ULTA SALON NDQ-ULTA

TIMELINESS

SAFETY

TECHNICAL

1

3

2

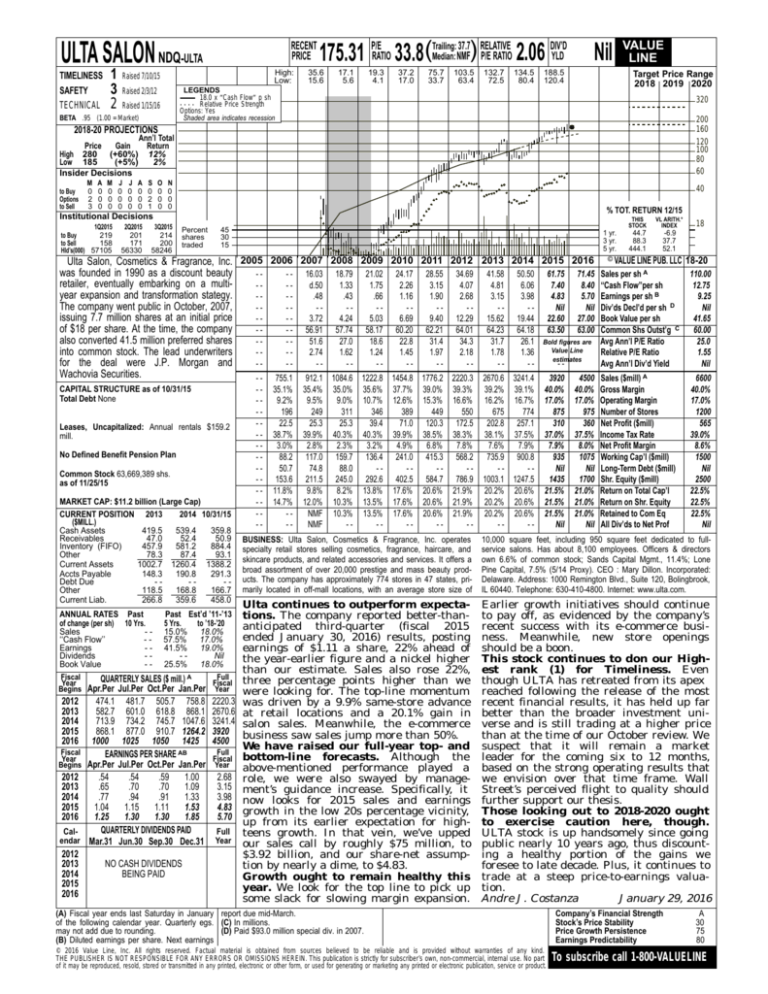

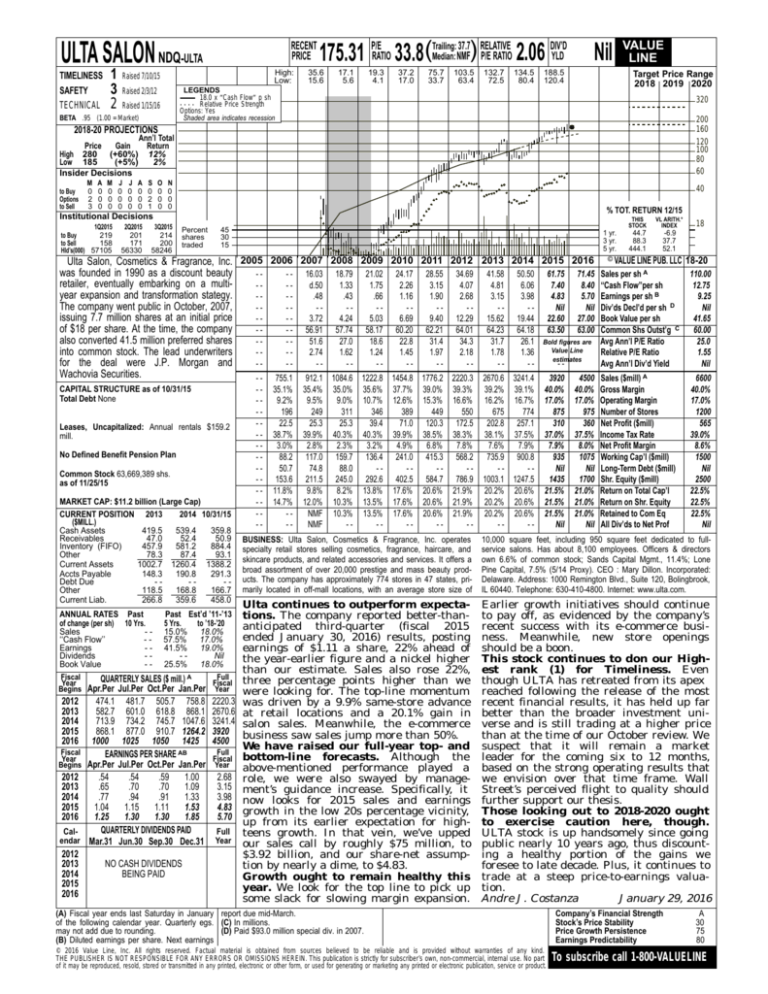

RECENT

PRICE

High:

Low:

Raised 7/10/15

37.7 RELATIVE

DIV’D

Median: NMF) P/E RATIO 2.06 YLD

175.31 P/ERATIO 33.8(Trailing:

35.6

15.6

17.1

5.6

19.3

4.1

37.2

17.0

75.7

33.7

103.5

63.4

132.7

72.5

134.5

80.4

Nil

188.5

120.4

Target Price Range

2018 2019 2020

LEGENDS

18.0 x ″Cash Flow″ p sh

. . . . Relative Price Strength

Options: Yes

Shaded area indicates recession

Raised 2/3/12

Raised 1/15/16

BETA .95 (1.00 = Market)

VALUE

LINE

320

200

160

120

100

80

60

2018-20 PROJECTIONS

Ann’l Total

Price

Gain

Return

High 280 (+60%) 12%

Low 185

(+5%)

2%

Insider Decisions

to Buy

Options

to Sell

M

0

2

3

A

0

0

0

M

0

0

0

J

0

0

0

J

0

0

0

A

0

0

0

S

0

2

1

O

0

0

0

N

0

0

0

40

% TOT. RETURN 12/15

Institutional Decisions

1Q2015

219

to Buy

to Sell

158

Hld’s(000) 57105

2Q2015

201

171

56330

3Q2015

214

200

58246

Percent

shares

traded

45

30

15

1 yr.

3 yr.

5 yr.

Ulta Salon, Cosmetics & Fragrance, Inc. 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

was founded in 1990 as a discount beauty

-- - 16.03 18.79 21.02 24.17 28.55 34.69 41.58 50.50 61.75 71.45

retailer, eventually embarking on a multi--d.50

1.33

1.75

2.26

3.15

4.07

4.81

6.06

7.40

8.40

year expansion and transformation stategy.

--.48

.43

.66

1.16

1.90

2.68

3.15

3.98

4.83

5.70

The company went public in October, 2007,

----------Nil

Nil

issuing 7.7 million shares at an initial price

--3.72

4.24

5.03

6.69

9.40 12.29 15.62 19.44 22.60 27.00

of $18 per share. At the time, the company

-- - 56.91 57.74 58.17 60.20 62.21 64.01 64.23 64.18 63.50 63.00

also converted 41.5 million preferred shares

--51.6

27.0

18.6

22.8

31.4

34.3

31.7

26.1 Bold figures are

Value Line

into common stock. The lead underwriters

--2.74

1.62

1.24

1.45

1.97

2.18

1.78

1.36

estimates

for the deal were J.P. Morgan and

-----------Wachovia Securities.

