PROCTER & GAMBLE NYSE-PG

TIMELINESS

SAFETY

TECHNICAL

4

1

5

High:

Low:

Lowered 9/4/15

57.4

48.9

59.7

51.2

RECENT

PRICE

64.7

52.8

75.2

60.4

20.1 RELATIVE

DIV’D

Median: 18.0) P/E RATIO 1.21 YLD 3.3%

79.68 P/ERATIO 21.0(Trailing:

73.8

54.9

63.5

43.9

65.4

39.4

67.7

57.6

71.0

59.1

85.8

68.4

93.9

75.3

91.8

65.0

Target Price Range

2018 2019 2020

LEGENDS

13.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

2-for-1 split 6/04

Options: Yes

Shaded area indicates recession

Raised 1/11/02

Lowered 12/25/15

BETA .65 (1.00 = Market)

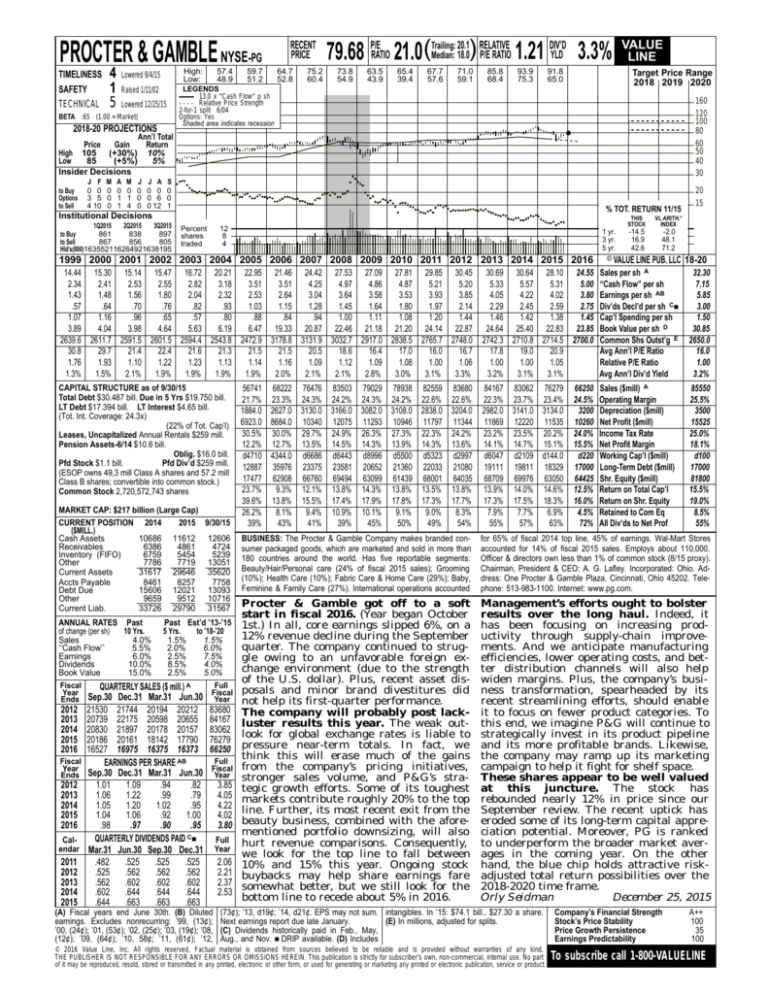

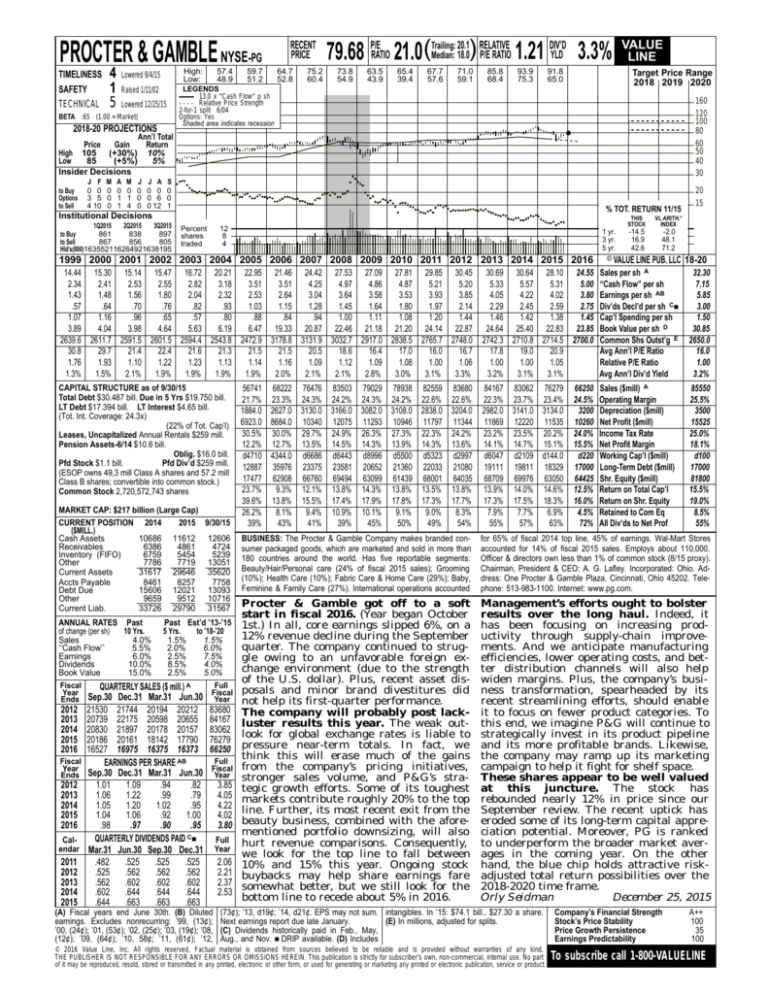

2018-20 PROJECTIONS

VALUE

LINE

160

120

100

80

60

50

40

30

Ann’l Total

Price

Gain

Return

High 105 (+30%) 10%

Low

85

(+5%)

5%

Insider Decisions

to Buy

Options

to Sell

J F

0 0

3 5

4 10

M

0

0

0

A

0

1

1

M

0

1

4

J

0

0

0

J A

0 0

0 6

0 12

S

0

0

1

% TOT. RETURN 11/15

Institutional Decisions

1Q2015

2Q2015

3Q2015

861

838

897

to Buy

to Sell

867

856

805

Hld’s(000)163552116264921638195

Percent

shares

traded

12

8

4

1 yr.

3 yr.

5 yr.

