How-To Guide: How to Use Ratios to Manage Cash Flow

advertisement

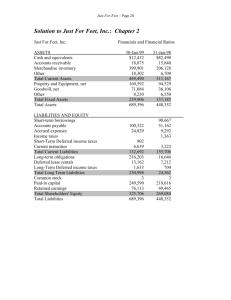

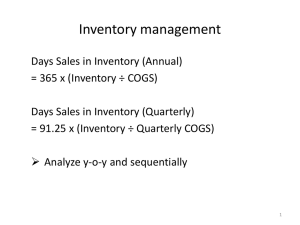

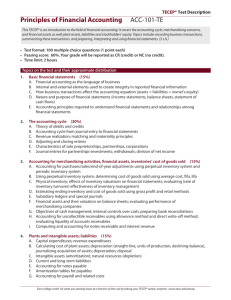

How-To Guide: How to Use Ratios to Manage Cash Flow With today’s accounting software packages, it is easier than ever to monitor all aspects of your business’s finances. Many packages, such as QuickBooks, even provide dashboards--graphical representations of company operations data that display an instant snapshot of your company’s financial data. But what exactly should you be monitoring? Tracking key ratios can help you understand and better manage cash flow. Here is a closer look at six key financial ratios. LIQUIDITY RATIOS Liquidity ratios measure how well your business’s current assets can meet its current financial obligations as payments come due. The three most important are: 1. Current Ratio tells you how well current assets are able to satisfy current liabilities. Formula: Current Assets ÷ Current Liabilities = Current Ratio Current assets include cash and cash equivalents, accounts receivable, inventory, notes receivable and prepaid expenses. Current liabilities include expenses due in the next 12 months, such as accounts payable, the portion of notes payable due in the next 12 months, and any other current accounts on the balance sheet. Current assets should be greater than current liabilities, or your business will have trouble paying its obligations. A current ratio of 1.5:1 is considered sufficient; a ratio of 2:1 or above is considered strong. 2. Quick Ratio shows the amount of liquid assets available to pay current liabilities. Formula: (Cash and Accounts Receivable) ÷ Current Liabilities = Quick Ratio Unlike the current ratio, the quick ratio doesn’t include inventory, which is not considered liquid. A quick ratio of 1:1 or above is considered “liquid” and means your business is in a good position to cover its liabilities. If your quick ratio is under 1:1, your business has more current liabilities than it has liquid assets to pay them. 3. Days of Cash indicates the amount of cash and very liquid assets, like money market holdings, you have on hand to operate your company. Formula: (Cash and Cash Equivalents) x 360 ÷ Revenue = Days of Dash How many days of cash do you need? Some business owners measure days of cash based on payroll or fixed expenses. For example, you might keep two payrolls’ worth of cash on hand, or one month’s worth of payroll and fixed expenses. A seasonal or cyclical business may need more days of cash at certain times. A good rule of thumb is to add up the expenses for which you want cash on hand, then add a cushion of 15 to 20 percent. EFFICIENCY RATIOS Efficiency ratios measure how well your business is using current assets and managing current liabilities. The three most important are: 1. Days Accounts Receivable (A/R) Outstanding, also called Days Sales Outstanding (DSO), measures how long it takes you to collect a period’s worth of accounts receivable. Formula: (Net A/R ÷ Credit Sales) x Days in Period = Days A/R Outstanding Days A/R Outstanding shows you how fast your A/R is turning into cash. Industries vary but in general, aim for a measure of 30 days or less. 2. Days of Inventory measures how long it takes you to turn over your inventory. Formula: (Inventory Value x 360) ÷ Cost of Sales = Days of Inventory Maintaining too much inventory is a common mistake that negatively affects cash flow, because valuable cash is being invested in a non-liquid asset. Measuring days of inventory takes sales fluctuations into account, so it’s a good way to measure the value of inventory you should have on hand. Seasonal businesses often start their season with more days of inventory, then decrease days of inventory as the season ends. 3. Days Accounts Payable (A/P) Outstanding shows how many days of payables your company owes to trade creditors and service providers. Formula: (Net A/P ÷ Credit Sales) x Days in Period = Days A/P Outstanding Most companies require payment in net 30 days, although it may be 45 – 60 days in some industries. It’s good practice never to let your accounts payable get higher than your accounts receivable. Since trade credit is valuable, you always want to pay on time—so if your A/P terms are net 30, aim for days of A/P to be between 25 and 30. Choosing the ratios that are most important for your business, measuring them often and adjusting as necessary can help improve your cash flow. A SCORE Mentor can help you complete this exercise and determine your next steps. SCORE has over 13,000 successful and experienced executives with small business know-how who want to help you. Find a Mentor at www.ebusinessnow.org