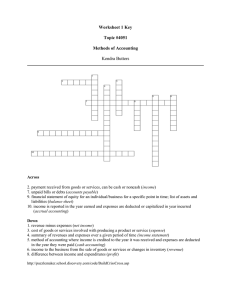

František Sudzina The long term goal •The goal of every business is to maximize the benefits for its owners •We can look at the benefits for owners from many aspects; the owners’ goals can be to •maximize profits, •to maximize the company’s value, etc. •These two goals require to produce the best product with the lowest possible costs 15 - 2 Example Imagine you have just finished high school and your uncle has given you 2 million CZK. You have a couple of options what to do with that money. You can use it to travel, or you can buy a luxurious car and find a job for 15,000 CZK monthly, for example. The third option is that you use the money to finance your studies because you expect to earn 50,000 CZK/month after finishing your studies. This means that you give up the joy from traveling or from a luxurious car in order to earn more money in the future because of additional education. 15 - 3 Capital •In order to start a business, you need some investment at the beginning; this investment can be cash, land, machinery, or our own knowledge and skills •The example illustrates the principle of capital •When the capital is created, there is a decision to postpone current consumption for the future •But that is not enough; somebody has to make an investment – produce a capital good that is able to increase the work productivity 15 - 4 Capital •In this case, it was you who was the investor; you had an investment opportunity – to invest into your education and the sources for this investment – a gift from your uncle and your ability to get a university degree •It is clear from this example that postponed consumption or savings precede the investment •Sometimes the person who is postponing the consumption is the same person who is making an investment 15 - 5 Capital •But in the market economics these are usually not the same people •Those, who save, usually do not always have investment opportunities, and that is why they lend capital to those, who have opportunities •For example, they put their savings to banks and then banks lend this money to companies with investment opportunities •Others allocate capital in business companies so they become their partners or shareholders 15 - 6 Business as a system •Business is a system whose goal is to change inputs into outputs •Inputs can be buildings, machines, material, human potential •Output is a product or a service. •In order to quantify or to compare against each other or among the industry the individual inputs, parts, and the results of processes, we need to convert all of them to a universal value - this value is money; the way this is done is called accounting 15 - 7 Development of accounting Single-entry accounting Dual-entry accounting Resources, events, agents 15 - 8 Chart of accounts - list of accounts with their identifiers, i.e. with their account numbers - in some countries (e.g. Germany), the numbering is mandatory – given e.g. by the law - in some countries (e.g. Sweden), the numbering is/was suggested but not mandatory -in some countries (e.g. Denmark), the numbering is up to the company itself - the number of digits in account numbers differs between countries - companies “split” an account by using additional digits in countries where numbering is mandatory 15 - 9 Types of accounts 1. Asset accounts-resources owned by the company, e.g. asset accounts are cash on hand, cash in bank, real estate, inventory, prepaid expenses, goodwill, and accounts receivable 2. Liability accounts-obligations of the company, e.g. accounts payable, bank loans, bonds payable, and accrued expenses 3. Equity accounts-residual equity of the company, e.g. common stock, paid-in capital, retained earnings 4. Revenue or income accounts-company's earnings, e.g. sales, service revenue and interest income 5. Expense accounts-company's expenditures, e.g. utilities, rents, depreciation, interest, and insurance 15 - 10 Chart of accounts in Sweden - BAS 15 - 11 Accounting At the beginning of an accounting year, there are •zeroes at income statement accounts •final values from the previous accounting year at balance sheet accounts •During an accounting year, you •only add values to income statement accounts (a company purchases something, you increase the expense account; a company sells something, you increase the revenue account) •both add and subtract value to/from balance sheet accounts (a company purchases something, you decrease the cash account; a company sells something, you increase the cash account) 15 - 12 Accrual Basis and Cash Basis The accrual basis of accounting recognizes revenues and expenses when they occur regardless of when cash is received or disbursed. The cash basis of accounting recognizes revenue and expense when cash is received and disbursed. 15 - 13 Accrual Basis and Cash Basis The major deficiency of the cash basis of accounting is that it is incomplete. It fails to match efforts and accomplishments in a manner that properly measures economic performance and financial position. 15 - 14 Adjustments to the Accounts Under the accrual basis of accounting, record: 1.Explicit transactions-day-to-day routine events 2.Implicit transactions - events that day-to-day recording procedures temporarily ignore, such as expiration of prepaid rent or accrual of interest due to the passage of time. Explicit transactions are easy to identify because they are supported by source documents. Implicit transactions are recorded at the end of each accounting period by using adjusting entries. 15 - 15 Principal Adjustments Four types of principal adjustments: Expiration of unexpired costs Recognition (earning) of unearned revenues Accrual of unrecorded expenses Accrual of unrecorded revenues 15 - 16 Adjustment Type I: Expiration of Unexpired Costs Assets other than cash and receivables are viewed as economic services awaiting future use—prepaid or stored costs, and they are carried forward to future periods. The values of assets frequently decline (and eventually disappear) because of the passage of time. When a company uses services represented by a particular cost, the cost expires. An unexpired cost is any asset that managers expect to become an expense in future periods. 15 - 17 Adjustment Type I: Expiration of Unexpired Costs Rather than immediately charge these costs as expenses, they are charged as expenses in future periods when the services are used. 15 - 18 Expiration of Unexpired Costs Assets frequently expire because of the passage of time. Assets other than cash and receivables are viewed as economic services awaiting future use. Unexpired costs are assets that managers expect to become expenses in future accounting periods. 15 - 19 Adjustment Type II: Unearned Revenue (Deferred Revenue) Unearned Revenue (deferred revenue) is . . . A liability recorded when a company receive collections from customers before it earns the revenue. Because customers have already paid in advance for merchandise or services . . . An obligation exists to deliver merchandise or service or refund the customers’ deposits if the goods or services are not delivered. 15 - 20 Adjustment Type III: Accrual of Unrecorded Expenses Accrue means to accumulate a receivable or payable during a given period, even though no explicit transaction occurs. Interest expense Employee wages 15 - 21 Adjustment Type IV: Accrual of Unrecorded Revenues The recognition of revenues that a company has earned but has not yet recorded in its accounts is . . . the mirror image of the accrual of unrecorded expenses. Interest Revenue 15 - 22 Summary of accruals – types I-IV 15 - 23 Exercise 15 - 24