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

14.44 15.30 15.14 15.47 16.72 20.21 22.95 21.46 24.42 27.53 27.09 27.81 29.85 30.45

2.34

2.41

2.53

2.55

2.82

3.18

3.51

3.51

4.25

4.97

4.86

4.87

5.21

5.20

1.43

1.48

1.56

1.80

2.04

2.32

2.53

2.64

3.04

3.64

3.58

3.53

3.93

3.85

.57

.64

.70

.76

.82

.93

1.03

1.15

1.28

1.45

1.64

1.80

1.97

2.14

1.07

1.16

.96

.65

.57

.80

.88

.84

.94

1.00

1.11

1.08

1.20

1.44

3.89

4.04

3.98

4.64

5.63

6.19

6.47 19.33 20.87 22.46 21.18 21.20 24.14 22.87

2639.6 2611.7 2591.5 2601.5 2594.4 2543.8 2472.9 3178.8 3131.9 3032.7 2917.0 2838.5 2765.7 2748.0

30.8

29.7

21.4

22.4

21.6

21.3

21.5

21.5

20.5

18.6

16.4

17.0

16.0

16.7

1.76

1.93

1.10

1.22

1.23

1.13

1.14

1.16

1.09

1.12

1.09

1.08

1.00

1.06

1.3%

1.5%

2.1%

1.9%

1.9%

1.9%

1.9%

2.0%

2.1%

2.1%

2.8%

3.0%

3.1%

3.3%

CAPITAL STRUCTURE as of 9/30/15

Total Debt $30.487 bill. Due in 5 Yrs $19.750 bill.

LT Debt $17.394 bill. LT Interest $4.65 bill.

(Tot. Int. Coverage: 24.3x)

(22% of Tot. Cap’l)

Leases, Uncapitalized Annual Rentals $259 mill.

Pension Assets-6/14 $10.6 bill.

Oblig. $16.0 bill.

