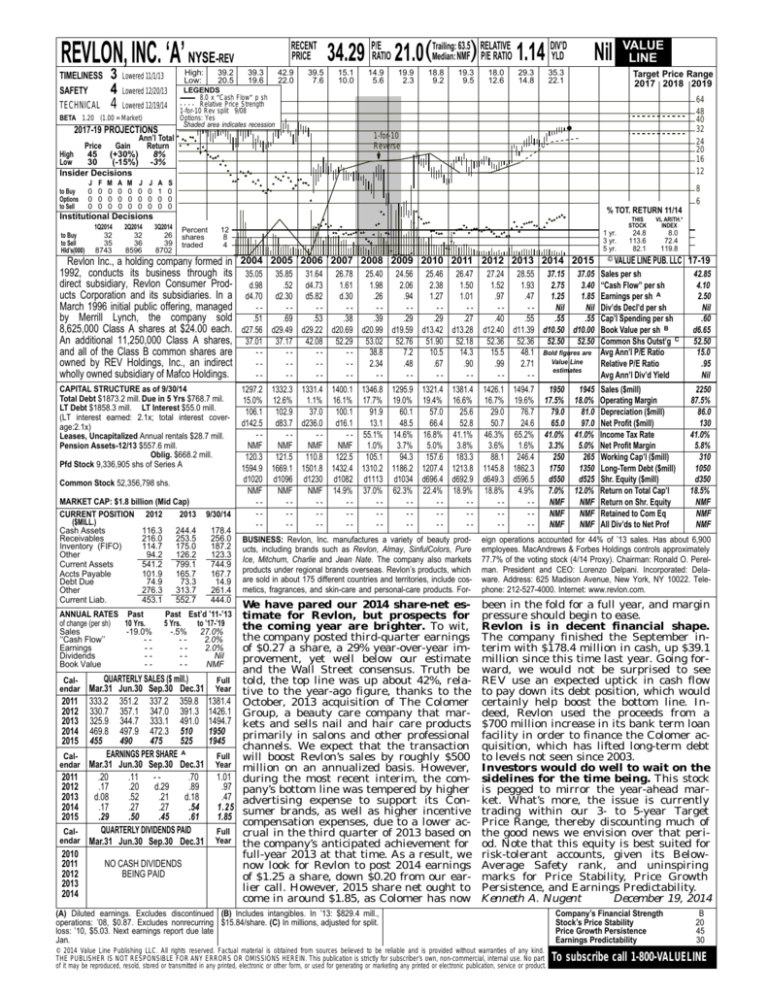

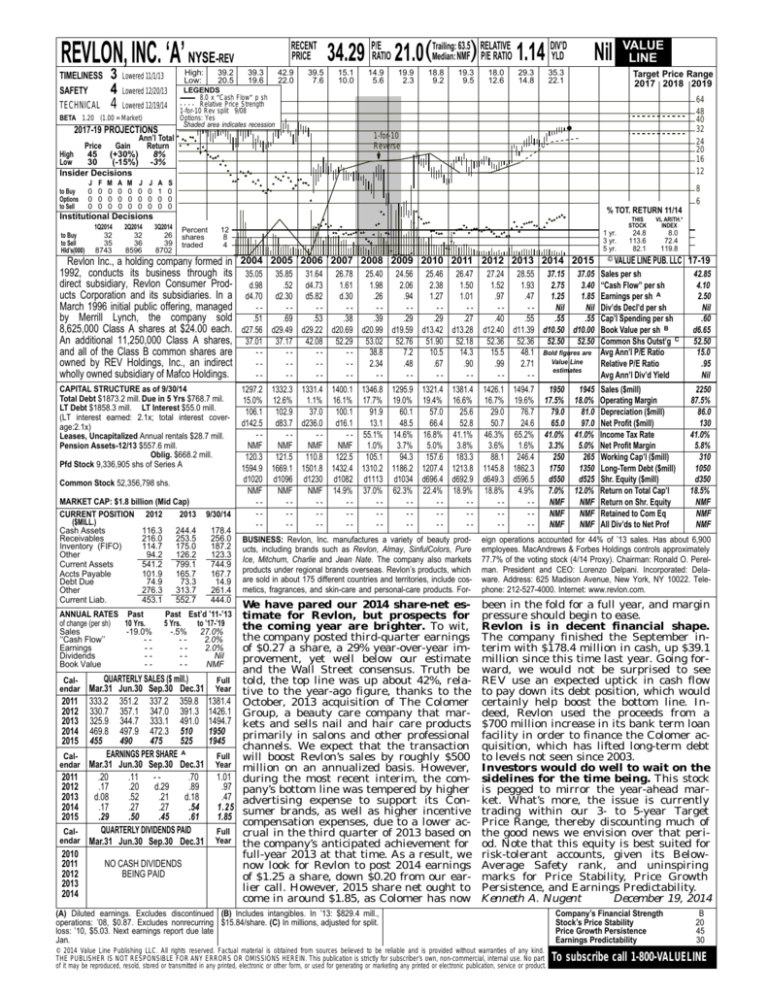

REVLON, INC. ‘A’ NYSE-REV

TIMELINESS

SAFETY

TECHNICAL

3

4

4

High:

Low:

Lowered 11/1/13

39.2

20.5

Lowered 12/19/14

2017-19 PROJECTIONS

F

0

0

0

M

0

0

0

A

0

0

0

M

0

0

0

J

0

0

0

J

0

0

0

A

1

0

0

42.9

22.0

39.5

7.6

15.1

10.0

14.9

5.6

19.9

2.3

18.8

9.2

19.3

9.5

18.0

12.6

29.3

14.8

Nil

35.3

22.1

Target Price Range

2017 2018 2019

64

48

40

32

24

20

16

12

S

0

0

0

8

6

% TOT. RETURN 11/14

Institutional Decisions

to Buy

to Sell

Hld’s(000)

1Q2014

32

35

8743

2Q2014

32

36

8596

3Q2014

26

39

8702

VALUE

LINE

1-for-10

Reverse

Ann’l Total

Price

Gain

Return

High

45 (+30%)

8%

Low

30

(-15%) -3%

Insider Decisions

J

0

0

0

39.3

19.6

63.5 RELATIVE

DIV’D

Median: NMF) P/E RATIO 1.14 YLD

34.29 P/ERATIO 21.0(Trailing:

LEGENDS

8.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

1-for-10 Rev split 9/08

Options: Yes

Shaded area indicates recession

Lowered 12/20/13

BETA 1.20 (1.00 = Market)

