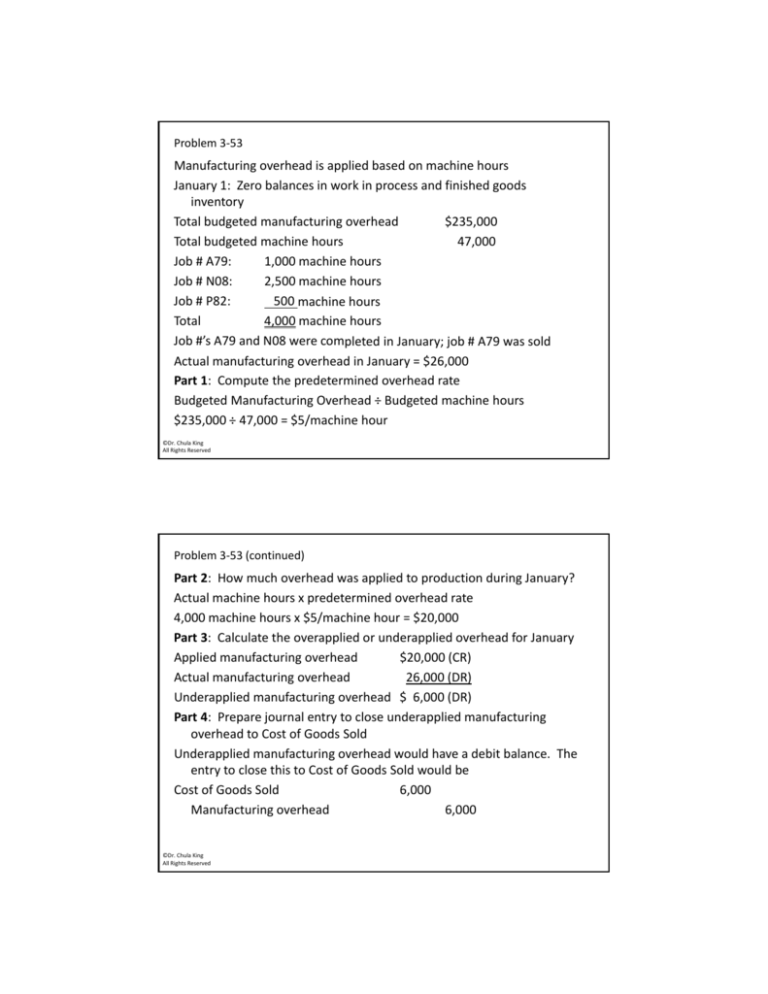

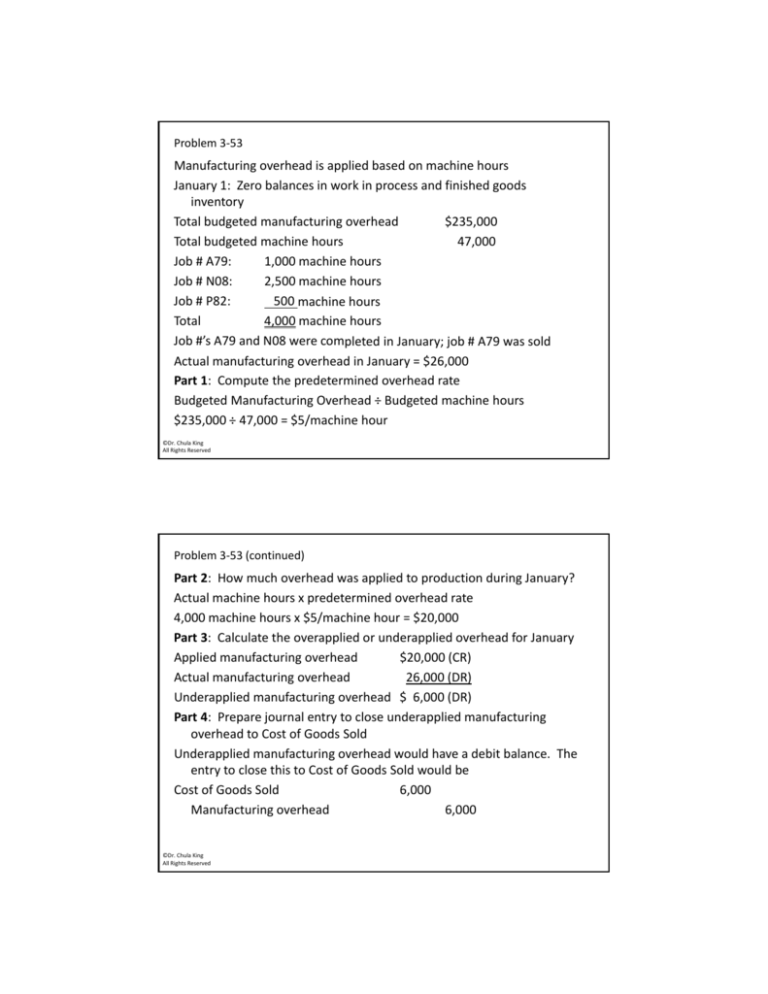

Problem 3‐53

Manufacturing overhead is applied based on machine hours

January 1: Zero balances in work in process and finished goods inventory

Total budgeted manufacturing overhead

$235,000

Total budgeted machine hours

47,000

Job # A79:

1,000 machine hours

Job # N08:

2,500 machine hours

Job # P82:

500 machine hours

Total

4,000 machine hours

Job #’s A79 and N08 were completed in January; job # A79 was sold

p

y; j

Actual manufacturing overhead in January = $26,000

Part 1: Compute the predetermined overhead rate

Budgeted Manufacturing Overhead ÷ Budgeted machine hours

$235,000 ÷ 47,000 = $5/machine hour

©Dr. Chula King

All Rights Reserved

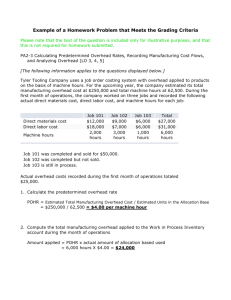

Problem 3‐53 (continued)

Part 2: How much overhead was applied to production during January?

Actual machine hours x predetermined overhead rate

4,000 machine hours x $5/machine hour = $20,000

Part 3: Calculate the overapplied or underapplied overhead for January

Applied manufacturing overhead

$20,000 (CR)

Actual manufacturing overhead

26,000 (DR)

Underapplied manufacturing overhead $ 6,000 (DR)

Part 4: Prepare journal entry to close underapplied manufacturing overhead to Cost of Goods Sold

Underapplied

pp