Pfd Stock $1.1 bill.

Pfd Div’d $259 mill.

(ESOP owns 49,3 mill Class A shares and 57.2 mill

Class B shares; convertible into common stock.)

Common Stock 2,720,572,743 shares

MARKET CAP: $217 billion (Large Cap)

CURRENT POSITION 2014

2015 9/30/15

($MILL.)

Cash Assets

10686 11612 12606

Receivables

6386

4861

4724

Inventory (FIFO)

6759

5454

5239

Other

7786

7719 13051

Current Assets

31617 29646 35620

Accts Payable

8461

8257

7758

Debt Due

15606 12021 13093

Other

9659

9512 10716

Current Liab.

33726 29790 31567

ANNUAL RATES Past

of change (per sh)

10 Yrs.

Sales

4.0%

‘‘Cash Flow’’

5.5%

Earnings

6.0%

Dividends

10.0%

Book Value

15.0%

Fiscal

Year

Ends

2012

2013

2014

2015

2016

Fiscal

Year

Ends

2012

2013

2014

2015

2016

Calendar

2011

2012

2013

2014

2015

Past Est’d ’13-’15

5 Yrs.

to ’18-’20

1.5%

1.5%

2.0%

6.0%

2.5%

7.5%

8.5%

4.0%

2.5%

5.0%

QUARTERLY SALES ($ mill.) A

Sep.30 Dec.31 Mar.31 Jun.30

21530 21744 20194 20212

20739 22175 20598 20655

20830 21897 20178 20157

20186 20161 18142 17790

16527 16975 16375 16373

EARNINGS PER SHARE AB

Sep.30 Dec.31 Mar.31 Jun.30

1.01

1.09

.94

.82

1.06

1.22

.99

.79

1.05

1.20

1.02

.95

1.04

1.06

.92

1.00

.98

.97

.90

.95

QUARTERLY DIVIDENDS PAID C■

Mar.31 Jun.30 Sep.30 Dec.31

.482

.525

.525

.525

.525

.562

.562

.562

.562

.602

.602

.602

.602

.644

.644

.644

.644

.663

.663

.663

Full

Fiscal

Year

83680

84167

83062

76279

66250

Full

Fiscal

Year

(A) Fiscal years end June 30th. (B) Diluted

earnings. Excludes nonrecurring: ’99, (13¢);