to Buy

Options

to Sell

RECENT

PRICE

Percent

shares

traded

12

8

4

1 yr.

3 yr.

5 yr.

THIS

STOCK

VL ARITH.*

INDEX

24.8

113.6

82.1

8.0

72.4

119.8

Revlon Inc., a holding company formed in 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 © VALUE LINE PUB. LLC 17-19

1992, conducts its business through its 35.05 35.85 31.64 26.78 25.40 24.56 25.46 26.47 27.24 28.55 37.15 37.05 Sales per sh

42.85

direct subsidiary, Revlon Consumer Prod- d.98

.52 d4.73

1.61

1.98

2.06

2.38

1.50

1.52

1.93

2.75

3.40 ‘‘Cash Flow’’ per sh

4.10

ucts Corporation and its subsidiaries. In a d4.70 d2.30 d5.82 d.30

.26

.94

1.27

1.01

.97

.47

1.25

1.85 Earnings per sh A

2.50

March 1996 initial public offering, managed

----------Nil

Nil Div’ds Decl’d per sh

Nil

by Merrill Lynch, the company sold

.51

.69

.53

.38

.39

.29

.29

.27

.40

.55

.55

.55 Cap’l Spending per sh

.60

8,625,000 Class A shares at $24.00 each. d27.56 d29.49 d29.22 d20.69 d20.99 d19.59 d13.42 d13.28 d12.40 d11.39 d10.50 d10.00 Book Value per sh B

