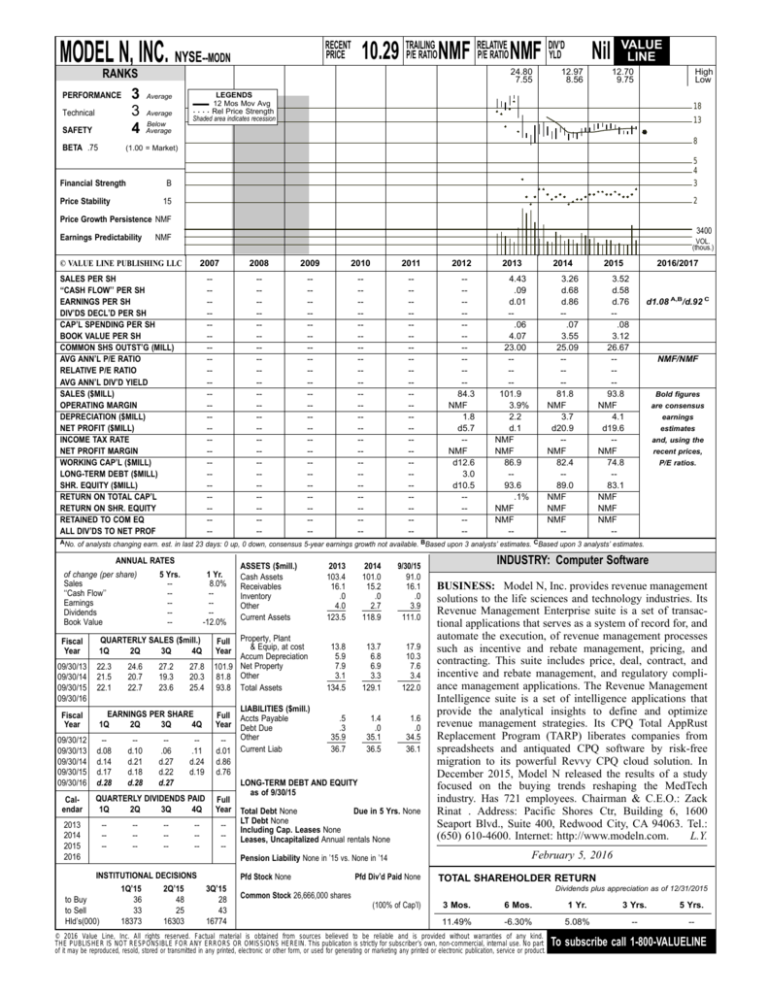

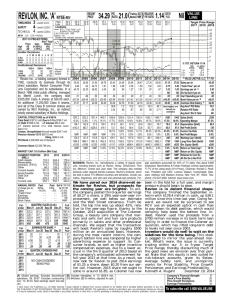

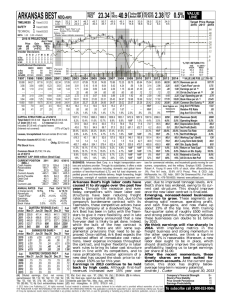

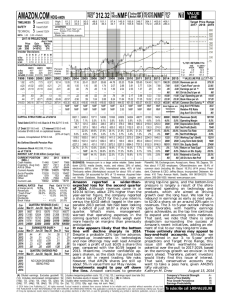

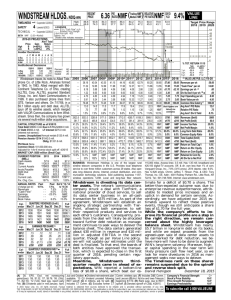

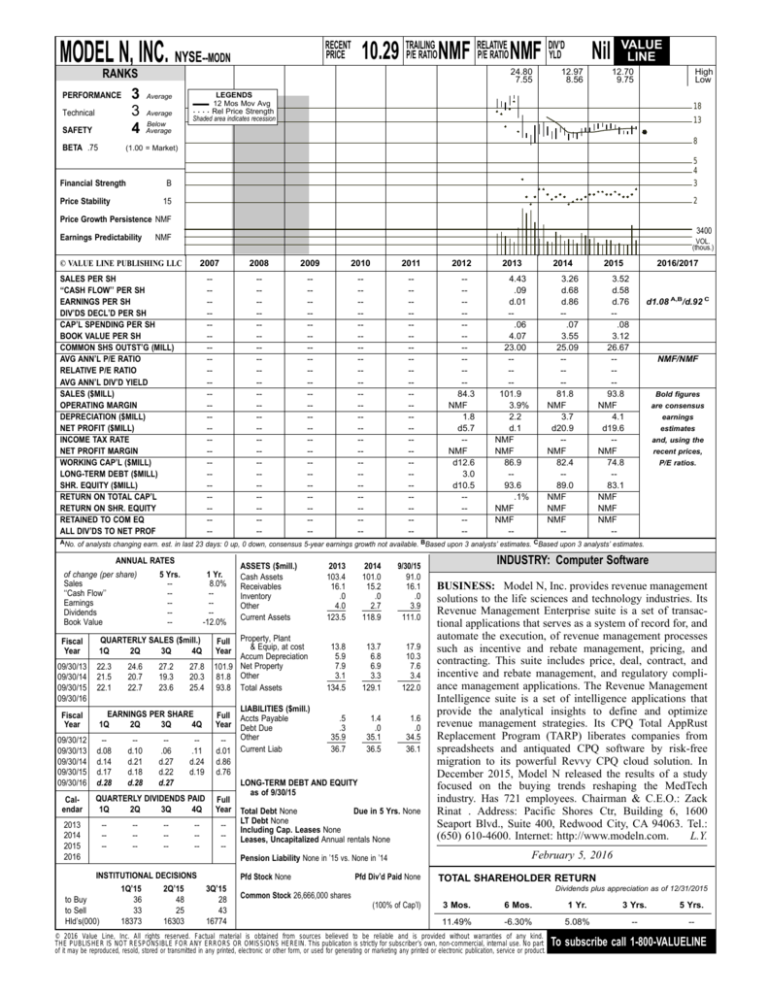

MODEL N, INC. NYSE--MODN

RECENT

PRICE

RELATIVE

DIV’D

P/E RATIO NMF P/E RATIO NMF YLD

10.29 TRAILING

24.80

7.55

RANKS

3

3

4

PERFORMANCE

Technical

SAFETY

BETA .75

Below

Average

12.97

8.56

12.70

9.75

High

Low

LEGENDS

12 Mos Mov Avg

Average

Average

VALUE

LINE

Nil

. . . . Rel Price Strength

18

Shaded area indicates recession

13

8

(1.00 = Market)

Financial Strength

Price Stability

B

5

4

3

15

2

Price Growth Persistence NMF

Earnings Predictability

3400

NMF

VOL.

(thous.)

© VALUE LINE PUBLISHING LLC

2007

2008

2009

2010

2011

2012

2013

2014

2015

------------------------

------------------------

------------------------

------------------------

------------------------

