file pdf - Borsa Italiana

advertisement

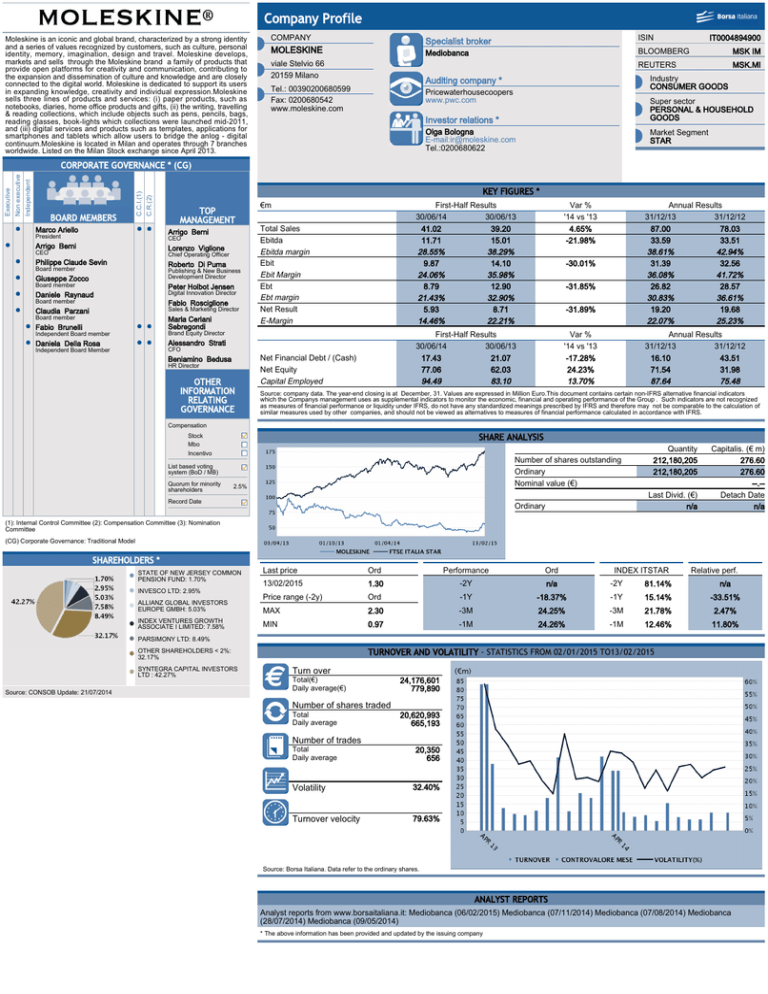

Company Profile Moleskine is an iconic and global brand, characterized by a strong identity and a series of values recognized by customers, such as culture, personal identity, memory, imagination, design and travel. Moleskine develops, markets and sells through the Moleskine brand a family of products that provide open platforms for creativity and communication, contributing to the expansion and dissemination of culture and knowledge and are closely connected to the digital world. Moleskine is dedicated to support its users in expanding knowledge, creativity and individual expression.Moleskine sells three lines of products and services: (i) paper products, such as notebooks, diaries, home office products and gifts, (ii) the writing, travelling & reading collections, which include objects such as pens, pencils, bags, reading glasses, book-lights which collections were launched mid-2011, and (iii) digital services and products such as templates, applications for smartphones and tablets which allow users to bridge the anlog - digital continuum.Moleskine is located in Milan and operates through 7 branches worldwide. Listed on the Milan Stock exchange since April 2013. COMPANY Specialist broker ISIN MOLESKINE Mediobanca BLOOMBERG MSK IM REUTERS MSK.MI viale Stelvio 66 20159 Milano Industry CONSUMER GOODS Auditing company * Tel.: 00390200680599 Fax: 0200680542 www.moleskine.com IT0004894900 Pricewaterhousecoopers www.pwc.com Super sector PERSONAL & HOUSEHOLD GOODS Investor relations * Olga Bologna E-mail:ir@moleskine.com Tel.:0200680622 Market Segment STAR C.R.(2) BOARD MEMBERS C.C.I.(1) Independent Non executive Executive CORPORATE GOVERNANCE * (CG) Marco Ariello KEY FIGURES * TOP MANAGEMENT Arrigo Berni President CEO Arrigo Berni Lorenzo Viglione CEO Chief Operating Officer Philippe Claude Sevin Roberto Di Puma Board member Giuseppe Zocco Publishing & New Business Development Director Board member Peter Holbot Jensen Daniele Raynaud Digital Innovation Director Board member Fabio Rosciglione Claudia Parzani Sales & Marketing Director Board member Maria Ceriani Sebregondi Fabio Brunelli Independent Board member Brand Equity Director Daniela Della Rosa Alessandro Strati €m Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin First-Half Results 30/06/14 30/06/13 41.02 39.20 11.71 15.01 28.55% 38.29% 9.87 14.10 24.06% 35.98% 8.79 12.90 21.43% 32.90% 5.93 8.71 14.46% 22.21% Var % '14 vs '13 4.65% -21.98% Net Financial Debt / (Cash) Net Equity Capital