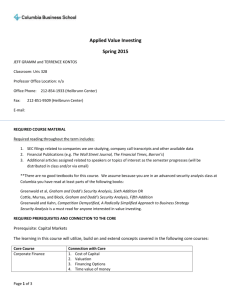

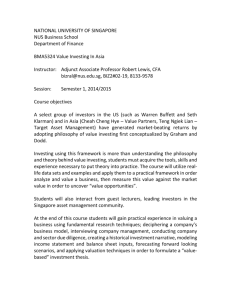

Syllabus

advertisement

Security Analysis Fall 2013 GUY SHANON Professor Office Location: Kingstown Capital Management Office Phone: Fax: 212-854-1933 (Heilbrunn Center) 212-851-9509 (Heilbrunn Center) E-mail: guy@kingstowncapital.com Class location: Kingstown Capital Management (100 Park Avenue, 21st Floor) TA: REQUIRED COURSE MATERIAL These books should be read in their entirety before the first day of class. This syllabus is being distributed in late June to allow you to have time to get this reading done. Be sure to start early. Security Analysis (Sixth Edition), Benjamin Graham and David Dodd* Value Investing From Graham to Buffett and Beyond, Bruce Greenwald, Judd Kahn, Paul Sonkin, Michael van Biema, The Little Book That Beats the Market, Joel Greenblatt Common Stocks Uncommon Profits, Kenneth Fisher *Security Analysis can be a bit tough to get through. Focus on the main sections and pace yourself – it’s hard to read this book quickly. Recommended Reading Distressed Debt Analysis, Stephen Moyer Fooled By Randomness, Nicholas Taleb Distress Investing: Principals & Techniques, Martin Whitman Analysis for Financial Management, Robert Higgins REQUIRED PREREQUISITES AND CONNECTION TO THE CORE Prerequisite: Capital Markets The learning in this course will utilize, build on and extend concepts covered in the following core courses: Page 1 of 7 Core Course Corporate Finance Connection with Core 1. Cost of Capital 2. Valuation 3. Financing Options 4. Time value of money 5. Opportunity cost (of capital) 6. The Capital Asset Pricing Model (CAPM) 7. Firm Valuation Model Financial Accounting 1. The “accounting equation” 2. Revenue and expense recognition 3. Resources and obligations – measurement and disclosure Global Economic 1. Risk Management Environment 2. What is Gross Domestic Product and how is it measured? 3. What causes inflation? 4. What causes changes in exchange rates? 5. What are the causes of business cycles? 6. What are the effects of monetary policy? 7. What are the effects of fiscal policy? 8. What is the role of financial markets in the economy? Managerial Economics 1. Barriers to entry 2. Moats 3. Maximization and thinking on the margin 4. Analyzing complex decision-making under uncertainty 5. Decision-based cost analysis 6. Pricing with market power 7. Market segmentation and other advanced pricing strategies 8. Understanding market competition and equilibrium thinking (in the short-run) 9. Market equilibrium thinking (in the long-run) and barriers to entry 10. Strategic interaction among firms and Nash equilibrium Strategy Formulation 1. Trade-offs, value-added, efficiencies 2. Creation of value vs. value capture 3. Competing firms 4. Co-optition and Complementors 5. Strategic interaction analysis 6. Diversification and scope 7. Ethics & IBS 8. Behavioral and evidence-based strategy 9. Management Students will be expected to have mastered these concepts and be able to apply them in the course. COURSE DESCRIPTION “An Investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.” – Security Analysis, Graham and Dodd Page 2 of 7 This course will use the sixth edition of Graham and Dodd’s Security Analysis as a framework for building up to a full appreciation of what the authors meant by this statement and ultimately a road map for a successful investing approach. We will explore: Financial Statement Analysis Valuation Methodologies Primary Research Behavioral Aspects of Investors and Security Markets Tips and Tools for The Research Process and “Pitching” Skills Consistent with the approach taken in Security Analysis, this course will examine both stocks and bonds, but will focus mostly on stocks. The above-mentioned areas will be addressed through a combination of short lectures that incorporate sections from Security Analysis, brief and full-blown case studies of companies to bring real-world meaning to the lecture concepts, guest lecturers, and group and individual assignments. Specifically, homework will be comprised of: Examples of companies and their financials (both dated and live) to reinforce concepts discussed in lecture for that week Two company case studies that are more fully developed than the above. These will comprise two class sessions towards the end of the course A final group project that students will begin to work on at the midpoint of the course, culminating in a presentation to the class at the end of the course COURSE OBJECTIVES This objective of this course is to introduce students to the field of security analysis and the kinds of things analysts consider and struggle with on a day-to-day basis. Successful investing is a lifetime pursuit that involves a commitment to constant learning and skills development. A good security analyst's investing approach is always being improved through on-the-job successes and failures and refinement of the investing process. This course is intended only as a starting off point for that journey – the rest is up to you. ASSIGNMENTS Short homework assignment based on lecture Final Group Project CLASSES 