To: Mr. Now U. Donit, President From:

advertisement

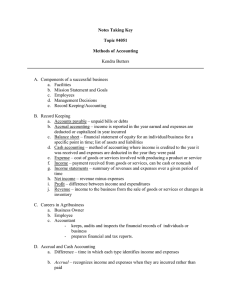

To: Mr. Now U. Donit, President From: Stephanie Moon, CPA Subject: Cash Basis of Accounting vs. the Accrual Basis of Accounting Date: March 2, 2004 As you are aware, our company is currently using the cash basis of accounting. However, I believe it would be to our benefit if we were to switch to the accrual basis. The accrual basis would benefit this company in multiple ways. First, let’s look at each of these methods: Cash and Accrual basis. With the cash method, revenue is recorded only when the cash is received, and expenses are recorded only when the cash is paid. On the other hand, the accrual basis recognizes revenue when it is earned and recognizes expenses in the period incurred, without regard to the time of receipt or payment of cash. Under the cash basis, the revenue recognition and the matching principles are ignored. Consequently, cash-basis financial statements are not in conformity with generally accepted accounting principles. The timing of net income is affected when using these two basis. When using the cash basis, nothing is recognized in the first month, everything happens in the following months. However, in the accrual basis, everything is recognized in the first month and nothing in the preceding months, and this allows your net income to be recognized in the month in which it was incurred. Other disadvantages of the cash basis of accounting are understating revenues, assets, expenses incurred, and owners’ equity. It would be to this companies benefit to switch from the cash basis of accounting to the accrual because of the way our business is run. We need our revenues as assets to be recognized when they are earned and our expenses when they are incurred, not visa versa. This change would help our company’s financial statements as well. Please consider strongly everything I have mentioned. If there are any questions that you might have please feel free to contact me. Thank you for your time.