file pdf - Borsa Italiana

advertisement

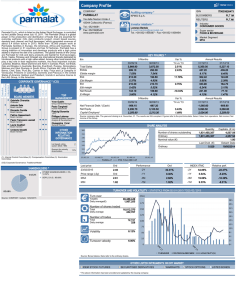

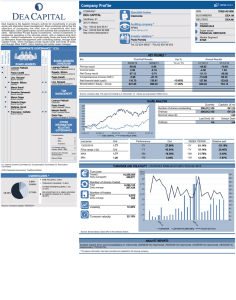

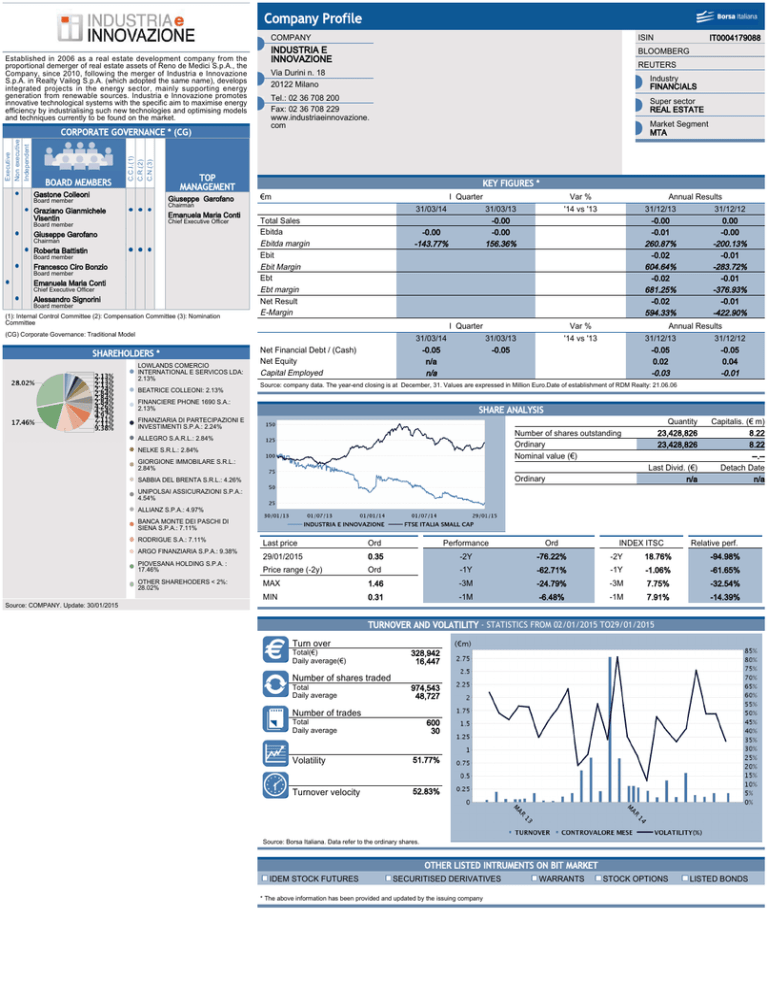

Company Profile Established in 2006 as a real estate development company from the proportional demerger of real estate assets of Reno de Medici S.p.A., the Company, since 2010, following the merger of Industria e Innovazione S.p.A. in Realty Vailog S.p.A. (which adopted the same name), develops integrated projects in the energy sector, mainly supporting energy generation from renewable sources. Industria e Innovazione promotes innovative technological systems with the specific aim to maximise energy efficiency by industrialising such new technologies and optimising models and techniques currently to be found on the market. BOARD MEMBERS C.C.I.(1) C.R.(2) C.N.(3) Executive Non executive Independent CORPORATE GOVERNANCE * (CG) Gastone Colleoni ISIN INDUSTRIA E INNOVAZIONE BLOOMBERG Industry FINANCIALS Tel.: 02 36 708 200 Fax: 02 36 708 229 www.industriaeinnovazione. com Emanuela Maria Conti Chief Executive Officer Board member Super sector REAL ESTATE Market Segment MTA KEY FIGURES * €m I Quarter Chairman Graziano Gianmichele Visentin Giuseppe Garofano Chairman Roberta Battistin Board member Francesco Ciro Bonzio Board member Emanuela Maria Conti Chief Executive Officer Alessandro Signorini Board member (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee 31/03/14 Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin LOWLANDS COMERCIO INTERNATIONAL E SERVICOS LDA: 2.13% BEATRICE COLLEONI: 2.13% 31/03/13 -0.00 -0.00 156.36% -0.00 -143.77% I Quarter (CG) Corporate Governance: Traditional Model SHAREHOLDERS * IT0004179088 REUTERS Via Durini n. 18 20122 Milano TOP MANAGEMENT Giuseppe Garofano Board member COMPANY 31/03/14 -0.05 n/a n/a Net Financial Debt / (Cash) Net Equity Capital Employed 31/03/13 -0.05 Var % '14 vs '13 Annual Results 31/12/13 31/12/12 -0.00 0.00 -0.01 -0.00 260.87% -200.13% -0.02 -0.01 604.64% -283.72% -0.02 -0.01 681.25% -376.93% -0.02 -0.01 594.33% -422.90% Var % '14 vs '13 Annual Results 31/12/13 31/12/12 -0.05 -0.05 0.02 0.04 -0.03 -0.01 Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro.Date of establishment of RDM Realty: 21.06.06 FINANCIERE PHONE 1690 S.A.: 2.13% SHARE ANALYSIS FINANZIARIA DI PARTECIPAZIONI E INVESTIMENTI S.P.A.: 2.24% Quantity 23,428,826 23,428,826 Number of shares outstanding Ordinary Nominal value (€) ALLEGRO S.A.R.L.: 2.84% NELKE S.R.L.: 2.84% GIORGIONE IMMOBILARE S.R.L.: 2.84% Last Divid. (€) n/a Ordinary SABBIA DEL BRENTA S.R.L.: 4.26% Capitalis. (€ m) 8.22 8.22 --.-Detach Date n/a UNIPOLSAI ASSICURAZIONI S.P.A.: 4.54% ALLIANZ S.P.A.: 4.97% BANCA MONTE DEI PASCHI DI SIENA S.P.A.: 7.11% RODRIGUE S.A.: 7.11% ARGO FINANZIARIA S.P.A.: 9.38% PIOVESANA HOLDING S.P.A. : 17.46% OTHER SHAREHODERS < 2%: 28.02% Last price Ord Performance Ord 29/01/2015 0.35 -2Y -76.22% -2Y INDEX ITSC 18.76% Relative perf. -94.98% Price range (-2y) Ord -1Y -62.71% -1Y -1.06% -61.65% MAX 1.46 -3M -24.79% -3M 7.75% -32.54% MIN 0.31 -1M -6.48% -1M 7.91% -14.39% Source: COMPANY. Update: 30/01/2015 TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO29/01/2015 Turn over Total(€) Daily average(€) 328,942 16,447 Number of shares traded Total Daily average 974,543 48,727 Number of trades Total Daily average 600 30 A Volatility 51.77% A Turnover velocity 52.83% Source: Borsa Italiana. Data refer to the ordinary shares. OTHER LISTED INTRUMENTS ON BIT MARKET IDEM STOCK FUTURES SECURITISED DERIVATIVES * The above information has been provided and updated by the issuing company WARRANTS STOCK OPTIONS LISTED BONDS