1&2 (September 3, September 10) Class Introduction History of value investing at CBS Guy Shanon/Kingstown backgrounds Introduction of students/what do students want to get out of the class? Class ground rules and expectations Page 3 of 7 Review road map of the course Market Efficiency and Value Investing – Backdrop For Security Analysis EMH o The basics o Are markets always efficient? o Grossman-Stiglitz paradox Markowitz mean/variance optimization Value Investing o Academic literature/empirical evidence o Margin of safety/capital preservation o Risk does not equal variance o Value vs. glamour multiples The Business Model How does this business make money/ what are the drivers? Break it down in simple terms, using common sense, then start asking questions Business “Quality” – Some Introductory Thoughts What does this really mean to the security analyst? Quick basics on competitive advantages and ROIC The price/quality continuum Screening For Ideas Using CapitalIQ, Bloomberg, other web-based resources Do’s/don’ts in screening CLASS 3 – September 17 Valuation Basics Triangulation o Public Comps o Private Comps o DCF o What’s good and what’s useless about this Emphasis on Cash Flow o Comparing cash flows from equities and bonds o Approaches to calculating free cash flow o Using EBITDA – Cap Ex as a yardstick Using Multiples Thoughtfully & Absolute Valuation o The market multiple o The Fed and Yardeni models o What return would you need to own the business in its entirety and have it be your family’s sold source of income? Page 4 of 7 o Justified multiples based on cash flow risk and growth o Operating income and cap rates o Which cash flow stream are we capitalizing? What Does Risk-Adjusted Return Mean? Return on Invested Capital How To Work On An Idea Be ruthless about your Return On Time Keep narrowing the issues Consensus vs. variant view SEC documents IR calls Staying organized and documentation Scuttlebutt research An investment memo example o Examples of good ones/templates CLASS 4 – September 24 The Primacy of The Balance Sheet What does it tell us & why is it so important? o Book value, tangible book value o Retained earnings o Financial leverage Common analytical areas, e.g., o Inventory LIFO/FIFO o Deferred revenue o Pension accounting o PP&E Cost vs. market o Deferred tax assets and liabilities o Working capital analysis o Intangible assets o Read the footnotes… Liquidation Analysis Capitalization o Building the cap table used in distressed debt analysis Book value multiples revisited CLASS 5 – October 1 The Income Statement Accrual vs. cash accounting EPS vs. cash earnings/quality of earnings Margins Accounting for minority interests Page 5 of 7 The Cash Flow Statement Breaking down the components Common sources of confusion CLASS 6 – October 8 Behavioral Finance Traditional vs. behavioral finance o Rational utility maximizer vs. Satisficer o Risk aversion vs. loss aversion Common Behavioral/Cognitive Biases o Anchoring and framing bias o Recency bias o Confirmation bias o Herding o Institutional biases on Wall Street o Agency biases Applying These Concepts As A Security Analyst Class 7 –October 22 Competitive Advantages Greenwaldian vs. Porter’s Five Forces Business “Quality” Considerations Revisited Evaluating Management Class 8 – October 29 Primary Research What to focus on How to obtain and organize information Separating the signal from the noise Class 9 – November 12 Pitching Skills What makes a successful pitch? o Key components o Tips for keeping it short and impactful o Coping with questions and interruptions Class 10 – November 19 Case Study #1 Class 11 – November 26 Page 6 of 7 Case Study #2 Class 12 – December 3 Final Project Pitches METHOD OF EVALUATION Class Participation 25% Homework Assignments Final Group Project 25% 50% Grades will reflect knowledge and application of the course material and communication skills. This course is intended to be interactive and class participation will be crucial to the success of this class. CLASSROOM NORMS AND EXPECTATIONS This course is being taught at the offices of Kingstown Capital, 100 Park Avenue (@ 40th Street). Class begins promptly at 2:15pm. Trains are often late, midtown is usually congested, rain and snow slow everything down – these are all things you should consider in building a margin of safety into the amount of time you budget to get to the office from campus. Anyone not in the conference room 5 minutes after the class start time will not be admitted. Each week one student will act as class secretary. Duties include taking assiduous notes during class, cleaning them up shortly thereafter and then distributing to the class, and also coordinating submission of homework assignments via email to the teaching assistant and professor. Any type of recording of the class is absolutely NOT permitted without prior approval. If you are going to miss a class you must provide notice in advance. This will be a small class of 13 students – every person counts, and there are no free riders. Students are expected to come to class prepared and ready to field cold-call questions. Page 7 of 7