toll brothersnyse-tol

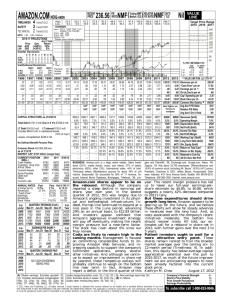

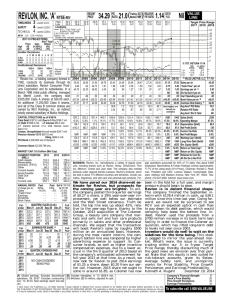

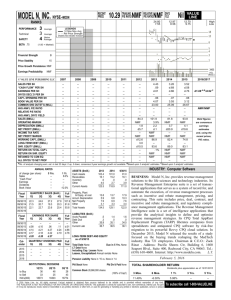

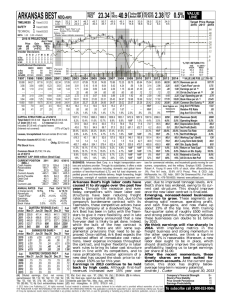

advertisement

TOLL BROTHERS NYSE-TOL TIMELINESS SAFETY TECHNICAL 4 3 5 High: Low: Lowered 4/1/16 58.7 32.6 RECENT PRICE 40.0 22.2 35.6 18.0 28.0 13.5 12.5 RELATIVE DIV’D Median: NMF) P/E RATIO 0.59 YLD 29.13 P/ERATIO 10.8(Trailing: 23.6 13.7 23.7 15.6 22.4 13.2 37.1 20.6 39.3 29.6 39.9 28.9 42.2 32.2 Nil 33.4 23.8 Target Price Range 2019 2020 2021 LEGENDS 11.0 x ″Cash Flow″ p sh . . . . Relative Price Strength 2-for-1 split 7/05 Options: Yes Shaded area indicates recession Raised 10/17/97 Lowered 9/2/16 BETA 1.35 (1.00 = Market) 2019-21 PROJECTIONS VALUE LINE 120 100 80 64 48 Ann’l Total Price Gain Return High 60 (+105%) 20% Low 40 (+35%) 9% Insider Decisions to Buy Options to Sell N 0 0 0 D 0 6 1 J 0 9 0 F 0 0 0 M 0 0 0 A 0 0 0 M 0 0 1 J 0 0 0 32 24 20 16 12 J 0 0 0 % TOT. RETURN 8/16 Institutional Decisions 4Q2015 1Q2016 2Q2016 183 190 188 to Buy to Sell 182 181 163 Hld’s(000) 139758 134630 128293 Percent shares traded 75 50 25 1 yr. 3 yr. 5 yr. 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 12.51 16.03 16.58 18.93 26.02 37.39 39.79 29.60 19.69 10.66 8.98 8.91 11.16 15.79 1.06 1.60 1.64 1.85 2.83 5.33 4.66 .42 d1.68 d4.44 .10 .38 .94 1.16 .97 1.38 1.46 1.72 2.52 4.78 4.17 .22 d1.88 d4.68 d.02 .24 .79 .97 --------------5.14 6.56 8.04 10.07 12.83 17.84 22.20 22.47 20.19 15.26 15.36 15.61 18.51 19.68 145.05 139.11 140.43 146.64 149.64 154.94 153.90 157.01 160.37 164.73 166.41 165.73 168.64 169.35 5.7 6.5 8.3 7.3 8.3 8.6 7.4 NMF ---NMF 33.1 34.4 .37 .33 .45 .42 .44 .46 .40 NMF ---NMF 2.11 1.93 --------------CAPITAL STRUCTURE as of 7/31/16 Total Debt $3876.9 mill. Due in 5 Yrs $2811.5 mill. LT Debt $2693.2 mill. LT Interest $120.0 mill. (Total interest coverage: 5.2X) (39% of Cap’l) Leases, Uncapitalized Annual Rentals $11.1 mill. Pension Assets-10/15 $21.6 mill. Obligation $35.8 mill. Pfd Stock None Common Stock 163,994,000 shs. as of 9/2/16 MARKET CAP: $4.8 billion (Mid Cap) CURRENT POSITION 2014 2015 ($MILL.) Cash Assets 616.7 945.8 Receivables 251.6 284.1 6490.3 6997.5 Inventory D Other 42.1 56.1 Current Assets 7400.7 8283.5 Accts Payable 225.3 237.0 Debt Due 744.5 1000.4 Other 931.4 951.2 Current Liab. 1901.2 2188.6 ANNUAL RATES Past of change (per sh) 10 Yrs. Revenues -2.5% ‘‘Cash Flow’’ -5.5% Earnings -6.0% Dividends -Book Value 5.0% Fiscal Year Ends 2013 2014 2015 2016 2017 Fiscal Year Ends 2013 2014 2015 2016 2017 Calendar 2012 2013 2014 2015 2016 7/31/16 395.0 280.3 7670.5 66.8 8412.6 276.2 1183.7 1072.6 2532.5 Past Est’d ’13-’15 5 Yrs. to ’19-’21 10.0% 14.0% - - 16.5% - - 16.5% -Nil 5.5% 11.0% QUARTERLY REVENUES ($ mill.) A Jan.31 Apr.30 Jul.31 Oct.31 424.6 516.0 689.2 1044.5 