file pdf - Borsa Italiana

advertisement

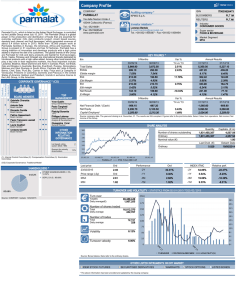

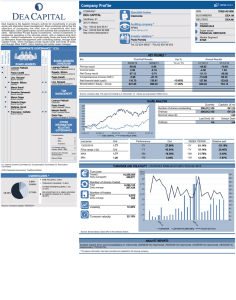

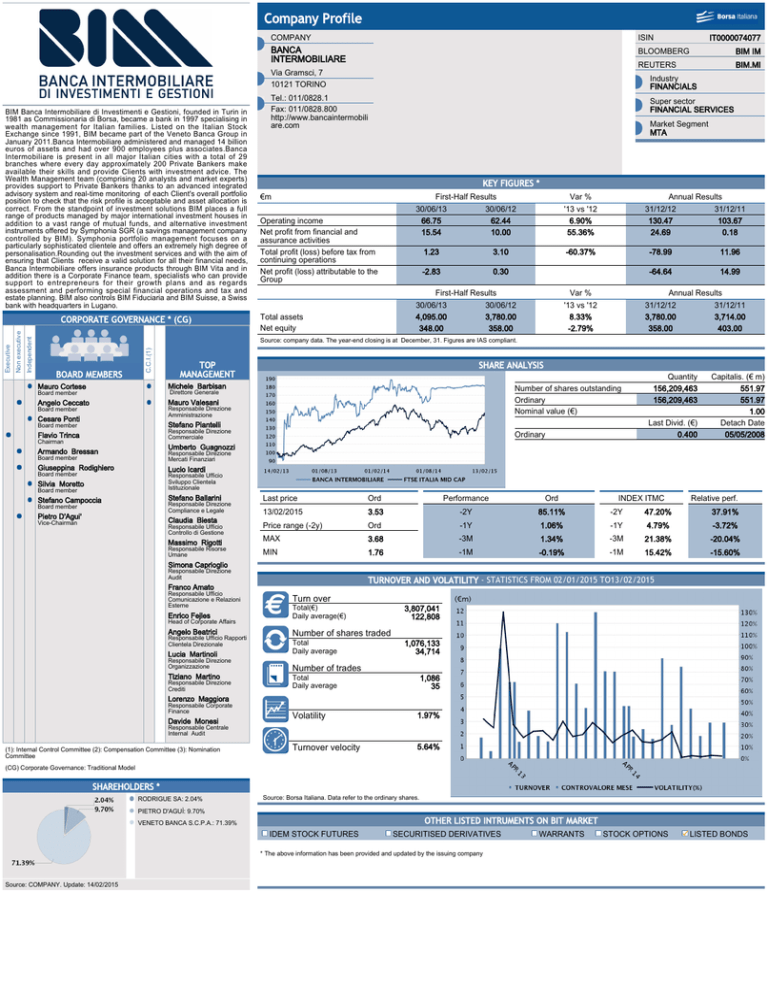

Company Profile COMPANY ISIN BANCA INTERMOBILIARE BLOOMBERG BIM IM REUTERS BIM.MI Via Gramsci, 7 10121 TORINO BIM Banca Intermobiliare di Investimenti e Gestioni, founded in Turin in 1981 as Commissionaria di Borsa, became a bank in 1997 specialising in wealth management for Italian families. Listed on the Italian Stock Exchange since 1991, BIM became part of the Veneto Banca Group in January 2011.Banca Intermobiliare administered and managed 14 billion euros of assets and had over 900 employees plus associates.Banca Intermobiliare is present in all major Italian cities with a total of 29 branches where every day approximately 200 Private Bankers make available their skills and provide Clients with investment advice. The Wealth Management team (comprising 20 analysts and market experts) provides support to Private Bankers thanks to an advanced integrated advisory system and real-time monitoring of each Client's overall portfolio position to check that the risk profile is acceptable and asset allocation is correct. From the standpoint of investment solutions BIM places a full range of products managed by major international investment houses in addition to a vast range of mutual funds, and alternative investment instruments offered by Symphonia SGR (a savings management company controlled by BIM). Symphonia portfolio management focuses on a particularly sophisticated clientele and offers an extremely high degree of personalisation.Rounding out the investment services and with the aim of ensuring that Clients receive a valid solution for all their financial needs, Banca Intermobiliare offers insurance products through BIM Vita and in addition there is a Corporate Finance team, specialists who can provide support to entrepreneurs for their growth plans and as regards assessment and performing special financial operations and tax and estate planning. BIM also controls BIM Fiduciaria and BIM Suisse, a Swiss bank with headquarters in Lugano. Industry FINANCIALS Tel.: 011/0828.1 Fax: 011/0828.800 http://www.bancaintermobili are.com Super sector FINANCIAL SERVICES Market Segment MTA KEY FIGURES * €m Operating income Net profit from financial and assurance activities Total profit (loss) before tax from continuing operations Net profit (loss) attributable to the Group First-Half Results 30/06/13 30/06/12 66.75 62.44 15.54 10.00 1.23 3.10 -2.83 0.30 Var % '13 vs '12 6.90% 55.36% -60.37% First-Half Results 30/06/13 30/06/12 4,095.00 3,780.00 348.00 358.00 Total assets Net equity Annual Results 31/12/12 31/12/11 130.47 103.67 24.69 0.18 Var % '13 vs '12 8.33% -2.79% -78.99 11.96 -64.64 14.99 Annual Results 31/12/12 31/12/11 3,780.00 3,714.00 358.00 403.00 Source: company data. The year-end closing is at December, 31. Figures are IAS compliant. BOARD MEMBERS C.C.I.