Exam II Topical Review

advertisement

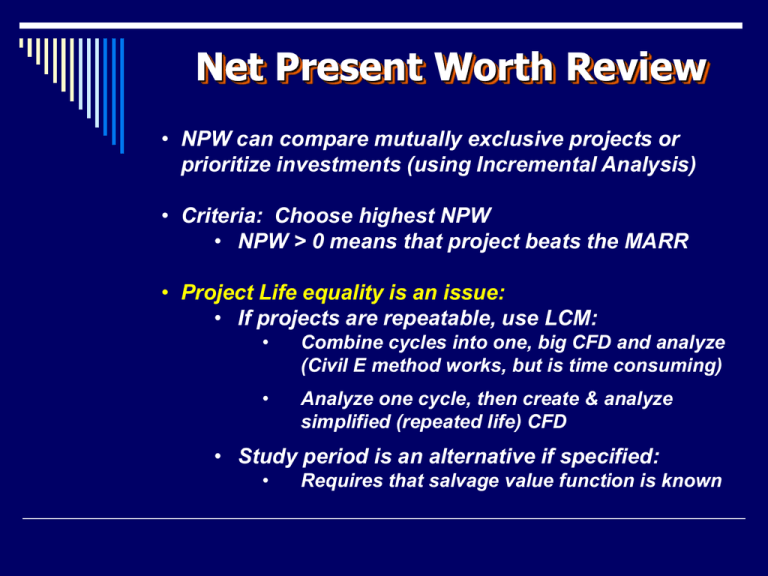

Net Present Worth Review • NPW can compare mutually exclusive projects or prioritize investments (using Incremental Analysis) • Criteria: Choose highest NPW • NPW > 0 means that project beats the MARR • Project Life equality is an issue: • If projects are repeatable, use LCM: • Combine cycles into one, big CFD and analyze (Civil E method works, but is time consuming) • Analyze one cycle, then create & analyze simplified (repeated life) CFD • Study period is an alternative if specified: • Requires that salvage value function is known Equivalent Annual Worth Review • EAW can compare mutually exclusive projects or prioritize investments (using Incremental Analysis) • Criteria: Choose highest EAW (lowest EAC) • EAW > 0 means that project beats the MARR • Project Life equality is NOT an issue: • Compare on same payment frequency, though: • Move non-annual flows to present / future, then annualize (NOT average!) over project life • Can use Opportunity Cost formulation to simplify capital equipment: (P – S)(A/P,i,n) – S(i) • IMPORTANT: • Land does not change in value (pt in 3-D space) Perpetuity Review • Perpetuity (Capitalized Cost) is used to fund projects that will “last forever” • Relationship: can live off of the period’s interest, but can’t touch account principle: A = P(i) • Steps: • Separate non-recurring cash flows from the recurring flows, then calculate CCNR: • Find net present value of all non-recurring flows • For all the recurring flows, calculate CCR: • Find annual equivalent of one cycle of each recurring flow, then combine to find net annual • Use perpetuity relationship to find present value of the net annual equivalent • Total capitalized cost is: CCT = CCNR + CCR Bonds Review • Bonds are used to acquire start-up capital early on, but wait to pay back the bulk of the borrowing until the production cash flow is realized (interest-only loan) • Basically reusing two concepts: • Solving CFD and finding Effective Interest Rates • Use Bond Cash Flow Diagram to solve: • • • • • Translate Bond Terminology to CFD Find ib and Dividend to flesh out the CFD Solve CFD for unknown Price / Yield to Maturity Yield to Maturity is i*, such that NPWBOND CFD = 0 Annual Yield: ia = (1 + i)m – 1 • Watch for Sunk Costs Trick: • Only worry about remaining cash flows! CFD with Bond Terms… ib = Coupon Rate Dividend Periods / Yr Dividend = (Face Value) (ib) – or – Face Value Coupon Rate Dividend Periods / Yr Face Value Yield Rate = ia = (1+ ib) m – 1 Dividend 0 1 2 3 n periods (to Maturity Date) Bond Price Yield to Maturity = i* such that NPW = 0 5 Internal Rate of Return Review • IRR can compare mutually exclusive projects or prioritize investments - MUST USE Incremental Analysis • Criteria: Choose IRR that is greater than MARR • IRR > 0 means that project makes money, but not necessarily better than the safe investment rate • Concepts: • IRR is the interest rate (i*), such that NPW = 0 • Note: Can only have one sign change in net CFD, otherwise there are multiple IRRs! • Strategies: • If only one table factor in CFD equation, solve for it and use tables to find approximate IRR • If more than one table factor involved, use divide & conquer to find approximate IRR using tables • Use spreadsheet and P/F or P/A factors if large problem Incremental Analysis Review • Incremental Analysis can be used to prioritize investments (using NPW, EAW, or even NFW), but it MUST be used when comparing relative measures (IRR or Cost/Benefit Ratio) • Caution: Equal lifetime issues (NPW and IRR) • Steps: • Order projects by increasing first costs • Find first feasible project becomes current best • • Compare with Doing Nothing if that is an option If a Revenue Project, IRR > MARR (worth > 0) • Pairwise Comparison on Incremental Cash Flow • • • Compare feasible options, & compare in–order! If > 0 (IRR > MARR), then higher cost is better If ≤ 0 (IRR ≤ MARR), then lower cost is better Incremental Analysis Review • Incremental Analysis comparison is like a single playoff tournament: • Seed the contenders on first costs, larger cost get byes • Only have to win incremental game to move on • Worthincr> $0 or if IRRincr > MARR higher cost wins • Worthincr ≤ $0 or if IRRincr ≤ MARR current best wins • Last one unbeaten is best choice • Start over with beaten contenders to find next best, etc. Do Nothing Low $ Contender Mid $ Contender High $ Contender