- - 755.1 912.1 1084.6 1222.8 1454.8 1776.2 2220.3 2670.6 3241.4

3920

4500

CAPITAL STRUCTURE as of 10/31/15

Total Debt None

Leases, Uncapitalized: Annual rentals $159.2

mill.

No Defined Benefit Pension Plan

Common Stock 63,669,389 shs.

as of 11/25/15

MARKET CAP: $11.2 billion (Large Cap)

CURRENT POSITION 2013

2014 10/31/15

($MILL.)

Cash Assets

419.5

539.4

359.8

Receivables

47.0

52.4

50.9

Inventory (FIFO)

457.9

581.2

884.4

Other

78.3

87.4

93.1

Current Assets

1002.7 1260.4 1388.2

Accts Payable

148.3

190.8

291.3

Debt Due

---Other

118.5

168.8

166.7

Current Liab.

266.8

359.6

458.0

ANNUAL RATES Past

of change (per sh) 10 Yrs.

Sales

-‘‘Cash Flow’’

-Earnings

-Dividends

-Book Value

-Fiscal

Year

Begins

2012

2013

2014

2015

2016

Fiscal

Year

Begins

2012

2013

2014

2015

2016

Calendar

2012

2013

2014

2015

2016

Past Est’d ’11-’13

5 Yrs.

to ’18-’20

15.0% 18.0%

57.5% 17.0%

41.5% 19.0%

-Nil

25.5% 18.0%

QUARTERLY SALES ($ mill.) A

Apr.Per Jul.Per Oct.Per Jan.Per

474.1 481.7 505.7 758.8

582.7 601.0 618.8 868.1

713.9 734.2 745.7 1047.6

868.1 877.0 910.7 1264.2

1000 1025 1050 1425

EARNINGS PER SHARE AB

Apr.Per Jul.Per Oct.Per Jan.Per

.54

.54

.59

1.00

.65

.70

.70

1.09

.77

.94

.91

1.33

1.04

1.15

1.11

1.53

1.25

1.30

1.30

1.85

QUARTERLY DIVIDENDS PAID

Mar.31 Jun.30 Sep.30 Dec.31

NO CASH DIVIDENDS

BEING PAID

Full

Fiscal

Year

2220.3

2670.6

3241.4

3920

4500

Full

Fiscal

Year

2.68

3.15

3.98

4.83

5.70

Full

Year

--------------

35.1%

9.2%

196

22.5

38.7%

3.0%

88.2

50.7

153.6

11.8%

14.7%

---

35.4%

9.5%

249

25.3

39.9%

2.8%

117.0

74.8

211.5

9.8%

12.0%

NMF

NMF

35.0%

9.0%

311

25.3

40.3%

2.3%

159.7

88.0

245.0

8.2%

10.3%

10.3%

--

35.6%

10.7%

346

39.4

40.3%

3.2%

136.4

-292.6

13.8%

13.5%

13.5%

--

37.7%

12.6%

389

71.0

39.9%

4.9%

241.0

-402.5

17.6%

17.6%

17.6%

--

39.0%

15.3%

449

120.3

38.5%

6.8%

415.3

-584.7

20.6%

20.6%

20.6%

--

39.3%

16.6%

550

172.5

38.3%

7.8%

568.2

-786.9

21.9%

21.9%

21.9%

--

39.2% 39.1%

16.2% 16.7%

675

774

202.8 257.1

38.1% 37.5%

7.6%

7.9%

735.9 900.8

--1003.1 1247.5

20.2% 20.6%

20.2% 20.6%

20.2% 20.6%

---

40.0%

17.0%

875

310

37.0%

7.9%

935

Nil

1435

21.5%

21.5%

21.5%

Nil

40.0%

17.0%

975

360

37.5%

8.0%

1075

Nil

1700

21.0%

21.0%

21.0%

Nil

THIS

STOCK

VL ARITH.*

INDEX

44.7

88.3

444.1

-6.9

37.7

52.1

© VALUE LINE PUB. LLC

18

18-20

Sales per sh A

‘‘Cash Flow’’per sh

Earnings per sh B

Div’ds Decl’d per sh D

Book Value per sh

Common Shs Outst’g C

Avg Ann’l P/E Ratio

Relative P/E Ratio

Avg Ann’l Div’d Yield

110.00

12.75

9.25

Nil

41.65

60.00

25.0

1.55

Nil

Sales ($mill) A

Gross Margin

Operating Margin

Number of Stores

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Cap’l ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Cap’l

