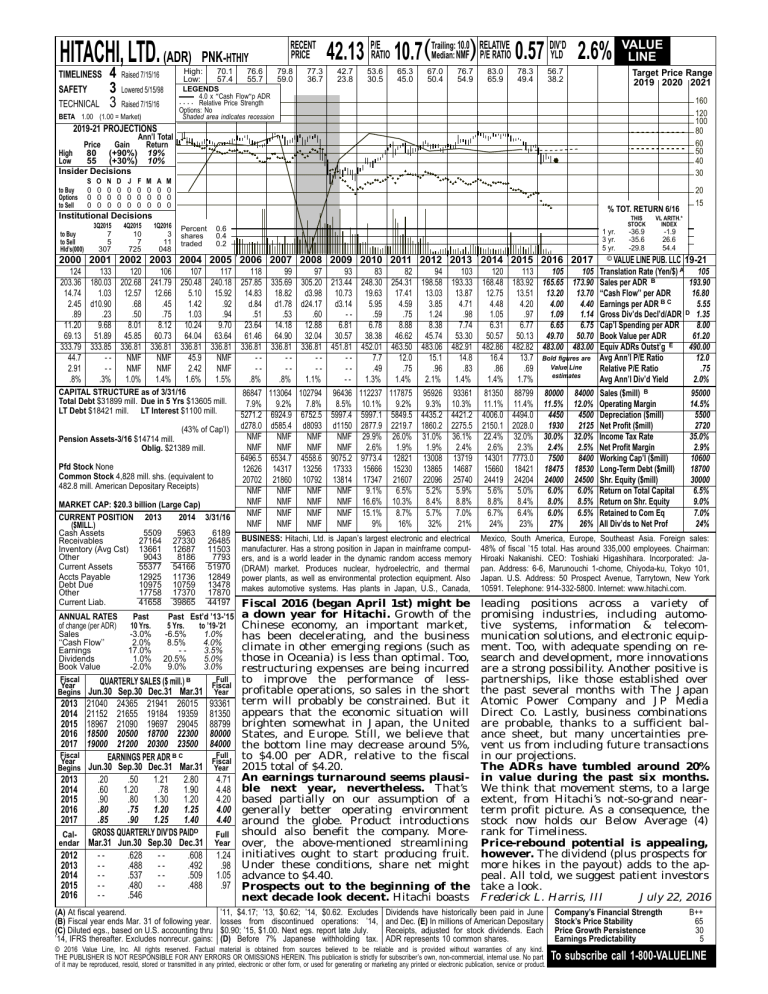

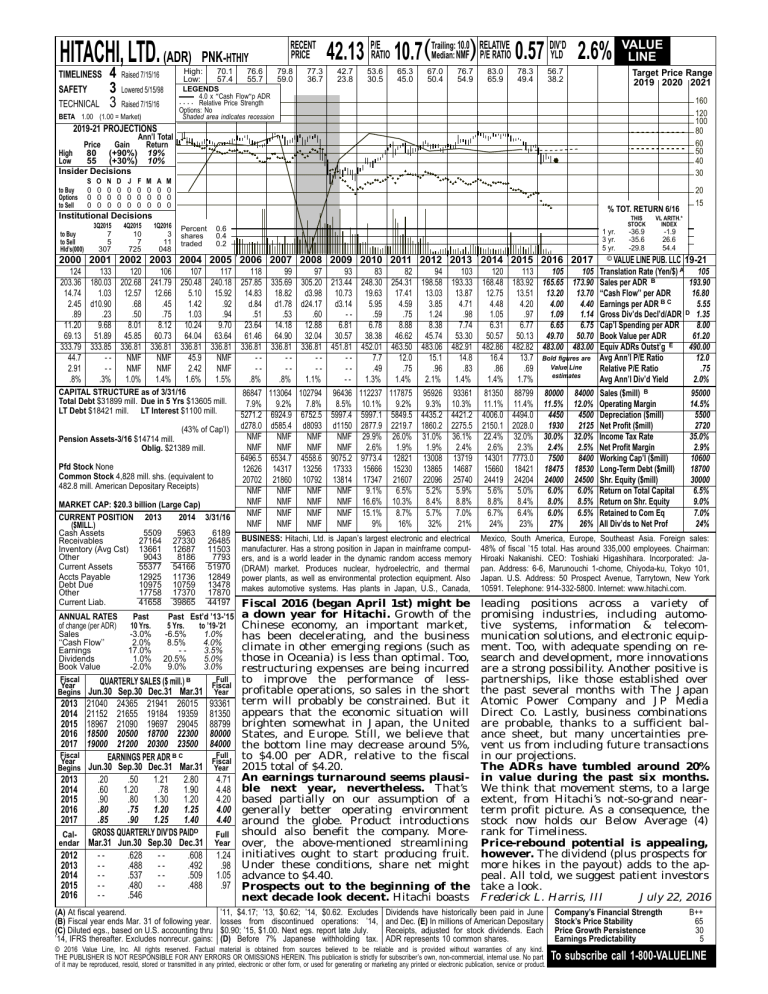

HITACHI, LTD. (ADR)