643.7 860.4 1056.9 1350.6 853.5 852.6 1028.0 1437.2 928.6 1115.6 1269.9 1785.9 1050 1200 1475 1925 EARNINGS PER SHARE A B Jan.31 Apr.30 Jul.31 Oct.31 .03 .14 .26 .54 .25 .35 .53 .71 .44 .37 .36 .80 .40 .51 .61 1.03 .48 .58 .75 1.19 QUARTERLY DIVIDENDS PAID Mar.31 Jun.30 Sep.30 Dec.31 NO CASH DIVIDENDS BEING PAID Full Fiscal Year 2674.3 3911.6 4171.3 5100 5650 Full Fiscal Year .97 1.84 1.97 2.55 3.00 Full Year 6123.5 19.2% 39.0% 687.2 11.2% 3586.8 2508.9 4570.0 1491.2 3415.9 15.2% 20.1% 20.1% -- 4647.0 2.8% 49.6% 35.7 .8% 3548.2 2024.2 4590.2 1492.3 3527.2 1.7% 1.0% 1.0% -- 3158.2 NMF -d297.8 NMF 2604.2 1523.2 4080.2 1486.4 3237.7 NMF NMF NMF -- 1755.3 NMF -d755.8 NMF 2347.9 835.7 3766.9 1635.5 2513.2 NMF NMF NMF -- 1494.8 NMF -d3.4 NMF 2285.9 955.9 3683.2 1544.1 2555.5 1.3% NMF NMF -- 1475.9 NMF -39.8 2.7% 2391.0 1025.7 3788.3 1491.0 2586.4 2.3% 1.5% 1.5% -- 1882.8 4.6% -135.1 7.2% 2664.5 1096.7 4317.9 2080.5 3121.7 3.8% 4.3% 4.3% -- 2674.3 8.9% 36.3% 170.6 6.4% 2664.5 1096.7 4617.2 2321.4 3333.0 4.2% 5.1% 5.1% -- THIS STOCK VL ARITH.* INDEX -15.9 1.6 80.9 10.9 29.8 84.5 © VALUE LINE PUB. LLC 8 19-21 23.50 23.86 31.50 35.75 2.18 2.21 2.90 3.40 1.84 1.97 2.55 3.00 --Nil Nil 23.15 24.15 26.65 29.75 166.47 174.85 162.00 158.00 19.0 18.5 Bold figures are Value Line 1.00 .94 estimates --- Revenues per sh A 46.65 ‘‘Cash Flow’’ per sh 4.60 A B Earnings per sh 4.00 Div’d Decl’d per sh Nil Book Value per sh 42.00 Common Shares Outst’g C150.00 Avg Ann’l P/E Ratio 12.5 Relative P/E Ratio .80 Avg Ann’l Div’d Yield Nil 3911.6 10.7% 32.6% 340.0 8.7% 4011.9 2478.4 5499.5 2655.0 3854.4 6.2% 8.8% 8.8% -- Revenues ($mill) A Operating Margin Income Tax Rate Net Profit ($mill) Net Profit Margin Homes Inventory ($mill) Land Inventory ($mill) Working Cap’l ($mill) Long-Term Debt ($mill) Shr. Equity ($mill) Return on Total Cap’l Return on Shr. Equity Retained to Com Eq All Div’ds to Net Prof 4171.2 11.3% 32.2% 363.2 8.7% 4888.9 2108.7 6094.9 2689.8 4222.6 6.1% 8.6% 8.6% -- 5100 13.2% 37.5% 445 8.7% 5650 13.5% 38.0% 515 9.1% 5800 2600 4315 7.5% 10.5% 10.5% Nil 5925 2775 4700 8.0% 11.0% 11.0% Nil 7000 14.0% 37.5% 660 9.4% 6275 3450 6295 7.5% 10.5% 10.5% Nil BUSINESS: Toll Brothers, Inc. is a builder of upscale single-family detached homes, townhouses, and condominiums located primarily on land it has developed. The company operates in 19 states and in 50 markets. Sold 5,525 single-family and attached homes in fiscal 2015. Single-family detached homes sell for between approximately $160,000 and $2,000,000. Company provides financing in conjunc- tion with several mortgage banking companies. Has approximately 3,900 employees. Robert I. Toll and Bruce E. Toll own 9.3% of the common stock; BlackRock Inc., 11.0%; JPMorgan Chase, 8.0% (1/16 Proxy). Chairman: Robert Toll. CEO: Douglas C. Yearley Jr. Inc.: DE. Address: 250 Gibraltar Road, Horsham, PA 19044. Telephone: 215-938-8000. Internet: www.tollbrothers.com. We look for Toll Brothers to deliver a roughly 30% bottom-line advance in fiscal 2016 (ends October 31st). The luxury homebuilder was able to shake off an uneven start to the fiscal year and produce two-consecutive strong quarters, including a 69% earnings surge in the July period. Toll’s single-family homebuilding operations have been the primary catalyst, driven by a healthy pace of home closings and a continued uptick in the average selling price. A shortage of available homes on the market has helped pricing, with more prospective buyers bidding on a smaller number of available properties. The homebuilding business has offset a smaller-than-expected contribution from joint ventures (JVs) this fiscal year, with projects expected to be completed in the current quarter now likely to be finalized in the first quarter of fiscal 2017. The earnings momentum should continue in fiscal 2017. New home orders and the backlog of homes under construction rose 18% and 19%, respectively, in the July quarter. Given that it takes 10 to 12 months for a Toll Brothers home to be completed from the time a contract is signed, revenue and earnings visibility should remain solid well into next year. Too, the aforementioned delayed JV projects will now be realized in fiscal 2017. Moreover, Toll Brothers continues to support share earnings with an aggressive stock-buyback program; it repurchased 11.4 million shares through the first nine months of fiscal 2016. Given these factors, we think share earnings will reach $3.00 next year. This stock is untimely. However, we think it may appeal to those with a longerterm investment horizon. Valued at 1.1 times our 2016 book value-per-share estimate, Toll Brothers stock trades at a discount to many of its homebuilding peers. And with lending rates likely to rise in the coming years, as the Federal Reserve begins to tighten the monetary reins, Toll Brothers’ business is less likely to take a hit than some of its peers that cater to the entry-level and first-time move-up markets. Indeed, affluent individuals, who are the typical buyers of a Toll Brothers property, are less prone to base their purchasing decisions on mortgage-rate levels. William G. Ferguson September 23, 2016 (A) Fiscal year ends October 31st. (C) In millions, adjusted for stock splits. (B) Diluted earnings. Excludes extraordinary gains/(losses): ’12, $2.06. Next earnings report due early December. (D) Specific identification. © 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind. THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product. Company’s Financial Strength Stock’s Price Stability Price Growth Persistence Earnings Predictability B++ 40 50 25 To subscribe call 1-800-VALUELINE