Employed First-Half Results 30/06/14 30/06/13 17.43 21.07 77.06 62.03 94.49 83.10 Var % '14 vs '13 -17.28% 24.23% 13.70% CFO Independent Board Member Beniamino Bedusa HR Director OTHER INFORMATION RELATING GOVERNANCE Annual Results 31/12/13 31/12/12 87.00 78.03 33.59 33.51 38.61% 42.94% 31.39 32.56 36.08% 41.72% 26.82 28.57 30.83% 36.61% 19.20 19.68 22.07% 25.23% -30.01% -31.85% -31.89% Annual Results 31/12/13 31/12/12 16.10 43.51 71.54 31.98 87.64 75.48 Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro.This document contains certain non-IFRS alternative financial indicators which the Companys management uses as supplemental indicators to monitor the economic, financial and operating performance of the Group . Such indicators are not recognized as measures of financial performance or liquidity under IFRS, do not have any standardized meanings prescribed by IFRS and therefore may not be comparable to the calculation of similar measures used by other companies, and should not be viewed as alternatives to measures of financial performance calculated in accordance with IFRS. Compensation SHARE ANALYSIS Stock Mbo Incentivo Number of shares outstanding Ordinary Nominal value (€) List based voting system (BoD / MB) Quorum for minority shareholders 2.5% Record Date Quantity 212,180,205 212,180,205 Last Divid. (€) n/a Ordinary Capitalis. (€ m) 276.60 276.60 --.-Detach Date n/a (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model SHAREHOLDERS * STATE OF NEW JERSEY COMMON PENSION FUND: 1.70% INVESCO LTD: 2.95% ALLIANZ GLOBAL INVESTORS EUROPE GMBH: 5.03% INDEX VENTURES GROWTH ASSOCIATE I LIMITED: 7.58% Last price Ord Performance Ord 13/02/2015 1.30 -2Y n/a -2Y INDEX ITSTAR 81.14% Relative perf. n/a Price range (-2y) Ord -1Y -18.37% -1Y 15.14% -33.51% MAX 2.30 -3M 24.25% -3M 21.78% 2.47% MIN 0.97 -1M 24.26% -1M 12.46% 11.80% PARSIMONY LTD: 8.49% OTHER SHAREHOLDERS < 2%: 32.17% SYNTEGRA CAPITAL INVESTORS LTD : 42.27% Source: CONSOB Update: 21/07/2014 TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO13/02/2015 Turn over Total(€) Daily average(€) 24,176,601 779,890 Number of shares traded Total Daily average 20,620,993 665,193 Number of trades Total Daily average 20,350 656 A Volatility 32.40% A Turnover velocity 79.63% Source: Borsa Italiana. Data refer to the ordinary shares. ANALYST REPORTS Analyst reports from www.borsaitaliana.it: Mediobanca (06/02/2015) Mediobanca (07/11/2014) Mediobanca (07/08/2014) Mediobanca (28/07/2014) Mediobanca (09/05/2014) * The above information has been provided and updated by the issuing company