TIMELINESS

SAFETY

TECHNICAL

4

3

3

High:

Low:

Raised 7/15/16

RECENT

PRICE

PNK-HTHIY

70.1

57.4

76.6

55.7

79.8

59.0

77.3

36.7

10.0 RELATIVE

DIV’D

Median: NMF) P/E RATIO 0.57 YLD 2.6%

42.13 P/ERATIO 10.7(Trailing:

42.7

23.8

53.6

30.5

65.3

45.0

67.0

50.4

76.7

54.9

83.0

65.9

78.3

49.4

56.7

38.2

Target Price Range

2019 2020 2021

LEGENDS

4.0 x ″Cash Flow″p ADR

. . . . Relative Price Strength

Options: No

Shaded area indicates recession

Lowered 5/15/98

Raised 7/15/16

BETA 1.00 (1.00 = Market)

VALUE

LINE

160

120

100

80

60

50

40

30

2019-21 PROJECTIONS

Ann’l Total

Price

Gain

Return

High

80 (+90%) 19%

Low

55 (+30%) 10%

Insider Decisions

to Buy

Options

to Sell

S

0

0

0

O

0

0

0

N

0

0

0

D

0

0

0

J

0

0

0

F

0

0

0

M

0

0

0

A

0

0

0

M

0

0

0

% TOT. RETURN 6/16

Institutional Decisions

to Buy

to Sell

Hld’s(000)

3Q2015

7

5

307

4Q2015

10

7

725

1Q2016

3

11

048

Percent

shares

traded

0.6

0.4

0.2

1 yr.

3 yr.

5 yr.

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

124

133

120

106

107

117

118

203.36 180.03 202.68 241.79 250.48 240.18 257.85

14.74

1.03 12.57 12.66

5.10 15.92 14.83

2.45 d10.90

.68

.45

1.42

.92

d.84

.89

.23

.50

.75

1.03

.94

.51

11.20

9.68

8.01

8.12 10.24

9.70 23.64

69.13 51.89 45.85 60.73 64.04 63.64 61.46

333.79 333.85 336.81 336.81 336.81 336.81 336.81

44.7

-NMF

NMF

45.9

NMF

-2.91

-NMF

NMF

2.42

NMF

-.8%

.3%

1.0%

1.4%

1.6%

1.5%

.8%

CAPITAL STRUCTURE as of 3/31/16

86847

Total Debt $31899 mill. Due in 5 Yrs $13605 mill.

7.9%

LT Debt $18421 mill. LT Interest $1100 mill.

5271.2

(43% of Cap’l) d278.0

NMF

Pension Assets-3/16 $14714 mill.

NMF

Oblig. $21389 mill.

6496.5

Pfd Stock None

12626

Common Stock 4,828 mill. shs. (equivalent to

20702

482.8 mill. American Depositary Receipts)

NMF

NMF

MARKET CAP: $20.3 billion (Large Cap)

NMF

CURRENT POSITION 2013

2014 3/31/16

NMF

($MILL.)

Cash Assets

Receivables

Inventory (Avg Cst)

Other

Current Assets

Accts Payable

Debt Due

Other

Current Liab.

ANNUAL RATES

of change (per ADR)

Sales

‘‘Cash Flow’’