----------84.3

NMF

1.8

d5.7

-NMF

d12.6

3.0

d10.5

-----

4.43

.09

d.01

-.06

4.07

23.00

---101.9

3.9%

2.2

d.1

NMF

NMF

86.9

-93.6

.1%

NMF

NMF

--

3.26

d.68

d.86

-.07

3.55

25.09

---81.8

NMF

3.7

d20.9

-NMF

82.4

-89.0

NMF

NMF

NMF

--

3.52

d.58

d.76

-.08

3.12

26.67

---93.8

NMF

4.1

d19.6

-NMF

74.8

-83.1

NMF

NMF

NMF

--

SALES PER SH

‘‘CASH FLOW’’ PER SH

EARNINGS PER SH

DIV’DS DECL’D PER SH

CAP’L SPENDING PER SH

BOOK VALUE PER SH

COMMON SHS OUTST’G (MILL)

AVG ANN’L P/E RATIO

RELATIVE P/E RATIO

AVG ANN’L DIV’D YIELD

SALES ($MILL)

OPERATING MARGIN

DEPRECIATION ($MILL)

NET PROFIT ($MILL)

INCOME TAX RATE

NET PROFIT MARGIN

WORKING CAP’L ($MILL)

LONG-TERM DEBT ($MILL)

SHR. EQUITY ($MILL)

RETURN ON TOTAL CAP’L

RETURN ON SHR. EQUITY

RETAINED TO COM EQ

ALL DIV’DS TO NET PROF

2016/2017

d1.08 A,B/d.92 C

NMF/NMF

Bold figures

are consensus

earnings

estimates

and, using the

recent prices,

P/E ratios.

