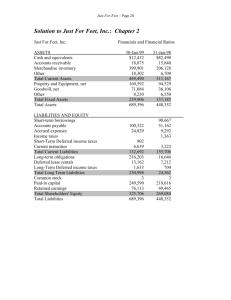

10-Year Financial Information

advertisement

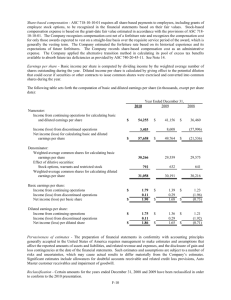

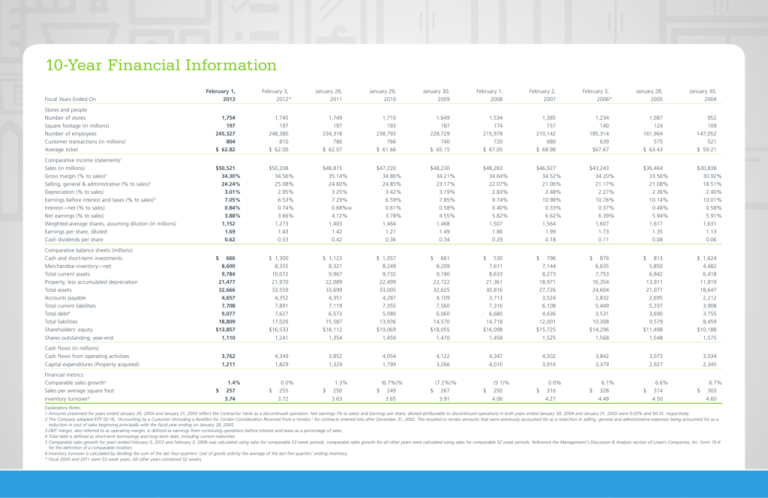

10-Year Financial Information Fiscal Years Ended On February 1, 2013 February 3, 2012* January 28, 2011 January 29, 2010 January 30, 2009 February 1, 2008 February 2, 2007 February 3, 2006* January 28, 2005 January 30, 2004 Stores and people Number of stores Square footage (in millions) Number of employees Customer transactions (in millions) Average ticket 1,754 197 245,327 804 $ 62.82 1,745 197 248,380 810 $ 62.00 1,749 197 234,318 786 $ 62.07 1,710 193 238,793 766 $ 61.66 1,649 187 228,729 740 $ 65.15 1,534 174 215,978 720 $ 67.05 1,385 157 210,142 680 $ 68.98 1,234 140 185,314 639 $67.67 1,087 124 161,964 575 $ 63.43 952 109 147,052 521 $ 59.21 Comparative income statements1 Sales (in millions) Gross margin (% to sales)2 Selling, general & administrative (% to sales)2 Depreciation (% to sales) Earnings before interest and taxes (% to sales)3 Interest—net (% to sales) Net earnings (% to sales) Weighted-average shares, assuming dilution (in millions) Earnings per share, diluted Cash dividends per share $50,521 34.30% 24.24% 3.01% 7.05% 0.84% 3.88% 1,152 1.69 0.62 $50,208 34.56% 25.08% 2.95% 6.53% 0.74% 3.66% 1,273 1.43 0.53 $48,815 35.14% 24.60% 3.25% 7.29% 0.68%w 4.12% 1,403 1.42 0.42 $47,220 34.86% 24.85% 3.42% 6.59% 0.61% 3.78% 1,464 1.21 0.36 $48,230 34.21% 23.17% 3.19% 7.85% 0.58% 4.55% 1,468 1.49 0.34 $48,283 34.64% 22.07% 2.83% 9.74% 0.40% 5.82% 1,507 1.86 0.29 $46,927 34.52% 21.06% 2.48% 10.98% 0.33% 6.62% 1,564 1.99 0.18 $43,243 34.20% 21.17% 2.27% 10.76% 0.37% 6.39% 1,607 1.73 0.11 $36,464 33.56% 21.08% 2.36% 10.14% 0.48% 5.94% 1,617 1.35 0.08 $30,838 30.92% 18.51% 2.40% 10.01% 0.58% 5.91% 1,631 1.13 0.06 Comparative balance sheets (millions) Cash and short-term investments Merchandise inventory—net Total current assets Property, less accumulated depreciation Total assets Accounts payable Total current liabilities Total debt4 Total liabilities Shareholders’ equity Shares outstanding, year-end $ 666 8,600 9,784 21,477 32,666 4,657 7,708 9,077 18,809 $13,857 1,110 $ 1,300 8,355 10,072 21,970 33,559 4,352 7,891 7,627 17,026 $16,533 1,241 $ 1,123 8,321 9,967 22,089 33,699 4,351 7,119 6,573 15,587 $18,112 1,354 $ 1,057 8,249 9,732 22,499 33,005 4,287 7,355 5,080 13,936 $19,069 1,459 $ 661 8,209 9,190 22,722 32,625 4,109 7,560 6,060 14,570 $18,055 1,470 $ 530 7,611 