d6.65

An additional 11,250,000 Class A shares, 37.01 37.17 42.08 52.29 53.02 52.76 51.90 52.18 52.36 52.36 52.50 52.50 Common Shs Outst’g C 52.50

and all of the Class B common shares are

----38.8

7.2

10.5

14.3

15.0

15.5

48.1 Bold figures are Avg Ann’l P/E Ratio

Value Line

owned by REV Holdings, Inc., an indirect

----2.34

.48

.67

.90

.99

2.71

Relative P/E Ratio

.95

estimates

wholly owned subsidiary of Mafco Holdings.

----------Avg Ann’l Div’d Yield

Nil

1297.2 1332.3 1331.4 1400.1 1346.8 1295.9 1321.4 1381.4

15.0% 12.6%

1.1% 16.1% 17.7% 19.0% 19.4% 16.6%

106.1 102.9

37.0 100.1

91.9

60.1

57.0

25.6

d142.5 d83.7 d236.0 d16.1

13.1

48.5

66.4

52.8

---- - 55.1% 14.6% 16.8% 41.1%

NMF

NMF

NMF

NMF

1.0%

3.7%

5.0%

3.8%

120.3 121.5 110.8 122.5 105.1

94.3 157.6 183.3

1594.9 1669.1 1501.8 1432.4 1310.2 1186.2 1207.4 1213.8

d1020 d1096 d1230 d1082 d1113 d1034 d696.4 d692.9

NMF

NMF

NMF 14.9% 37.0% 62.3% 22.4% 18.9%

-------------------------

1426.1 1494.7

16.7% 19.6%

29.0

76.7

50.7

24.6

46.3% 65.2%

3.6%

1.6%

88.1 246.4

1145.8 1862.3

d649.3 d596.5

18.8%

4.9%

-------

BUSINESS: Revlon, Inc. manufactures a variety of beauty products, including brands such as Revlon, Almay, SinfulColors, Pure

Ice, Mitchum, Charlie and Jean Nate. The company also markets

products under regional brands overseas. Revlon’s products, which

are sold in about 175 different countries and territories, include cosmetics, fragrances, and skin-care and personal-care products. For-

eign operations accounted for 44% of ’13 sales. Has about 6,900

employees. MacAndrews & Forbes Holdings controls approximately

77.7% of the voting stock (4/14 Proxy). Chairman: Ronald O. Perelman. President and CEO: Lorenzo Delpani. Incorporated: Delaware. Address: 625 Madison Avenue, New York, NY 10022. Telephone: 212-527-4000. Internet: www.revlon.com.

We have pared our 2014 share-net estimate for Revlon, but prospects for

the coming year are brighter. To wit,

the company posted third-quarter earnings

of $0.27 a share, a 29% year-over-year improvement, yet well below our estimate

and the Wall Street consensus. Truth be

Full told, the top line was up about 42%, relaYear tive to the year-ago figure, thanks to the

1381.4 October, 2013 acquisition of The Colomer

1426.1 Group, a beauty care company that mar1494.7 kets and sells nail and hair care products

1950

primarily in salons and other professional

1945

channels. We expect that the transaction

Full will boost Revlon’s sales by roughly $500

Year million on an annualized basis. However,

1.01 during the most recent interim, the com.97 pany’s bottom line was tempered by higher

.47 advertising expense to support its Con1.25 sumer brands, as well as higher incentive

1.85

compensation expenses, due to a lower acFull crual in the third quarter of 2013 based on

Year the company’s anticipated achievement for

full-year 2013 at that time. As a result, we

now look for Revlon to post 2014 earnings

of $1.25 a share, down $0.20 from our earlier call. However, 2015 share net ought to

come in around $1.85, as Colomer has now

been in the fold for a full year, and margin

pressure should begin to ease.

