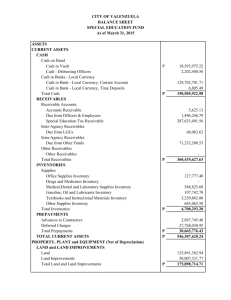

balance sheet analysis

advertisement

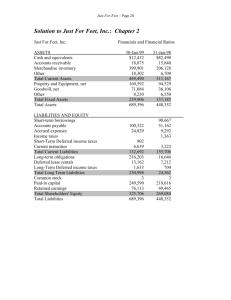

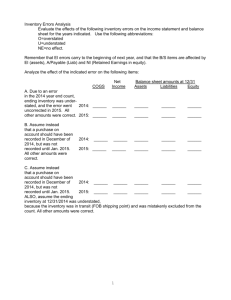

Inventory management Days Sales in Inventory (Annual) = 365 x (Inventory ÷ COGS) Days Sales in Inventory (Quarterly) = 91.25 x (Inventory ÷ Quarterly COGS) Analyze y-o-y and sequentially 1 Applied to components: Days Sales in Raw Materials(Annual) = 365 x (Raw Materials ÷ COGS) Days Sales in Work in Process(Annual) = 365 x (Work in Process ÷ COGS) Days Sales in Finished Goods(Annual) = 365 x (Finished Goods ÷ COGS) 2 Positive divergence – When raw materials and work in process pile up compared to finished goods Negative divergence – When finished goods pile up relative to raw materials and work in process 3 Sale of Written-Off Inventory Margins are artificially inflated when companies write-off inventory and then sell them later Example: Cisco “As a result of the restructuring program and decline in forecasted revenue, we recorded restructuring costs and other special charges of $1.17 billion classified as operating expenses and an additional excess inventory charge classified as cost of sales. The excess inventory charge recorded in the third quarter of fiscal 2001 was $2.25 billion. This excess inventory charge was subsequently reduced in the fourth quarter of fiscal 2001 by a $187 million…” 4 Other items to watch out for – Assets side Allowance for doubtful accounts (ADA) Compare the ADA as a % of gross accounts receivable: ADA ÷ (ADA + net accounts receivable) ADA should track gross receivables Goodwill and intangibles Large goodwill and intangibles could mean assets are overvalued due to acquisitions If goodwill changes without an acquisition, it could mean management adjusted a purchase price for an acquisition 5 Other current assets Companies can treat expenses as if they were assets (this is known as capitalizing an expense). This means expenses don’t show up in the income statement (so earnings are higher), but show up in the balance sheet instead. Capitalized earnings may be called “other current assets”. When (Other Current Assets ÷ Revenues) increases, it could mean companies are capitalizing expenses. 6 Other items to watch out for – Liabilities side Deferred revenue Revenue a company receives before it delivers the product or service. Days in deferred revenue (DDR) = (91.25 x deferred revenue) ÷ quarterly revenue If DSO – DDR is declining, the company is generating less deferred revenue relative to the terms it is offering customers. 7 Accrued liabilities Or, “other current liabilities”, or “other liabilities” Reserves are often lumped into these categories. A company taking serial charges could be building up reserves. Reserves are usually set up to cover contingent liabilities. But companies can also be building reserves to smooth income --- i.e., dipping into the “cookie jar”. Check accrued liabilities relative to revenue. If it falls, it could be an indication that the company reversed a reserve giving an artificial boost to earnings. 8 • Sources: – Del Vecchio and Jacobs, What’s Behind the Numbers? 9