8,633 21,361 30,816 3,713 7,316 6,680 14,718 $16,098 1,458 $ 796 7,144 8,273 18,971 27,726 3,524 6,108 4,436 12,001 $15,725 1,525 $ 876 6,635 7,753 16,354 24,604 2,832 5,449 3,531 10,308 $14,296 1,568 $ 813 5,850 6,842 13,911 21,077 2,695 5,337 3,690 9,579 $11,498 1,548 $ 1,624 4,482 6,418 11,819 18,647 2,212 3,908 3,755 8,459 $10,188 1,575 Cash flows (in millions) Cash flows from operating activities Capital expenditures (Property acquired) 3,762 1,211 4,349 1,829 3,852 1,329 4,054 1,799 4,122 3,266 4,347 4,010 4,502 3,916 3,842 3,379 3,073 2,927 3,034 2,345 1.4% $ 257 3.74 0.0% $ 255 3.72 1.3% $ 250 3.63 (6.7%)% $ 249 3.65 (7.2%)% $ 267 3.91 (5.1)% $ 292 4.06 0.0% $ 316 4.27 6.1% $ 328 4.49 6.6% $ 314 4.50 6.7% $ 303 4.60 Financial metrics Comparable sales growth5 Sales per average square foot Inventory turnover6 Explanatory Notes: 1 Amounts presented for years ended January 30, 2004 and January 31, 2003 reflect the Contractor Yards as a discontinued operation. Net earnings (% to sales) and Earnings per share, diluted attributable to discontinued operations in both years ended January 30, 2004 and January 31, 2003 were 0.05% and $0.01, respectively. 2 The Company adopted EITF 02-16, “Accounting by a Customer (Including a Reseller) for Certain Consideration Received from a Vendor,” for contracts entered into after December 31, 2002. This resulted in certain amounts that were previously accounted for as a reduction in selling, general and administrative expenses being accounted for as a reduction in cost of sales beginning principally with the fiscal year ending on January 28, 2005. 3 EBIT margin, also referred to as operating margin, is defined as earnings from continuing operations before interest and taxes as a percentage of sales. 4 Total debt is defined as short-term borrowings and long-term debt, including current maturities. 5 Comparable sales growth for years ended February 3, 2012 and February 3, 2006 was calculated using sales for comparable 53 week periods, comparable sales growth for all other years were calculated using sales for comparable 52 week periods. Reference the Management’s Discussion & Analysis section of Lowe’s Companies, Inc. Form 10-K for the definition of a comparable location. 6 Inventory turnover is calculated by dividing the sum of the last four quarters’ cost of goods sold by the average of the last five quarters’ ending inventory. * Fiscal 2005 and 2011 were 53 week years. All other years contained 52 weeks.