Earnings

Dividends

Book Value

Fiscal

Year

Begins

2013

2014

2015

2016

2017

Fiscal

Year

Begins

2013

2014

2015

2016

2017

Calendar

2012

2013

2014

2015

2016

5509

27164

13661

9043

55377

12925

10975

17758

41658

Past

10 Yrs.

-3.0%

2.0%

17.0%

1.0%

-2.0%

5963

27330

12687

8186

54166

11736

10759

17370

39865

6189

26485

11503

7793

51970

12849

13478

17870

44197

Past Est’d ’13-’15

5 Yrs.

to ’19-’21

-6.5%

1.0%

8.5%

4.0%

-3.5%

20.5%

5.0%

9.0%

3.0%

QUARTERLY SALES ($ mill.) B

Jun.30 Sep.30 Dec.31 Mar.31

21040 24365 21941 26015

21152 21655 19184 19359

18967 21090 19697 29045

18500 20500 18700 22300

19000 21200 20300 23500

EARNINGS PER ADR B C

Jun.30 Sep.30 Dec.31 Mar.31

.20

.50

1.21

2.80

.60

1.20

.78

1.90

.90

.80

1.30

1.20

.80

.75

1.20

1.25

.85

.90

1.25

1.40

GROSS QUARTERLY DIV’DS PAIDD

Mar.31 Jun.30 Sep.30 Dec.31

-.628

-.608

-.488

-.492

-.537

-.509

-.480

-.488

-.546

Full

Fiscal

Year

93361

81350

88799

80000

84000

Full

Fiscal

Year

(A) At fiscal yearend.

(B) Fiscal year ends Mar. 31 of following year.

(C) Diluted egs., based on U.S. accounting thru

’14, IFRS thereafter. Excludes nonrecur. gains:

4.71

4.48

4.20

4.00

4.40

Full

Year

1.24

.98

1.05

.97

99

335.69

18.82

d1.78

.53

14.18

64.90

336.81

--.8%

113064

9.2%

6924.9

d585.4

NMF

NMF

6534.7

14317

21860

NMF

NMF

NMF

NMF

97

305.20

d3.98

d24.17

.60

12.88

32.04

336.81

--1.1%

102794

7.8%

6752.5

d8093

NMF

NMF

4558.6

13256

10792

NMF

NMF

NMF

NMF

93

213.44

10.73

d3.14

-6.81

30.57

451.81

---96436

8.5%

5997.4

d1150

NMF

NMF

9075.2

17333

13814

NMF

NMF

NMF

NMF

83

248.30

19.63

5.95

.59

6.78

38.38

452.01

7.7

.49

1.3%

112237

10.1%

5997.1

2877.9

29.9%

2.6%

9773.4

15666

17347

9.1%

16.6%

15.1%

9%

82

254.31

17.41

4.59

.75

8.88

46.62

463.50

12.0

.75

1.4%

117875

9.2%

5849.5

2219.7

26.0%

1.9%

12821

15230

21607

6.5%

10.3%

8.7%

16%

94

198.58

13.03

3.85

1.24

8.38

45.74

483.06

15.1

.96

2.1%

95926

9.3%

4435.2

1860.2

31.0%

1.9%

13008

13865

22096

5.2%

8.4%

5.7%

32%

103

193.33

13.87

4.71

.98

7.74

53.30

482.91

14.8

.83

1.4%

93361

10.3%

4421.2

2275.5

36.1%

2.4%

13719

14687

25740

5.9%

8.8%

7.0%

21%

120

168.48

12.75

4.48

1.05

6.31

50.57

482.86

16.4

.86

1.4%

81350

11.1%

4006.0

2150.1

22.4%

2.6%

14301

15660

24419

5.6%

8.8%

6.7%

24%

THIS

STOCK

VL ARITH.*

INDEX

-36.9

-35.6

-29.8

-1.9

26.6

54.4

© VALUE LINE PUB. LLC

20

15

19-21

113

105

105 Translation Rate (Yen/$) A 105

193.90

183.92 165.65 173.90 Sales per ADR B

13.51 13.20 13.70 ‘‘Cash Flow’’ per ADR

16.80

5.55

4.20

4.00

4.40 Earnings per ADR B C

D

1.35

.97

1.09

1.14 Gross Div’ds Decl’d/ADR

6.77

6.65

6.75 Cap’l Spending per ADR

8.00

50.13 49.70 50.70 Book Value per ADR

61.20

490.00

482.82 483.00 483.00 Equiv ADRs Outst’g E

12.0

13.7 Bold figures are Avg Ann’l P/E Ratio

Value Line

.69

Relative P/E Ratio

.75

estimates

1.7%

Avg Ann’l Div’d Yield

2.0%

95000

88799 80000 84000 Sales ($mill) B

11.4% 11.5% 12.0% Operating Margin

14.5%

4494.0

4450

4500 Depreciation ($mill)

5500

2028.0

1930

2125 Net Profit ($mill)

2720

32.0% 30.0% 32.0% Income Tax Rate

35.0%

2.3%

2.4%

2.5% Net Profit Margin

2.9%

7773.0

7500

8400 Working Cap’l ($mill)

10600

18421 18475 18530 Long-Term Debt ($mill)

