file pdf - Borsa Italiana

advertisement

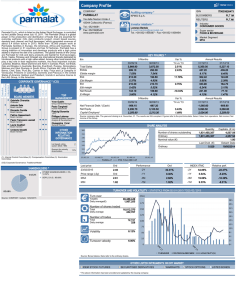

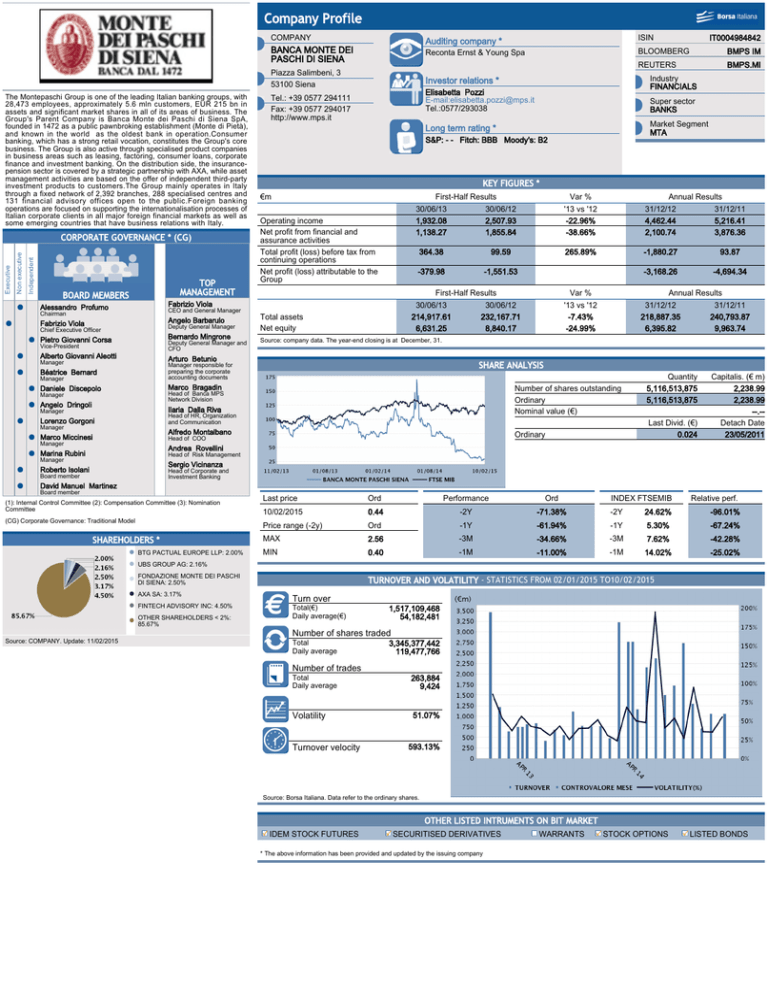

Company Profile The Montepaschi Group is one of the leading Italian banking groups, with 28,473 employees, approximately 5.6 mln customers, EUR 215 bn in assets and significant market shares in all of its areas of business. The Group's Parent Company is Banca Monte dei Paschi di Siena SpA, founded in 1472 as a public pawnbroking establishment (Monte di Pietà), and known in the world as the oldest bank in operation.Consumer banking, which has a strong retail vocation, constitutes the Group's core business. The Group is also active through specialised product companies in business areas such as leasing, factoring, consumer loans, corporate finance and investment banking. On the distribution side, the insurancepension sector is covered by a strategic partnership with AXA, while asset management activities are based on the offer of independent third-party investment products to customers.The Group mainly operates in Italy through a fixed network of 2,392 branches, 288 specialised centres and 131 financial advisory offices open to the public.Foreign banking operations are focused on supporting the internationalisation processes of Italian corporate clients in all major foreign financial markets as well as some emerging countries that have business relations with Italy. Independent Non executive Executive CORPORATE GOVERNANCE * (CG) TOP MANAGEMENT BOARD MEMBERS COMPANY Auditing company * ISIN BANCA MONTE DEI PASCHI DI SIENA Reconta Ernst & Young Spa BLOOMBERG BMPS IM REUTERS BMPS.MI Piazza Salimbeni, 3 53100 Siena Investor relations * CEO and General Manager Chairman Angelo Barbarulo Fabrizio Viola Deputy General Manager Chief Executive Officer Bernardo Mingrone Pietro Giovanni Corsa Vice-President Deputy General Manager and CFO Alberto Giovanni Aleotti Arturo Betunio Manager Manager Manager responsible for preparing the corporate accounting documents Daniele Discepolo Marco Bragadin Béatrice Bernard Angelo Dringoli KEY FIGURES * €m First-Half Results 30/06/13 30/06/12 1,932.08 2,507.93 1,138.27 1,855.84 Operating income Net profit from financial and assurance activities Total profit (loss) before tax from continuing operations Net profit (loss) attributable to the Group 364.38 99.59 -379.98 -1,551.53 First-Half Results 30/06/13 30/06/12 214,917.61 232,167.71 6,631.25 8,840.17 Total assets Net equity Manager -1,880.27 93.87 -3,168.26 -4,694.34 Var % '13 vs '12 -7.43% -24.99% Annual Results 31/12/12 31/12/11 218,887.35 240,793.87 6,395.82 9,963.74 Quantity 5,116,513,875 5,116,513,875 Last Divid. (€) 0.024 Ordinary Head of COO Manager 265.89% Number of shares outstanding Ordinary Nominal value (€) Alfredo Montalbano Marco Miccinesi Annual Results 31/12/12 31/12/11 4,462.44 5,216.41 2,100.74 3,876.36 SHARE ANALYSIS Head of HR, Organization and Communication Lorenzo Gorgoni Var % '13 vs '12 -22.96% -38.66% Source: company data. The year-end closing is at December, 31. Ilaria Dalla Riva Manager Market Segment MTA S&P: - - Fitch: BBB Moody's: B2 Head of Banca MPS Network Division Manager Super sector BANKS Long term rating * Fabrizio Viola Alessandro Profumo Industry FINANCIALS Elisabetta Pozzi E-mail:elisabetta.pozzi@mps.it Tel.:0577/293038 Tel.: +39 0577 294111 Fax: +39 0577 294017 http://www.mps.it IT0004984842 Capitalis. (€ m) 2,238.99 2,238.99 --.-Detach Date 23/05/2011 Andrea Rovellini Marina Rubini Head of Risk Management Manager Sergio Vicinanza Roberto Isolani Head of Corporate and Investment Banking Board member David Manuel Martinez Board member (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model SHAREHOLDERS * BTG PACTUAL EUROPE LLP: 2.00% Last price Ord Performance Ord 10/02/2015 0.44 -2Y -71.38% -2Y INDEX FTSEMIB 24.62% Relative perf. -96.01% Price range (-2y) Ord -1Y -61.94% -1Y 5.30% -67.24% MAX 2.56 -3M -34.66% -3M 7.62% -42.28% MIN 0.40 -1M -11.00% -1M 14.02% -25.02% UBS GROUP AG: 2.16% FONDAZIONE MONTE DEI PASCHI DI SIENA: 2.50% AXA SA: 3.17% FINTECH ADVISORY INC: 4.50% OTHER SHAREHOLDERS < 2%: 85.67% TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO10/02/2015 Turn over Total(€) Daily average(€) 1,517,109,468 54,182,481 Number of shares traded Source: COMPANY. Update: 11/02/2015 Total Daily average 3,345,377,442 119,477,766 Number of trades Total Daily average 263,884 9,424 A Volatility 51.07% A Turnover velocity 593.13% Source: Borsa Italiana. Data refer to the ordinary shares. OTHER LISTED INTRUMENTS ON BIT MARKET IDEM STOCK FUTURES SECURITISED DERIVATIVES * The above information has been provided and updated by the issuing company WARRANTS STOCK OPTIONS LISTED BONDS