Revlon is in decent financial shape.

The company finished the September interim with $178.4 million in cash, up $39.1

million since this time last year. Going forward, we would not be surprised to see

REV use an expected uptick in cash flow

to pay down its debt position, which would

certainly help boost the bottom line. Indeed, Revlon used the proceeds from a

$700 million increase in its bank term loan

facility in order to finance the Colomer acquisition, which has lifted long-term debt

to levels not seen since 2003.

Investors would do well to wait on the

sidelines for the time being. This stock

is pegged to mirror the year-ahead market. What’s more, the issue is currently

trading within our 3- to 5-year Target

Price Range, thereby discounting much of

the good news we envision over that period. Note that this equity is best suited for

risk-tolerant accounts, given its BelowAverage Safety rank, and uninspiring

marks for Price Stability, Price Growth

Persistence, and Earnings Predictability.

Kenneth A. Nugent

December 19, 2014

CAPITAL STRUCTURE as of 9/30/14

Total Debt $1873.2 mill. Due in 5 Yrs $768.7 mil.

LT Debt $1858.3 mill. LT Interest $55.0 mill.

(LT interest earned: 2.1x; total interest coverage:2.1x)

Leases, Uncapitalized Annual rentals $28.7 mill.

Pension Assets-12/13 $557.6 mill.

Oblig. $668.2 mill.

Pfd Stock 9,336,905 shs of Series A

Common Stock 52,356,798 shs.

MARKET CAP: $1.8 billion (Mid Cap)

CURRENT POSITION 2012

2013

($MILL.)

Cash Assets

116.3

244.4

Receivables

216.0

253.5

Inventory (FIFO)

114.7

175.0

Other

94.2

126.2

Current Assets

541.2

799.1

Accts Payable

101.9

165.7

Debt Due

74.9

73.3

Other

276.3

313.7

Current Liab.

453.1

552.7

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Sales

-19.0%

‘‘Cash Flow’’

-Earnings

-Dividends

-Book Value

--

178.4

256.0

187.2

123.3

744.9

167.7

14.9

261.4

444.0

Past Est’d ’11-’13

5 Yrs.

to ’17-’19

-.5% 27.0%

-2.0%

-2.0%

-Nil

-NMF

QUARTERLY SALES ($ mill.)

Mar.31 Jun.30 Sep.30 Dec.31

2011 333.2 351.2 337.2 359.8

2012 330.7 357.1 347.0 391.3

2013 325.9 344.7 333.1 491.0

2014 469.8 497.9 472.3 510

2015 455

490

475

525

EARNINGS PER SHARE A

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2011

.20

.11 - .70

2012

.17

.20

d.29

.89

2013

d.08

.52

.21

d.18

2014

.17

.27

.27

.54

2015

.29

.50

.45

.61

QUARTERLY DIVIDENDS PAID

Calendar Mar.31 Jun.30 Sep.30 Dec.31

2010

2011

NO CASH DIVIDENDS

2012

BEING PAID

2013

2014

Calendar

9/30/14

1950

17.5%

79.0

65.0

41.0%

3.3%

250

1750

d550

7.0%

NMF

NMF

NMF

(A) Diluted earnings. Excludes discontinued (B) Includes intangibles. In ’13: $829.4 mill.,

operations: ’08, $0.87. Excludes nonrecurring $15.84/share. (C) In millions, adjusted for split.

loss: ’10, $5.03. Next earnings report due late

Jan.

© 2014 Value Line Publishing LLC. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

1945

18.0%

81.0

97.0

41.0%

5.0%

265

1350

d525

12.0%

NMF

NMF

NMF

Sales ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

2250

87.5%

86.0

130

41.0%

5.8%

310

1050

d350

18.5%

NMF

NMF

NMF

B

20

45

30

To subscribe call 1-800-VALUELINE