file pdf - Borsa Italiana

advertisement

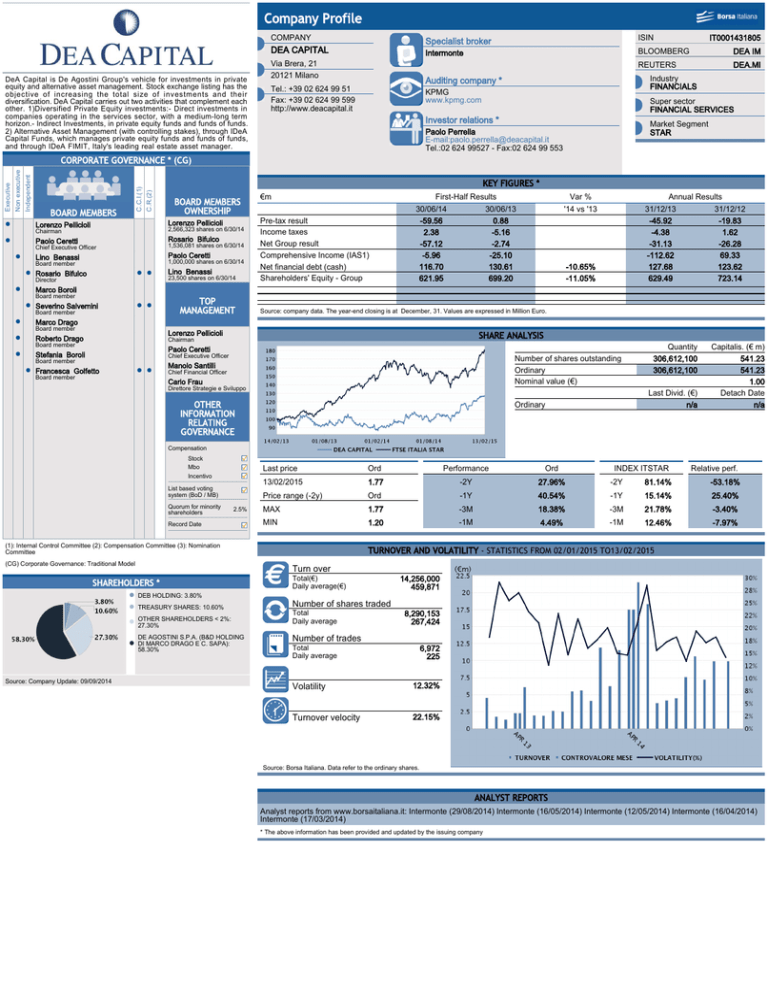

Company Profile DeA Capital is De Agostini Group's vehicle for investments in private equity and alternative asset management. Stock exchange listing has the objective of increasing the total size of investments and their diversification. DeA Capital carries out two activities that complement each other. 1)Diversified Private Equity investments:- Direct investments in companies operating in the services sector, with a medium-long term horizon.- Indirect Investments, in private equity funds and funds of funds. 2) Alternative Asset Management (with controlling stakes), through IDeA Capital Funds, which manages private equity funds and funds of funds, and through IDeA FIMIT, Italy's leading real estate asset manager. COMPANY Specialist broker ISIN DEA CAPITAL Intermonte BLOOMBERG DEA IM REUTERS DEA.MI Via Brera, 21 20121 Milano Industry FINANCIALS Auditing company * Tel.: +39 02 624 99 51 Fax: +39 02 624 99 599 http://www.deacapital.it IT0001431805 KPMG www.kpmg.com Super sector FINANCIAL SERVICES Investor relations * Market Segment STAR Paolo Perrella E-mail:paolo.perrella@deacapital.it Tel.:02 624 99527 - Fax:02 624 99 553 KEY FIGURES * C.R.(2) BOARD MEMBERS C.C.I.(1) Independent Non executive Executive CORPORATE GOVERNANCE * (CG) BOARD MEMBERS OWNERSHIP Lorenzo Pellicioli Lorenzo Pellicioli Chairman 2,566,323 shares on 6/30/14 Paolo Ceretti Rosario Bifulco Chief Executive Officer 1,536,081 shares on 6/30/14 Lino Benassi Paolo Ceretti Board member 1,000,000 shares on 6/30/14 Rosario Bifulco Lino Benassi 23,500 shares on 6/30/14 Director €m Pre-tax result Income taxes Net Group result Comprehensive Income (IAS1) Net financial debt (cash) Shareholders' Equity - Group First-Half Results 30/06/14 30/06/13 -59.56 0.88 2.38 -5.16 -57.12 -2.74 -5.96 -25.10 116.70 130.61 621.95 699.20 Var % '14 vs '13 Annual Results 31/12/13 31/12/12 -45.92 -19.83 -4.38 1.62 -31.13 -26.28 -112.62 69.33 127.68 123.62 629.49 723.14 -10.65% -11.05% Marco Boroli Board member TOP MANAGEMENT Severino Salvemini Board member Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro. Marco Drago Board member Lorenzo Pellicioli Roberto Drago SHARE ANALYSIS Chairman Board member Paolo Ceretti Stefania Boroli Chief Executive Officer Board member Number of shares outstanding Ordinary Nominal value (€) Manolo Santilli Francesca Golfetto Chief Financial Officer Board member Carlo Frau Direttore Strategie e Sviluppo OTHER INFORMATION RELATING GOVERNANCE Quantity 306,612,100 306,612,100 Last Divid. (€) n/a Ordinary Capitalis. (€ m) 541.23 541.23 1.00 Detach Date n/a Compensation Stock Mbo Incentivo List based voting system (BoD / MB) Quorum for minority shareholders 2.5% Record Date Last price Ord Performance Ord 13/02/2015 1.77 -2Y 27.96% -2Y 81.14% -53.18% Price range (-2y) Ord -1Y 40.54% -1Y 15.14% 25.40% MAX 1.77 -3M 18.38% -3M 21.78% -3.40% MIN 1.20 -1M 4.49% -1M 12.46% -7.97% (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model INDEX ITSTAR Relative perf. TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO13/02/2015 Turn over SHAREHOLDERS * Total(€) Daily average(€) 14,256,000 459,871 DEB HOLDING: 3.80% TREASURY SHARES: 10.60% OTHER SHAREHOLDERS < 2%: 27.30% DE AGOSTINI S.P.A. (B&D HOLDING DI MARCO DRAGO E C. SAPA): 58.30% Source: Company Update: 09/09/2014 Number of shares traded Total Daily average 8,290,153 267,424 Number of trades Total Daily average 6,972 225 A Volatility 12.32% A Turnover velocity 22.15% Source: Borsa Italiana. Data refer to the ordinary shares. ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Intermonte (29/08/2014) Intermonte (16/05/2014) Intermonte (12/05/2014) Intermonte (16/04/2014) Intermonte (17/03/2014) * The above information has been provided and updated by the issuing company