Return on Shr. Equity

Retained to Com Eq

All Div’ds to Net Prof

6600

40.0%

17.0%

1200

565

39.0%

8.6%

1500

Nil

2500

22.5%

22.5%

22.5%

Nil

BUSINESS: Ulta Salon, Cosmetics & Fragrance, Inc. operates

specialty retail stores selling cosmetics, fragrance, haircare, and

skincare products, and related accessories and services. It offers a

broad assortment of over 20,000 prestige and mass beauty products. The company has approximately 774 stores in 47 states, primarily located in off-mall locations, with an average store size of

10,000 square feet, including 950 square feet dedicated to fullservice salons. Has about 8,100 employees. Officers & directors

own 6.6% of common stock; Sands Capital Mgmt., 11.4%; Lone

Pine Capital, 7.5% (5/14 Proxy). CEO : Mary Dillon. Incorporated:

Delaware. Address: 1000 Remington Blvd., Suite 120, Bolingbrook,

IL 60440. Telephone: 630-410-4800. Internet: www.ulta.com.

Ulta continues to outperform expectations. The company reported better-thananticipated third-quarter (fiscal 2015

ended January 30, 2016) results, posting

earnings of $1.11 a share, 22% ahead of

the year-earlier figure and a nickel higher

than our estimate. Sales also rose 22%,

three percentage points higher than we

were looking for. The top-line momentum

was driven by a 9.9% same-store advance

at retail locations and a 20.1% gain in

salon sales. Meanwhile, the e-commerce

business saw sales jump more than 50%.

We have raised our full-year top- and

bottom-line forecasts. Although the

above-mentioned performance played a

role, we were also swayed by management’s guidance increase. Specifically, it

now looks for 2015 sales and earnings

growth in the low 20s percentage vicinity,

up from its earlier expectation for highteens growth. In that vein, we’ve upped

our sales call by roughly $75 million, to

$3.92 billion, and our share-net assumption by nearly a dime, to $4.83.

Growth ought to remain healthy this

year. We look for the top line to pick up

some slack for slowing margin expansion.

Earlier growth initiatives should continue

to pay off, as evidenced by the company’s

recent success with its e-commerce business. Meanwhile, new store openings

should be a boon.

This stock continues to don our Highest rank (1) for Timeliness. Even

though ULTA has retreated from its apex

reached following the release of the most

recent financial results, it has held up far

better than the broader investment universe and is still trading at a higher price

than at the time of our October review. We

suspect that it will remain a market

leader for the coming six to 12 months,

based on the strong operating results that

we envision over that time frame. Wall

Street’s perceived flight to quality should

further support our thesis.

Those looking out to 2018-2020 ought

to exercise caution here, though.

ULTA stock is up handsomely since going

public nearly 10 years ago, thus discounting a healthy portion of the gains we

foresee to late decade. Plus, it continues to

trade at a steep price-to-earnings valuation.

Andre J. Costanza

January 29, 2016

(A) Fiscal year ends last Saturday in January report due mid-March.

of the following calendar year. Quarterly egs. (C) In millions.

may not add due to rounding.

(D) Paid $93.0 million special div. in 2007.

(B) Diluted earnings per share. Next earnings

© 2016 Value Line, Inc. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscriber’s own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Company’s Financial Strength

Stock’s Price Stability

Price Growth Persistence

Earnings Predictability

A

30

75

80

To subscribe call 1-800-VALUELINE