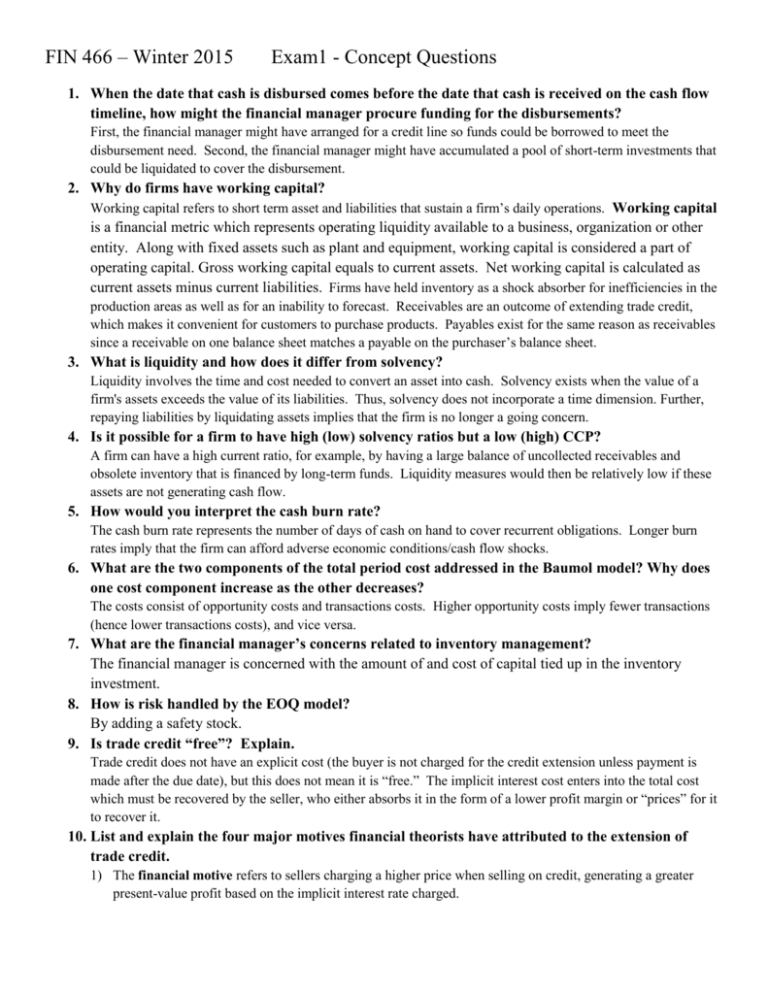

FIN 466 Exam 1: Finance Concept Questions

advertisement

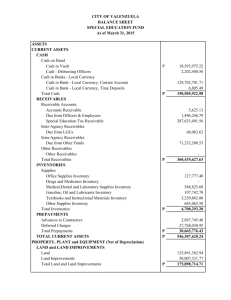

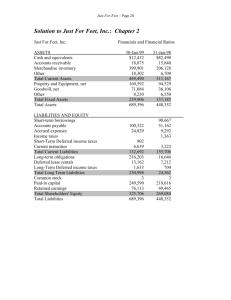

FIN 466 – Winter 2015 Exam1 - Concept Questions 1. When the date that cash is disbursed comes before the date that cash is received on the cash flow timeline, how might the financial manager procure funding for the disbursements? First, the financial manager might have arranged for a credit line so funds could be borrowed to meet the disbursement need. Second, the financial manager might have accumulated a pool of short-term investments that could be liquidated to cover the disbursement. 2. Why do firms have working capital? Working capital refers to short term asset and liabilities that sustain a firm’s daily operations. Working capital is a financial metric which represents operating liquidity available to a business, organization or other entity. Along with fixed assets such as plant and equipment, working capital is considered a part of operating capital. Gross working capital equals to current assets. Net working capital is calculated as current assets minus current liabilities. Firms have held inventory as a shock absorber for inefficiencies in the production areas as well as for an inability to forecast. Receivables are an outcome of extending trade credit, which makes it convenient for customers to purchase products. Payables exist for the same reason as receivables since a receivable on one balance sheet matches a payable on the purchaser’s balance sheet. 3. What is liquidity and how does it differ from solvency? Liquidity involves the time and cost needed to convert an asset into cash. Solvency exists when the value of a firm's assets exceeds the value of its liabilities. Thus, solvency does not incorporate a time dimension. Further, repaying liabilities by liquidating assets implies that the firm is no longer a going concern. 4. Is it possible for a firm to have high (low) solvency ratios but a low (high) CCP? A firm can have a high current ratio, for example, by having a large balance of uncollected receivables and obsolete inventory that is financed by long-term funds. Liquidity measures would then be relatively low if these assets are not generating cash flow. 5. How would you interpret the cash burn rate? The cash burn rate represents the number of days of cash on hand to cover recurrent obligations. Longer burn rates imply that the firm can afford adverse economic conditions/cash flow shocks. 6. What are the two components of the total period cost addressed in the Baumol model? Why does one cost component increase as the other decreases? The costs consist of opportunity costs and transactions costs. Higher opportunity costs imply fewer transactions (hence lower transactions costs), and vice versa. 7. What are the financial manager’s concerns related to inventory management? The financial manager is concerned with the amount of and cost of capital tied up in the inventory investment. 8. How is risk handled by the EOQ model? By adding a safety stock. 9. Is trade credit “free”? Explain. Trade credit does not have an explicit cost (the buyer is not charged for the credit extension unless payment is made after the due date), but this does not mean it is “free.” The implicit interest cost enters into the total cost which must be recovered by the seller, who either absorbs it in the form of a lower profit margin or “prices” for it to recover it. 10. List and explain the four major motives financial theorists have attributed to the extension of trade credit. 1) The financial motive refers to sellers charging a higher price when selling on credit, generating a greater present-value profit based on the implicit interest rate charged. 2) Under the operating motive, suppliers respond to variable and uncertain demand by the way in which they extend trade credit, instead of using more costly responses such as installing extra capacity, building or depleting inventories, or forcing customers to wait in line. 3) The argument that sales contracting costs between buyers and sellers are reduced for buyers because they can inspect the quantity and quality of goods prior to payment and reduce the payment if some goods are missing or defective is the contracting cost motive. 4) The pricing motive is attributed to a situation in which sellers in certain industries are unable to alter their prices, perhaps because they are part of an oligopoly or due to governmental regulation; unpublished variations in credit policy allow these sellers to effectively charge varying amounts to their customers.