manufacturing overhead would have a debit balance. The g

entry to close this to Cost of Goods Sold would be

Cost of Goods Sold

6,000

Manufacturing overhead

6,000

©Dr. Chula King

All Rights Reserved

Problem 3‐53

Part 5: Prepare the journal entry to prorate the underapplied manufacturing overhead among work in process, finished goods and cost of goods sold accounts

First Step: Determine the percentage of applied manufacturing overhead in each inventory category to the total:

P

Percentage t

A

Account

t

J b#

Job #

A

Amount

t

Work in process P82 $ 2,500 (500x$5)

2,500÷20,000 = 12.5%

Finished goods

N08

12,500 (2,500x$5) 12,500÷20,000 = 62.5%

Cost of goods sold A79

5,000 (1,000x$5) 5,000 ÷20,000 = 25.0%

Total

$20,000

100.0%

Second Step: Based on the percentages, allocate the underapplied overhead to the three inventory accounts

A

Account

t

U d

Underapplied

li d OHx Percentage = Amount allocated

OH P

t

A

t ll t d

Work in process

6,000 x 12.5% = $ 750

Finished goods 6,000 x 62.5% = 3,750 Cost of goods sold 6,000 x 25.0% = 1,500

Total

$ 6,000

©Dr. Chula King

All Rights Reserved

Problem 3‐53 (continued)

Journal entry:

Work in process inventory

Finished goods inventory

Cost of goods sold

Manufacturing overhead

©Dr. Chula King

All Rights Reserved

750

3,750

1,500

6,000