(1) Independent Non executive Executive CORPORATE GOVERNANCE * (CG) IT0000074077 TOP MANAGEMENT SHARE ANALYSIS Michele Barbisan Mauro Cortese Board member Direttore Generale Angelo Ceccato Mauro Valesani Number of shares outstanding Ordinary Nominal value (€) Responsabile Direzione Amministrazione Board member Cesare Ponti Board member Stefano Piantelli Flavio Trinca Responsabile Direzione Commerciale Chairman Quantity 156,209,463 156,209,463 Last Divid. (€) 0.400 Ordinary Capitalis. (€ m) 551.97 551.97 1.00 Detach Date 05/05/2008 Umberto Guagnozzi Armando Bressan Board member Responsabile Direzione Mercati Finanziari Giuseppina Rodighiero Lucio Icardi Board member Board member Responsabile Ufficio Sviluppo Clientela Istituzionale Stefano Campoccia Stefano Ballarini Silvia Moretto Responsabile Direzione Compliance e Legale Board member Pietro D'Agui' Claudia Biesta Vice-Chairman Responsabile Ufficio Controllo di Gestione Massimo Rigotti Responsabile Risorse Umane Last price Ord Performance Ord 13/02/2015 3.53 -2Y 85.11% -2Y INDEX ITMC 47.20% Relative perf. Price range (-2y) Ord -1Y 1.06% -1Y 4.79% -3.72% MAX 3.68 -3M 1.34% -3M 21.38% -20.04% MIN 1.76 -1M -0.19% -1M 15.42% -15.60% 37.91% Simona Caprioglio Responsabile Direzione Audit TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO13/02/2015 Franco Amato Responsabile Ufficio Comunicazione e Relazioni Esterne Enrico Fejles Head of Corporate Affairs Angelo Beatrici Responsabile Ufficio Rapporti Clientela Direzionale Lucia Martinoli Responsabile Direzione Organizzazione Tiziano Martino Responsabile Direzione Crediti Lorenzo Maggiora Responsabile Corporate Finance Davide Monesi Responsabile Centrale Internal Audit (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee Turn over Total(€) Daily average(€) 3,807,041 122,808 Number of shares traded Total Daily average 1,076,133 34,714 Number of trades Total Daily average 1,086 35 A Volatility 1.97% A Turnover velocity 5.64% (CG) Corporate Governance: Traditional Model SHAREHOLDERS * RODRIGUE SA: 2.04% Source: Borsa Italiana. Data refer to the ordinary shares. PIETRO D'AGUÌ: 9.70% OTHER LISTED INTRUMENTS ON BIT MARKET VENETO BANCA S.C.P.A.: 71.39% IDEM STOCK FUTURES SECURITISED DERIVATIVES * The above information has been provided and updated by the issuing company Source: COMPANY. Update: 14/02/2015 WARRANTS STOCK OPTIONS LISTED BONDS