ANo. of analysts changing earn. est. in last 23 days: 0 up, 0 down, consensus 5-year earnings growth not available. BBased upon 3 analysts’ estimates. CBased upon 3 analysts’ estimates.

ANNUAL RATES

of change (per share)

Sales

‘‘Cash Flow’’

Earnings

Dividends

Book Value

Fiscal

Year

09/30/13

09/30/14

09/30/15

09/30/16

Fiscal

Year

09/30/12

09/30/13

09/30/14

09/30/15

09/30/16

Calendar

5 Yrs.

------

QUARTERLY SALES ($mill.)

1Q

2Q

3Q

4Q

22.3

21.5

22.1

24.6

20.7

22.7

27.2

19.3

23.6

2013

103.4

16.1

.0

4.0

123.5

2014

101.0

15.2

.0

2.7

118.9

9/30/15

91.0

16.1

.0

3.9

111.0

Property, Plant

& Equip, at cost

Accum Depreciation

101.9 Net Property

81.8 Other

93.8 Total Assets

13.8

5.9

7.9

3.1

134.5

13.7

6.8

6.9

3.3

129.1

17.9

10.3

7.6

3.4

122.0

LIABILITIES ($mill.)

Accts Payable

Debt Due

Other

Current Liab

.5

.3

35.9

36.7

1.4

.0

35.1

36.5

1.6

.0

34.5

36.1

1 Yr.

8.0%

----12.0%

27.8

20.3

25.4

Full

Year

EARNINGS PER SHARE

1Q

2Q

3Q

4Q

Full

Year

-d.08

d.14

d.17

d.28

-d.01

d.86

d.76

-d.10

d.21

d.18

d.28

-.06

d.27

d.22

d.27

-.11

d.24

d.19

QUARTERLY DIVIDENDS PAID

1Q

2Q

3Q

4Q

2013

2014

2015

2016

----

----

----

----

ASSETS ($mill.)

Cash Assets

Receivables

Inventory

Other

Current Assets

Full

Year

----

LONG-TERM DEBT AND EQUITY

as of 9/30/15

Total Debt None

Due in 5 Yrs. None

LT Debt None

Including Cap. Leases None

Leases, Uncapitalized Annual rentals None

INDUSTRY: Computer Software

BUSINESS: Model N, Inc. provides revenue management

solutions to the life sciences and technology industries. Its

Revenue Management Enterprise suite is a set of transactional applications that serves as a system of record for, and

automate the execution, of revenue management processes

such as incentive and rebate management, pricing, and

contracting. This suite includes price, deal, contract, and

incentive and rebate management, and regulatory compliance management applications. The Revenue Management

Intelligence suite is a set of intelligence applications that

provide the analytical insights to define and optimize

revenue management strategies. Its CPQ Total AppRust

Replacement Program (TARP) liberates companies from

spreadsheets and antiquated CPQ software by risk-free

migration to its powerful Revvy CPQ cloud solution. In

December 2015, Model N released the results of a study

focused on the buying trends reshaping the MedTech

industry. Has 721 employees. Chairman & C.E.O.: Zack

Rinat . Address: Pacific Shores Ctr, Building 6, 1600

Seaport Blvd., Suite 400, Redwood City, CA 94063. Tel.:

L.Y.

(650) 610-4600. Internet: http://www.modeln.com.

February 5, 2016

Pension Liability None in ’15 vs. None in ’14

INSTITUTIONAL DECISIONS

to Buy

to Sell

Hld’s(000)

1Q’15

36

33

18373

2Q’15

48

25

16303

Pfd Stock None

3Q’15

28

43

16774

Pfd Div’d Paid None

TOTAL SHAREHOLDER RETURN

Dividends plus appreciation as of 12/31/2015

Common Stock 26,666,000 shares

(100% of Cap’l)

3 Mos.

6 Mos.

1 Yr.

3 Yrs.

5 Yrs.

11.49%

-6.30%

5.08%

--

--

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

To subscribe call 1-800-VALUELINE