Lecture 6 - Investment appraisal methods (III)

advertisement

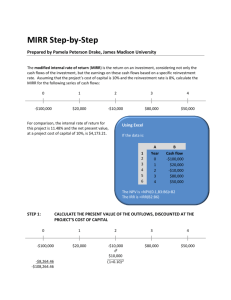

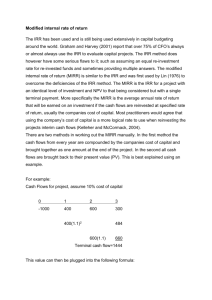

EPJ3760 Construction Investments Lecture 6: October 2013 6.1 Internal Rate of Return 6.1 Internal Rate of Return Internal Rate of Return (IRR) (The discount rate which equates the present value of the future net cash flows with the initial investment.) That is: • the discount rate which makes NPV = 0 • the maximum interest rate at which you would borrow to finance the project Decision Rules • Accept projects with IRR ≥ MARR (minimum acceptable rate of return) • Reject projects with IRR < MARR Calculation n where 1 Initial cash outlay (time 0) Solve for IRR by: • Trial and error • Other calculators (e.g. Excel function, financial tables) 2 • Considers the time value of money • Consistent with shareholder wealth maximisation • Intuitive appeal (rate feels better than absolute number because it is readily comparable with other rates) • Doesn’t require advance specification of the discount rate Discounted cumulative cash flow (discount rate = 21,86% = IRR) -10000 -10000 -10000 Year 1 4000 -6363,6 -6717,61 Year 2 4000 -3057,9 -4024,08 Year 3 4000 -52,6 Year 4 4000 2679,5 -1813,77 0 Disadvantages 3 6.2 Modified IRR Modified Internal Rate of Return (MIRR) (The discount rate which equates the present value of the cash outflows (calculated on the basis of the finance rate or MARR) with the present value of the project’s terminal value. Where the terminal value is the sum of the future values of the project’s cash inflows compounded to the project’s termination (at the reinvestment rate or MARR). ) Decision Rules • Accept projects with MIRR ≥ MARR • Reject projects with MIRR < MARR • Where two projects are mutually exclusive, do not rank on MIRR values, accept the one with the higher NPV. Emlyn Witt IO = the initial cash investment ACFt = Annual net cash flow in time period t IRR = the internal rate of return t = the projects expected life 6.1 Internal Rate of Return For example, if an initial investment of 10000 produces net cash flows of 4000 for 4 years, the IRR of this investment is: Discounted cumulative cash flow (discount rate = 10%) ACFt (1 + IRR)t Benefits of using IRR Calculation Net cash flows Σ t=1 6.1 Internal Rate of Return Time = IO • Reinvestment rate assumption (i.e. cash inflows are reinvested at the IRR) may be unreasonable • Multiple IRRs possible where sign reversals occur in cash flow • Requires detailed cash flow predictions over the entire life of the project. • Only as accurate as the cash flow predictions. • When scale differences exist, there can be a ranking conflict with the NPV method. 4 6.2 Modified IRR Calculation PVoutflows = PVinflows n n Σ t=0 ACOFt (1 + k)t where 5 = Σ ACIFt (1 + k)n-t t=0 (1 + MIRR)n TV = (1 + MIRR)n ACIFt = Annual net cash inflow in time period t ACOFt = Annual net cash outflow in time period t TV = the Terminal Value of all the cash inflows compounded at the discount rate k = the appropriate discount rate MIRR = the Modified Internal Rate of Return n = the project’s expected life 6 1 EPJ3760 Construction Investments Lecture 6: October 2013 6.2 Modified IRR 6.2 Modified IRR Calculation Calculation For example, if an initial investment of 10000 produces net cash flows of 4000 for 4 years and the discount rate is taken as 10%, the MIRR of this investment is: Time Net cash flows Initial cash outlay (time 0) PVoutflows -10000 Step 1 (previous slide): calculate PVoutflows TV (of inflows) Step 2 (previous slide): calculate TV of inflows (Step 1) 10000 Year 1 4000 5324 Year 2 4000 4840 Year 3 4000 4400 Year 4 4000 4000 Total Step 3: PVoutflows = TV (1 + MIRR)n 18564 10000 = (1 + MIRR)4 (Step 2) 18564 7 MIRR = 16,7% 8 6.2 Modified IRR Benefits of using MIRR • Considers the time value of money • Consistent with shareholder wealth maximisation • Intuitive appeal (rate feels better than absolute number because it is readily comparable with other rates) • Overcomes the reinvestment rate problem of IRR by allowing the reinvestment rate to be specified. Disadvantages • Requires detailed cash flow predictions over the entire life of the project. • Only as accurate as the cash flow and reinvestment rate predictions. • When scale differences exist, there can still be a ranking conflict with the NPV method. • Multiple MIRRs possible where sign reversals occur in cash flow. Emlyn Witt 9 2