18700

24204 24000 24500 Shr. Equity ($mill)

30000

5.0%

6.0%

6.0% Return on Total Capital

6.5%

8.4%

8.0%

8.5% Return on Shr. Equity

9.0%

6.4%

6.0%

6.5% Retained to Com Eq

7.0%

23%

27%

26% All Div’ds to Net Prof

24%

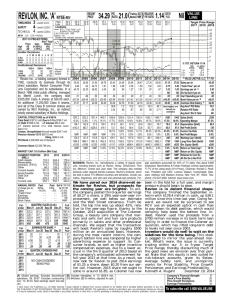

BUSINESS: Hitachi, Ltd. is Japan’s largest electronic and electrical

manufacturer. Has a strong position in Japan in mainframe computers, and is a world leader in the dynamic random access memory

(DRAM) market. Produces nuclear, hydroelectric, and thermal

power plants, as well as environmental protection equipment. Also

makes automotive systems. Has plants in Japan, U.S., Canada,

Mexico, South America, Europe, Southeast Asia. Foreign sales:

48% of fiscal ’15 total. Has around 335,000 employees. Chairman:

Hiroaki Nakanishi. CEO: Toshiaki Higashihara. Incorporated: Japan. Address: 6-6, Marunouchi 1-chome, Chiyoda-ku, Tokyo 101,

Japan. U.S. Address: 50 Prospect Avenue, Tarrytown, New York

10591. Telephone: 914-332-5800. Internet: www.hitachi.com.

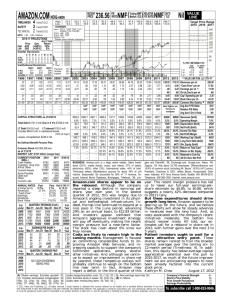

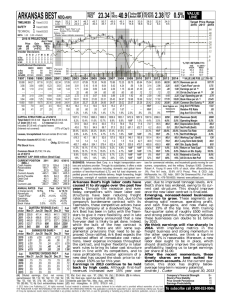

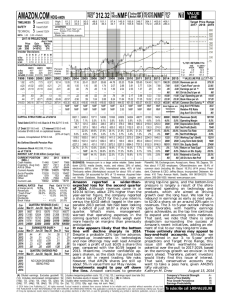

Fiscal 2016 (began April 1st) might be

a down year for Hitachi. Growth of the

Chinese economy, an important market,

has been decelerating, and the business

climate in other emerging regions (such as

those in Oceania) is less than optimal. Too,

restructuring expenses are being incurred

to improve the performance of lessprofitable operations, so sales in the short

term will probably be constrained. But it

appears that the economic situation will

brighten somewhat in Japan, the United

States, and Europe. Still, we believe that

the bottom line may decrease around 5%,

to $4.00 per ADR, relative to the fiscal

2015 total of $4.20.

An earnings turnaround seems plausible next year, nevertheless. That’s

based partially on our assumption of a

generally better operating environment

around the globe. Product introductions

should also benefit the company. Moreover, the above-mentioned streamlining

initiatives ought to start producing fruit.

Under these conditions, share net might

advance to $4.40.

Prospects out to the beginning of the

next decade look decent. Hitachi boasts

leading positions across a variety of

promising industries, including automotive systems, information & telecommunication solutions, and electronic equipment. Too, with adequate spending on research and development, more innovations

are a strong possibility. Another positive is

partnerships, like those established over

the past several months with The Japan

Atomic Power Company and JP Media

Direct Co. Lastly, business combinations

are probable, thanks to a sufficient balance sheet, but many uncertainties prevent us from including future transactions

in our projections.

The ADRs have tumbled around 20%

in value during the past six months.

We think that movement stems, to a large

extent, from Hitachi’s not-so-grand nearterm profit picture. As a consequence, the

stock now holds our Below Average (4)

rank for Timeliness.

Price-rebound potential is appealing,

however. The dividend (plus prospects for

more hikes in the payout) adds to the appeal. All told, we suggest patient investors

take a look.

Frederick L. Harris, III

July 22, 2016

’11, $4.17; ’13, $0.62; ’14, $0.62. Excludes

losses from discontinued operations: ’14,

$0.90; ’15, $1.00. Next egs. report late July.

(D) Before 7% Japanese withholding tax.

Dividends have historically been paid in June

and Dec. (E) In millions of American Depositary

Receipts, adjusted for stock dividends. Each

ADR represents 10 common shares.

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

B++

65

30

5

To subscribe call 1-800-VALUELINE