’00, (24¢); ’01, (53¢); ’02, (25¢); ’03, (19¢); ’08,

(12¢); ’09, (64¢); ’10, 58¢; ’11, (61¢); ’12,

3.85

4.05

4.22

4.02

3.80

Full

Year

2.06

2.21

2.37

2.53

THIS

STOCK

VL ARITH.*

INDEX

-14.5

16.9

42.6

-2.0

48.1

71.2

© VALUE LINE PUB. LLC

30.69 30.64 28.10 24.55 Sales per sh A

5.33

5.57

5.31

5.00 ‘‘Cash Flow’’ per sh

4.05

4.22

4.02

3.80 Earnings per sh AB

2.29

2.45

2.59

2.75 Div’ds Decl’d per sh C■

1.46

1.42

1.38

1.45 Cap’l Spending per sh

24.64 25.40 22.83 23.85 Book Value per sh D

2742.3 2710.8 2714.5 2700.0 Common Shs Outst’g E

17.8

19.0

20.9

Avg Ann’l P/E Ratio

1.00

1.00

1.05

Relative P/E Ratio

3.2%

3.1%

3.1%

Avg Ann’l Div’d Yield

Sales ($mill) A

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

20

15

18-20

32.30

7.15

5.85

3.00

1.50

30.85

2650.0

16.0

1.00

3.2%

56741 68222 76476 83503 79029 78938 82559 83680

21.7% 23.3% 24.3% 24.2% 24.3% 24.2% 22.6% 22.6%

1884.0 2627.0 3130.0 3166.0 3082.0 3108.0 2838.0 3204.0

6923.0 8684.0 10340 12075 11293 10946 11797 11344

30.5% 30.0% 29.7% 24.9% 26.3% 27.3% 22.3% 24.2%

12.2% 12.7% 13.5% 14.5% 14.3% 13.9% 14.3% 13.6%

d4710 4344.0 d6686 d6443 d8996 d5500 d5323 d2997

12887 35976 23375 23581 20652 21360 22033 21080

17477 62908 66760 69494 63099 61439 68001 64035

23.7%

9.3% 12.1% 13.8% 14.3% 13.8% 13.5% 13.8%

39.6% 13.8% 15.5% 17.4% 17.9% 17.8% 17.3% 17.7%

26.2%

8.1%

9.4% 10.9% 10.1%

9.1%

9.0%

8.3%

39%

43%

41%

39%

45%

50%

49%

54%

84167 83062 76279

22.3% 23.7% 23.4%

2982.0 3141.0 3134.0

11869 12220 11535

23.2% 23.5% 20.2%

14.1% 14.7% 15.1%

d6047 d2109 d144.0

19111 19811 18329

68709 69976 63050

13.9% 14.0% 14.6%

17.3% 17.5% 18.3%

7.9%

7.7%

6.9%

55%

57%

63%

BUSINESS: The Procter & Gamble Company makes branded consumer packaged goods, which are marketed and sold in more than

180 countries around the world. Has five reportable segments:

Beauty/Hair/Personal care (24% of fiscal 2015 sales); Grooming

(10%); Health Care (10%); Fabric Care & Home Care (29%); Baby,

Feminine & Family Care (27%). International operations accounted

for 65% of fiscal 2014 top line, 45% of earnings. Wal-Mart Stores

accounted for 14% of fiscal 2015 sales. Employs about 110,000.

Officer & directors own less than 1% of common stock (8/15 proxy).

Chairman, President & CEO: A. G. Lafley. Incorporated: Ohio. Address: One Procter & Gamble Plaza, Cincinnati, Ohio 45202. Telephone: 513-983-1100. Internet: www.pg.com.

Procter & Gamble got off to a soft

start in fiscal 2016. (Year began October

1st.) In all, core earnings slipped 6%, on a

12% revenue decline during the September

quarter. The company continued to struggle owing to an unfavorable foreign exchange environment (due to the strength

of the U.S. dollar). Plus, recent asset disposals and minor brand divestitures did

not help its first-quarter performance.

The company will probably post lackluster results this year. The weak outlook for global exchange rates is liable to

pressure near-term totals. In fact, we

think this will erase much of the gains

from the company’s pricing initiatives,

stronger sales volume, and P&G’s strategic growth efforts. Some of its toughest

markets contribute roughly 20% to the top

line. Further, its most recent exit from the

beauty business, combined with the aforementioned portfolio downsizing, will also

hurt revenue comparisons. Consequently,

we look for the top line to fall between

10% and 15% this year. Ongoing stock

buybacks may help share earnings fare

somewhat better, but we still look for the

bottom line to recede about 5% in 2016.

Management’s efforts ought to bolster

results over the long haul. Indeed, it

has been focusing on increasing productivity through supply-chain improvements. And we anticipate manufacturing

efficiencies, lower operating costs, and better distribution channels will also help

widen margins. Plus, the company’s business transformation, spearheaded by its

recent streamlining efforts, should enable

it to focus on fewer product categories. To

this end, we imagine P&G will continue to

strategically invest in its product pipeline

and its more profitable brands. Likewise,

the company may ramp up its marketing

campaign to help it fight for shelf space.

These shares appear to be well valued

at this juncture. The stock has

rebounded nearly 12% in price since our

September review. The recent uptick has

eroded some of its long-term capital appreciation potential. Moreover, PG is ranked

to underperform the broader market averages in the coming year. On the other

hand, the blue chip holds attractive riskadjusted total return possibilities over the

2018-2020 time frame.

Orly Seidman

December 25, 2015

(73¢); ’13, d19¢; ’14, d21¢. EPS may not sum. intangibles. In ’15: $74.1 bill., $27.30 a share.

(E) In millions, adjusted for splits.

Next earnings report due late January.

(C) Dividends historically paid in Feb., May,

Aug., and Nov. ■ DRIP available. (D) Includes

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

66250

24.5%

3200

10260

24.0%

15.5%

d220

17000

64425

12.5%

16.0%

4.5%

72%

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

85550

25.5%

3500

15525

25.0%

18.1%

d100

17000

81800

15.5%

19.0%

8.5%

55%

A++

100

35

100

To subscribe call 1-800-VALUELINE