Syllabus

advertisement

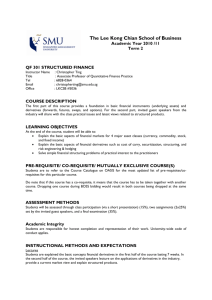

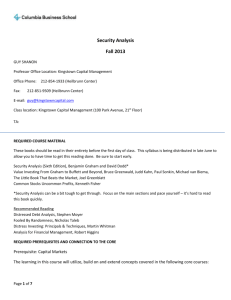

Applied Value Investing Spring 2015 JEFF GRAMM and TERRENCE KONTOS Classroom: Uris 328 Professor Office Location: n/a Office Phone: Fax: 212-854-1933 (Heilbrunn Center) 212-851-9509 (Heilbrunn Center) E-mail: REQUIRED COURSE MATERIAL Required reading throughout the term includes: 1. SEC filings related to companies we are studying, company call transcripts and other available data 2. Financial Publications (e.g. The Wall Street Journal, The Financial Times, Barron’s) 3. Additional articles assigned related to speakers or topics of interest as the semester progresses (will be distributed in class and/or via email) **There are no good textbooks for this course. We assume because you are in an advanced security analysis class at Columbia you have read at least parts of the following books: Greenwald et al, Graham and Dodd’s Security Analysis, Sixth Addition OR Cottle, Murray, and Block, Graham and Dodd’s Security Analysis, Fifth Addition Greenwald and Kahn, Competition Demystified, A Radically Simplified Approach to Business Strategy Security Analysis is a must read for anyone interested in value investing. REQUIRED PREREQUISITES AND CONNECTION TO THE CORE Prerequisite: Capital Markets The learning in this course will utilize, build on and extend concepts covered in the following core courses: Core Course Corporate Finance Page 1 of 3 Connection with Core 1. Cost of Capital 2. Valuation 3. Financing Options 4. Time value of money 5. 6. 7. 1. 2. 3. 1. 2. 3. 4. 5. 6. 7. 8. 1. 2. 3. 4. 5. 6. 7. 8. Opportunity cost (of capital) The Capital Asset Pricing Model (CAPM) Firm Valuation Model Financial Accounting The “accounting equation” Revenue and expense recognition Resources and obligations – measurement and disclosure Global Economic Risk Management Environment What is Gross Domestic Product and how is it measured? What causes inflation? What causes changes in exchange rates? What are the causes of business cycles? What are the effects of monetary policy? What are the effects of fiscal policy? What is the role of financial markets in the economy? Managerial Economics Barriers to entry Moats Maximization and thinking on the margin Analyzing complex decision-making under uncertainty Decision-based cost analysis Pricing with market power Market segmentation and other advanced pricing strategies Understanding market competition and equilibrium thinking (in the short-run) 9. Market equilibrium thinking (in the long-run) and barriers to entry 10. Strategic interaction among firms and Nash equilibrium Strategy Formulation 1. Trade-offs, value-added, efficiencies 2. Creation of value vs. value capture 3. Competing firms 4. Co-optition and Complementors 5. Strategic interaction analysis 6. Diversification and scope 7. Ethics & IBS 8. Behavioral and evidence-based strategy 9. Management Students will be expected to have mastered these concepts and be able to apply them in the course. COURSE DESCRIPTION & OBJECTIVES Our goal is to introduce students to the Graham and Dodd value investing framework in an organized manner by training them as if they were fund analysts. The purpose of the course is to help students develop and deliver compelling investment ideas, grounded in fundamental research. The course focuses on the practical application of theoretical concepts and we will spend significant portions of each class presenting, critiquing and refining investment recommendations. The ability to “pitch” a stock and convincingly argue that a company is undervalued by the market will be critical to landing a job in the industry and succeeding there. The class will be kept small to take advantage of the instructional method. Class discussions will be complemented by guest discussions from highly regarded investment professionals from the long only and hedge fund community. Page 2 of 3 ASSIGNMENTS Weekly assignments will consist of investment write-ups on one or more companies chosen by the instructors. Assignments will be due at a designated time before each session. There will be an assignment due before the first class on September 9th. The final presentation will consist of an investment write-up in addition to an oral presentation and Q&A session. METHOD OF EVALUATION Class Participation Weekly Assignments/Pitches Final Presentation 40% 30% 30% CLASSROOM NORMS AND EXPECTATIONS Class Participation: Class participation and peer reviews of investment presentations are essential to the success of the class. Please come prepared to discuss assignments. Attendance is mandatory and absences will adversely affect your overall grade. In order to respect the confidentiality of our guest speakers, classroom sessions will not be recorded. Final Company Pitch: In the second half of the course, students will be assigned a single company to research. They must prepare a detailed pitch for final submission and presentation to the professors as well as a panel of fund managers. Guest Speakers: This course will involve several buy-side guest lectures; class participation will be crucial to the success of the course. Page 3 of 3