Change in Inventory Methods and Inventory Errors

advertisement

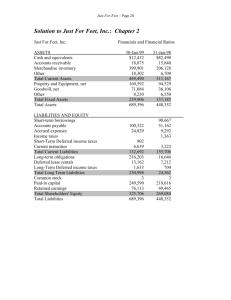

Inventories: Additional Issues CHANGE IN INVENTORY METHOD AND INVENTORY ERRORS Change in Accounting Principle Basic Rule A change in accounting principle is reported in the current year income statement as a separate item after discontinued operations and extraordinary items, as the cumulative effect (after-tax) of the change. The previous financial statements are not restated. Pro forma EPS disclosure is required. Exception to Basic Rule Change in inventory method to LIFO If is virtually impossible to calculate the cumulative effect of the change in accounting principle when the inventory method is change to LIFO. Therefore, there is no special accounting. The year of adoption becomes the first LIFO layer. Financial statement disclosure is necessary. Change in inventory method from LIFO The change in accounting principle which involves a change in inventory method from LIFO to some other method requires retroactive restatement of the prior year financial statements. Inventory Errors Ending Inventory Misstated When ending inventory is misstated there is a cascading effect throughout the financial statements. If ending inventory is understated Income Statement Cost of goods sold will be overstated Net income will be understated Balance sheet Inventory is understated Retained earnings will be understated Working capital will be understated Current ratio will be understated Example: The financial statements for Spencer Company for the year ended December 31, 2000 are as follows: D:\106756421.doc 3/7/2016 1 Inventories: Additional Issues Spencer Company Statement of Income and Retained Earnings December 31, 2000 Sales Cost of goods sold: Beginning inventory Purchases Purchase returns and allowance Purchase discounts Net purchases Freight-in Total merchandise available for sale Less: ending inventory Cost of goods sold Gross profit Operating expenses Income before income taxes Income taxes Net income Beginning retained earnings Ending retained earnings D:\106756421.doc 3/7/2016 $2,000,000 $400,000 $1,200,000 150,000 24,000 1,026,000 40,000 1,066,000 1,466,000 500,000 966,000 1,034,000 600,000 434,000 43,400 390,600 159,400 $550,000 2 Inventories: Additional Issues Spencer Company Balance Sheet December 31, 2000 ASSETS Cash Accounts receivable Inventory Total current assets Property, plant and equipment Accumulated deprecation Total property, plant and equipment Total assets $200,000 400,000 500,000 $1,100,000 500,000 200,000 700,000 $1,800,000 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable 200,000 Accrued liabilites 100,000 Total current liabilities $300,000 Long-term debt 600,000 Total liabilites 900,000 Shareholders' equity: Common stock 100,000 Additional paid-in capital 250,000 Retained earnings 550,000 Total shareholders' equity 900,000 Total liabilities and shareholders' equity $1,800,000 After the financial statements were prepared and published it was discovered that there was an error made in counting the ending inventory. The ending inventory should have been $600,000. The following is a restatement of the financial statements reflecting this correction of the error. D:\106756421.doc 3/7/2016 3 Inventories: Additional Issues Spencer Company RESTATED Statement of Income and Retained Earnings December 31, 2000 Sales Cost of goods sold: Beginning inventory Purchases Purchase returns and allowance Purchase discounts Net purchases Freight-in Total merchandise available for sale Less: ending inventory Cost of goods sold Gross profit Operating expenses Income before income taxes Income taxes Net income Beginning retained earnings Ending retained earnings D:\106756421.doc 3/7/2016 $2,000,000 $400,000 $1,200,000 150,000 24,000 1,026,000 40,000 1,066,000 1,466,000 600,000 866,000 1,134,000 600,000 534,000 53,400 480,600 159,400 $640,000 4 Inventories: Additional Issues Spencer Company RESTATED Balance Sheet December 31, 2000 ASSETS Cash Accounts receivable Inventory Total current assets Property, plant and equipment Accumulated deprecation Total property, plant and equipment Total assets $200,000 400,000 600,000 $1,200,000 500,000 200,000 700,000 $1,900,000 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable 200,000 Accrued liabilites 100,000 Total current liabilities $300,000 Long-term debt 600,000 Total liabilites 900,000 Shareholders' equity: Common stock 110,000 Additional paid-in capital 250,000 Retained earnings 640,000 Total shareholders' equity 1,000,000 Total liabilities and shareholders' equity $1,900,000 The following schedule provides an analysis of the impact of the errors on the various accounts in the income statement and the balance sheet. D:\106756421.doc 3/7/2016 5 Inventories: Additional Issues INCOME STATEMENT Cost of goods sold Income tax expense Net income Overstated 100,000 Understated 10,000 90,000 BALANCE SHEET Inventory 100,000 Accrued liabilities (additional income tax payable) 10,000 Retained earnings 90,000 Working capital Current assets less current liabilities: 90,000 Original $800,000 Restated $890,000 Current ratio 0.20 Current assets divided by current liabilities: Original .3.67 Restated 3.87 Purchases and Inventory Misstated Assuming the periodic inventory system is being used, if a purchase at year-end was not recorded nor counted in ending inventory the financial statements would be misstated as follows: Income Statement Purchases would be understated Ending inventory would be understated Cost of goods sold would not be affected Net income would not be affected Balance sheet Inventory would be understated Accounts payable would be understated Retained earnings would not be affected Working capital would not be affected Current ratio would be overstated Financial Statement Reporting Errors discovered after the issuance of financial statements require restatement. For all years reported the financial statements are restated to correct for the error. The beginning balance of retained earnings of the earliest year reported is restated by reporting a prior period adjustment. A prior period adjustment adjusts the beginning balance of retained earnings to account for the correction of the error in all years prior to those reported in the financial statements. D:\106756421.doc 3/7/2016 6