cash used by operating activities Depreciation and amortization 16,129 8,783 Deferred income taxes 12,100 2,194 Deferred lease rentals 2,655 2,111 Change in assets and liabilities Accounts receivable -2,795 -8,918 Merchandise inventory -170,169 -56,616 Other assets -8,228 -5,643 Accounts payable 34,638 7,495 Accrued expenses 7,133 2,264 Income taxes -181 543 Net cash used by operating activities -82,070 -26,384 Net cash used for investing activities -79,183 -32,067 Net cash provided by financing activities 91,175 2,156 Net (decrease) increase in cash and cash equivalents -70,078 -56,295 Just-For-Feet – Page 22 RATIOS Current ratio Quick ratio Net working capital, NWC Net liquid balance, NLB Working capital requirements, WCR WCR/Sales Cash flow from operations Cash conversion period Days inventory held, DIH Days sales outstanding, DSO Days payables outstanding, DPO Current liquidity index Total assets / total sales, A/S After-tax profit ratio, m Dividend payout ratio, d Debt to equity ratio, D/E Sustainable growth rate, g* Actual sales growth rate, g 1998 3.39 0.37 316,798 5,773 311,025 0.40 -82,070 250.63 322.69 8.89 80.95 0.0045 0.8897 0.0344 0 0.7092 7.07% 61.89% 1997 2.00 0.67 155,461 -11,399 166,860 0.35 (similar -26,384 to W.T. 214.22 Grant 268.88 CCP in 12.08 the early 66.74 70's) 0.9367 0.0447 0 0.0913 5.50% a.) Current ratio versus quick ratio The current ratio increased primarily due to the significant increase in inventory. The quick ratio fell because current assets other than inventory fell relative to the slight decline in current liabilities. b.) Discussion of working capital cycle Days inventory held increased from 268 days in fiscal 1997 to 322 days in 1998. Days sales outstanding decreased from 12 days to 9 days. Days payables outstanding increased from 67 days to 81 days. Thus the cash conversion period increased from 214 days to 250 days. c.) Ability to pay current obligations The company's operations generated a deficit cash flow each of the two years which explains the dwindling cash balance. d.) Solvency and liquidity positions While the current ratio increased from 2 to 3.39, this increase can be attributed to the increased inventory and not to increased liquidity. The current liquidity index is approximately zero which indicates that the company has no liquid resources to cover currently maturing debt. e.) The sustainable growth rate From 1997 to 1998, sales grew almost 62%. However the sustainable growth rate calculated using year-end 1997 figures was only 8.66%. To finance this excess growth, the company's debt-to-equity ratio increased in 1998 to 1.11 from a level of .67 in 1997. Just-For-Feet – Page 23 f.) Conclusions While earnings increased and the company's current ratio increased from 1997 to 1998, the company's operations generated an increasing deficit cash flow level; and the company's current liquidity index shows a lack of any liquid resources relative to the current level of debt due. The company is in a significant liquidity crisis.