Company Profile - Borsa Italiana

advertisement

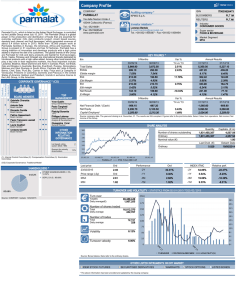

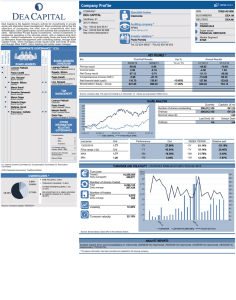

Company Profile Mid Industry Capital S.p.A. (MIC) is an investment company focused on small and medium enterprises active in industrial and services sectors. Listed on the Milan Stock Exchange since May 2007. MIC manages its investment portfolio in a flexible way and with no time restrictions. The strategy is based on selecting companies operating in profitable niche areas and turning them into hubs of aggregation and growth in their area of expertise. Balanced and contained use of the financial leverage. Current portfolio include the 76% participation in Mar-Ter Spedizioni S.p.A., a leading port logistic operator based in Monfalcone and Livorno. COMPANY Investor relations * ISIN Mid Industry Capital Giorgio Garuzzo E-mail:info@midindustry.com Tel.:+39027626171 - Fax:+390276261726 BLOOMBERG MIC IM REUTERS MIC.MI Galleria Sala dei Longobardi, 2 20121 Milano Industry FINANCIALS Tel.: 027626171 Fax: 0276261726 www.midindustry.com Super sector FINANCIAL SERVICES Market Segment MIV C.C.I.(1) Independent Non executive Executive CORPORATE GOVERNANCE * (CG) BOARD MEMBERS TOP MANAGEMENT Giorgio Garuzzo Giorgio Garuzzo Chairman - Managing Director Chairman Luciano Balbo Luciano Balbo Vice President Vice President Paolo Giorgio Bassi Paolo Giorgio Bassi Chief Executive Officer Chief Executive Officer Sergio Chiostri Stefano Cannizzaro CFO Board Member Federica Mantini Board Member Mario Rey Board Member Mario Gabbrielli Board Member Laura Sanvito Board Member KEY FIGURES * €m Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin Annual Results 31/12/13 31/12/12 89.06 81.06 15.80 15.61 17.75% 19.26% 13.53 -2.31 15.19% -2.85% 9.71 5.73 10.90% 7.07% 4.21 -11.83 4.73% -14.59% Var % '13 vs '12 9.88% 1.25% Net Financial Debt / (Cash) Net Equity Capital Employed Annual Results 31/12/13 31/12/12 32.84 36.61 61.84 57.11 94.68 93.73 Var % '13 vs '12 -10.30% 8.27% 1.01% (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model SHAREHOLDERS * FONDAZIONE CASSA DI RISPARMIO DI IMOLA: 2.36% IT0004166762 Annual Results 31/12/11 76.01 16.22 21.34% 12.76 16.79% 9.83 12.93% 4.04 5.32% 69.30% Annual Results 31/12/11 8.02 93.71 101.72 Source: company data. The year-end closing is at December, 31. Values are expressed in Million Euro.Consolidated results FONDAZIONE CASSA DI RISPARMIO DI CUNEO: 2.37% SHARE ANALYSIS DARIO LEVI (PERSONALMENTE O TRAMITE L&A CAPITAL S.R.L.): 2.41% PALLADIO FINANZIARIA SPA: 6.98% Number of shares outstanding Ordinary Nominal value (€) FONDAZIONE CASSA DI RISPARMIO DI PIACENZA E VIGEVANO: 7.11% Ordinary ARBUS S.R.L.: 3.55% MYRTA MAZZA LODI: 3.64% HDI VAG (TRAMITE HDI ASSICURAZIONI S.P.A.): 9.57% GIORGIO GARUZZO (PERSONALMENTE O TRAMITE TECKEL S.A., SIMON FIDUCIARIA SPA E INVESGES S.R.L.): 11.85% FIRST CAPITAL SPA: 25.76% Source: COMPANY. Update: 14/02/2015 Quantity 4,220,225 4,220,225 Last Divid. (€) 1.300 INDEX ITSC Capitalis. (€ m) 26.11 26.11 --.-Detach Date 25/08/2014 Last price Ord Performance Ord 13/02/2015 6.19 -2Y 99.66% -2Y 33.32% Relative perf. Price range (-2y) Ord -1Y 30.89% -1Y 1.50% 29.38% MAX 6.67 -3M 3.10% -3M 20.58% -17.48% MIN 2.08 -1M 0.58% -1M 16.44% -15.86% 66.34% TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO13/02/2015 Turn over Total(€) Daily average(€) 342,669 11,054 Number of shares traded Total Daily average 54,523 1,759 Number of trades Total Daily average 142 5 A Volatility 30.51% A Turnover velocity 10.59% Source: Borsa Italiana. Data refer to the ordinary shares. OTHER LISTED INTRUMENTS ON BIT MARKET IDEM STOCK FUTURES SECURITISED DERIVATIVES * The above information has been provided and updated by the issuing company WARRANTS STOCK OPTIONS LISTED BONDS